Ethereum trades close to $2,000 After a pointy decline, the long-term chart motion signifies a closing leg up in a multi-year construction. Brief-term worth motion is at present tense within the triangle, getting ready for the following decisive transfer as momentum cools.

Ethereum counts “diagonal enlargement” as $9,000-1,8,000, zone marks subsequent goal

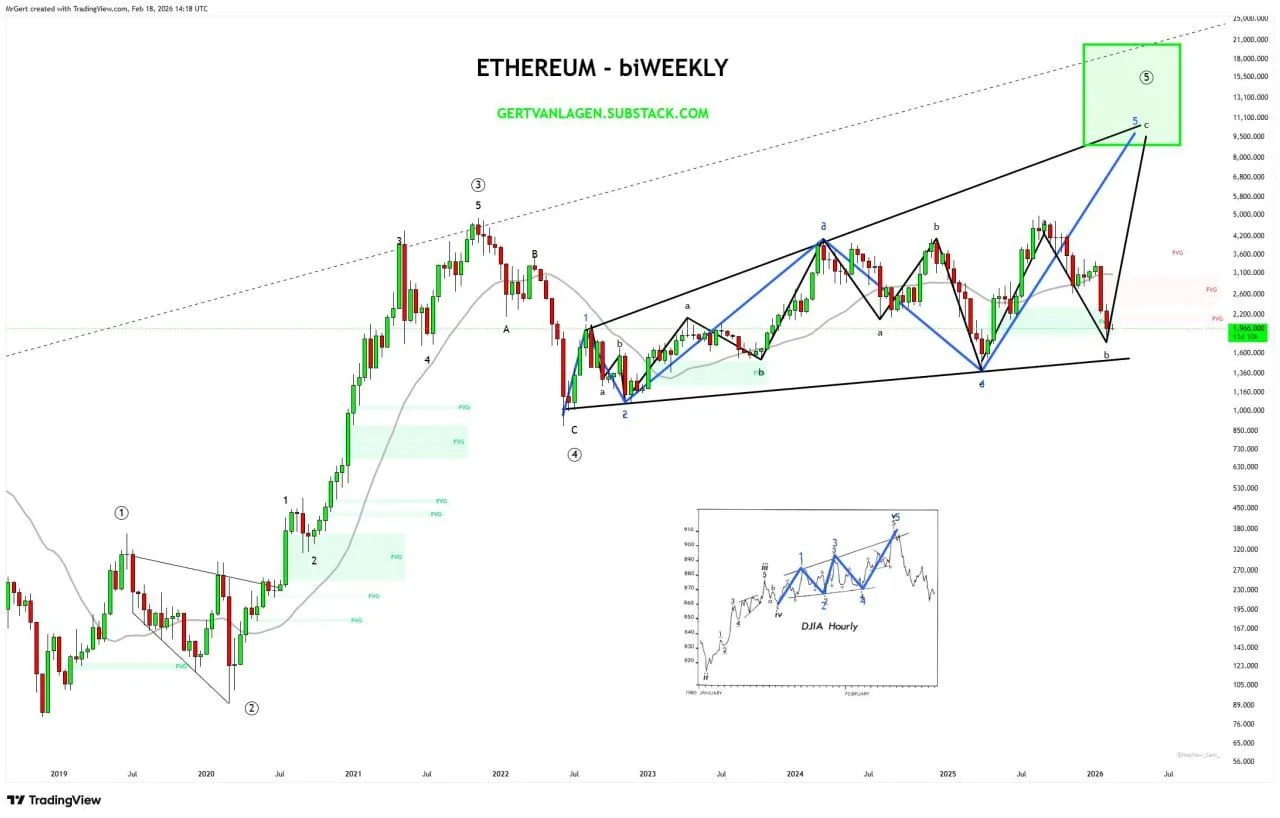

Ethereum continues to trace what analyst Gerd van Lagen described as a “textbook prolonged diagonal” on its biweekly chart. In a submit to

Ethereum biweekly chart. sauce: Gerd van Lagen of X

Van Lagen stated that the following leg ⑤-5-b fell after Ethereum misplaced the straightforward shifting common of the upper timeframe. He added that the newest decline closed the truthful worth hole marked between roughly $1,800 and $2,300, a zone highlighted as a earlier imbalance on the chart.

The analyst framed ⑤-5-c as a remaining upside push throughout the construction and set the anticipated goal zone between $9,000 and $18,000. He set an invalidation on the break under the extent labeled ⑤-4 on the chart. This might invalidate the depend in his framework.

$ETH On the every day chart, the bottom is maintained under $2,000 resulting from short-term triangle formation.

Ethereum was buying and selling round $1,972 on the every day ETHUSD chart as the worth compressed right into a slim triangle under the $2,100 space. This sample adopted a pointy decline from the low $3,000s, adopted by a push all the way down to the lows whereas the lows slowly rose from the mid-$1,800s. This construction signifies short-term indecision as the worth stays under earlier assist round $2,000 and is at present performing as resistance.

Ethereum USD 1D chart. sauce: Rendoshi on X

On the identical chart, a earlier swing confirmed an analogous compression part in early 2025, with costs resuming close to resistance earlier than resolving greater. Present settings are under a broad vary that ranges from round $1,150 on the draw back to $4,950 on the upside, ranges marked as historic assist and resistance each day. Costs stay effectively under the ceiling that has restricted their rise since late 2024.

RSI momentum remained within the decrease band, exhibiting a slight rebound from readings under 30 as costs stabilized. Whereas this indicator displays the cooling of downward stress after the latest decline, worth motion continued to report a decent candlestick close to the highest of the triangle. The chart highlights that it’s repeatedly testing the identical assist zone with no clear break, leaving short-term course unresolved whereas the market waits for a definitive transfer.