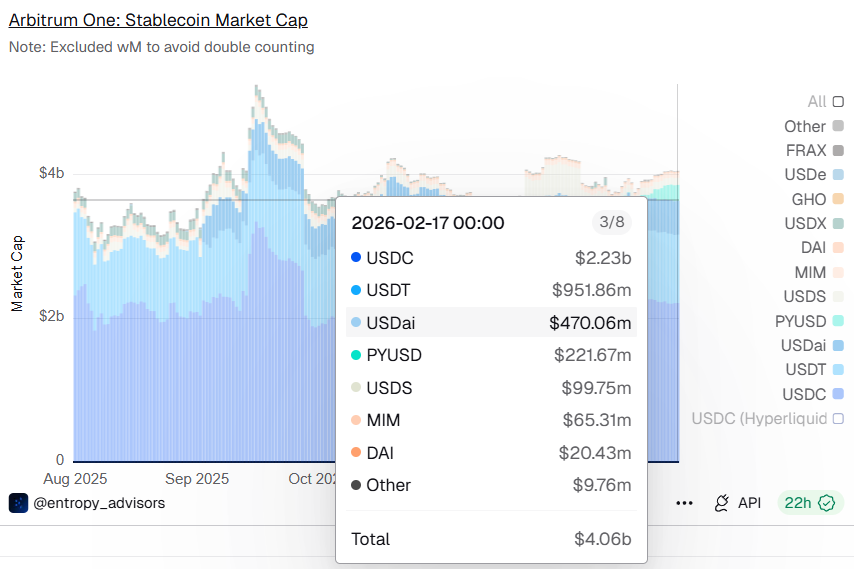

paypal $PYUSD The stablecoin's market cap exceeded $4 billion this month, and provide on Layer 2 Arbitrum One has elevated to the purpose the place it ranks because the fourth largest stablecoin within the community.

Arbitrum at the moment has belongings price $220 million, in response to knowledge compiled by consulting agency Entropy Advisors. $PYUSD Right here's what's circulating on the community: $USDAIUSDC and USDT. DefiLlama knowledge is $PYUSD The availability worth at Arbitrum is $256.6 million.

Stablecoin deployed on Arbitrum One. Supply: Dune Analytics

As an Entropy Advisors analyst defined in a Feb. 16 X put up: $PYUSDThe rise in Arbitrum seems to be associated to a partnership introduced in mid-December between PayPal and USDai lead developer Permian Labs ($USDAI).

Based mostly on the settlement, $PYUSD Added as backing for reserve belongings $USDAI And the protocol's funds and liquidity belongings, based totally on Arbitrumand, are tied to funding AI infrastructure resembling GPUs and knowledge facilities.

In response to the announcement, as much as $1 billion $PYUSD Deposits to USDai earn 4.5% APY as a part of a 1-year incentive program.

“With this integration, $USDAILoans will be issued within the following methods: $PYUSD You may pay on to your PayPal account. Debtors will pay for GPUs, knowledge middle prices, leases, and subscriptions utilizing a single dollar-based rail. ” $USDAI stated in a put up from December X.

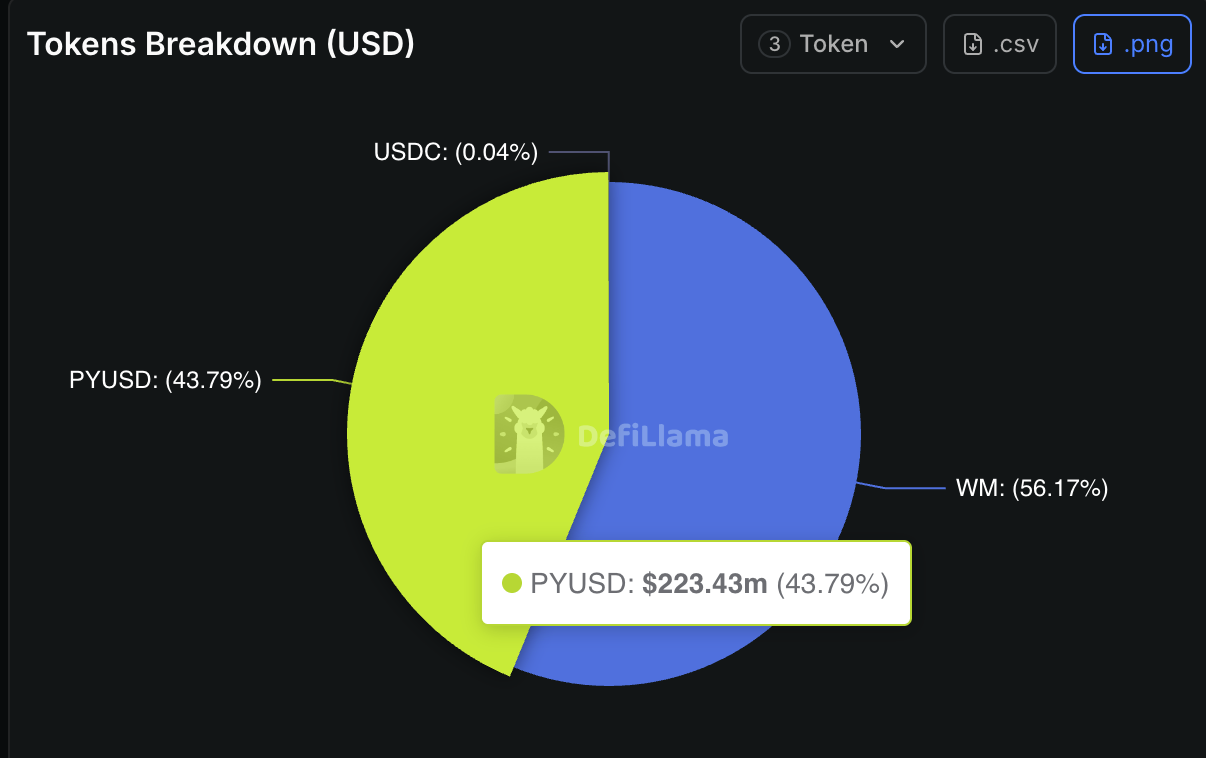

After integration, knowledge from DefiLlama exhibits that the majority $PYUSDThe availability of on Arbitrum is expanded inside USDai. $PYUSD It at the moment accounts for over 43% of all token deposits on the protocol, second solely to WrappedM by M0 (WM). $USDAIis the underlying asset and accounts for over 56% of TVL.

Token breakdown $USDAI. Supply: Defilama

however, $USDAIIts personal doc states that “incentives will likely be used early to make sure liquidity, however should not end-state yield sources,” implying that whereas stablecoins are primarily being launched to assist funds within the early phases, the protocol is meant to maneuver to GPU- and AI-backed lending as the first supply of yield and collateral.

Arbitrum One at the moment holds the biggest quantity of Ethereum L2 by whole quantity secured, with $16.82 billion, in response to L2Beat knowledge.