Bitcoin ($BTC) is at the moment present process an important consolidation part after a shaky begin till February 2026. After hitting an all-time excessive of $126,100 in late 2025, the flagship cryptocurrency confronted a pointy correction and fell in the direction of the $60,000 assist zone earlier this month. As of immediately, February 21, 2026, Bitcoin is exhibiting indicators of restoration and nearly $68,162. The query for a lot of merchants is whether or not the present momentum is sufficient to push Bitcoin costs above psychological ranges. $70,000 threshold.

Will Bitcoin worth attain $70,000?

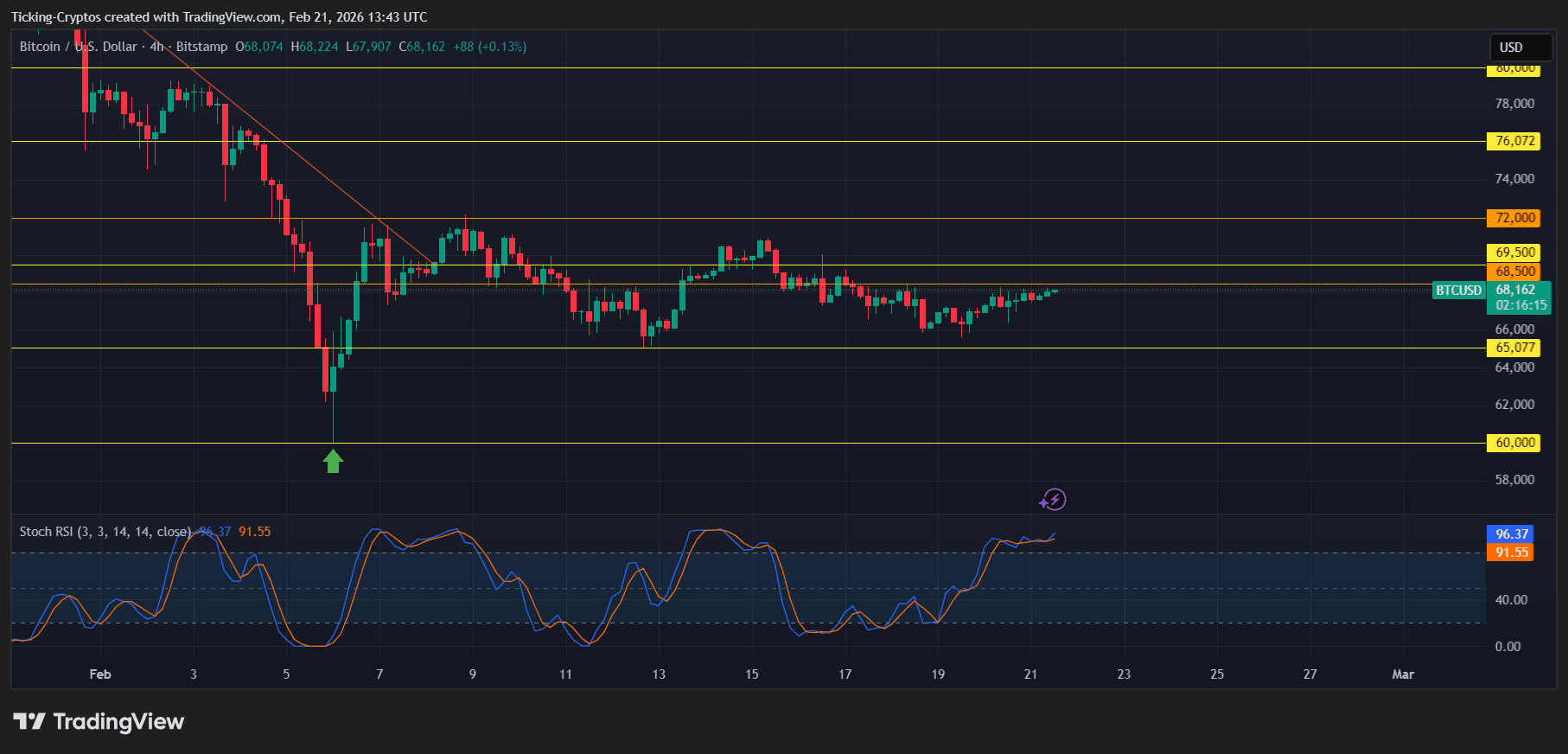

Present technical settings recommend that Bitcoin is testing a big overhead provide zone. Based mostly on current worth traits, $70,000 to $71,000 Vary has acted as a “wall” for bulls. nonetheless, Inventory RSI It reveals a bullish crossover within the oversold area, indicating that the worth motion is stabilizing above. $65,000 So long as assist is on the market, the trail to $70,000 stays the first short-term purpose. A sustained rise above $68,500 is an instantaneous precondition for this transfer.

Bitcoin worth evaluation: 4-hour chart outlook

The 4-hour chart reveals some essential layers of worth motion that merchants should monitor.

resistance and assist ranges

- Rapid resistance: The primary hurdle is $68,500adopted instantly by the secondary resistance. $69,500.

- 70K barrier: of $70,000 The mark isn’t just on a psychological stage, however matches the earlier rejection level seen in mid-February.

- Essential assist: As an obstacle, $65,077 A “line within the sand” stays. if $BTC If it falls beneath this, a retest will happen. $60,000 It turns into simpler to fall right into a psychological ground.

momentum indicator

of Inventory RSI (3, 3, 14, 14) is at the moment on the higher restrict (round 96.37) and is trending upward. Whereas this means robust shopping for momentum, it additionally means that the asset is coming into “overbought” territory within the quick time period. That is normally achieved earlier than a lightweight cooling interval or sideways maintain earlier than the following leg is raised.

Market psychology and macro components

The broader crypto information panorama for February 2026 is dominated by a mixture of “excessive worry” and cautious optimism. Latest information from Santiment reveals that the “Lambo” meme and retail FOMO have all however dried up, and contrarian analysts see this as a wholesome signal for a sustainable backside.

Bitcoin worth prediction: What is going to occur? $BTC worth?

For these seeking to commerce within the present vary, evaluating platforms is crucial to make sure you restrict slippage throughout excessive volatility breaks. Try our trade comparability to seek out the very best liquidity supplier. $BTC/USD.

- Bullish state of affairs: Day by day closing worth above $69,500 more likely to trigger a surge because of liquidations $72,000primarily setting you again $70,000 in handles.

- Bearish state of affairs: failure of violation $68,500 Consequently, a “double high” occurred on the 4-hour chart, $64,000 – $65,000 zone.

Whatever the path, throughout this time of excessive macro uncertainty, it's a good suggestion to guard your belongings with a {hardware} pockets.

Conclusion: The street to $70,000

Bitcoin is in “wait and see” mode. Though the technicals on the 4-hour chart are bullish with the restoration from the $64,000 low, the resistance above $70,000 stays robust. If the present impartial sentiment turns right into a reassuring rebound, Bitcoin may firmly return to the $70,000 to $75,000 vary by the tip of February.