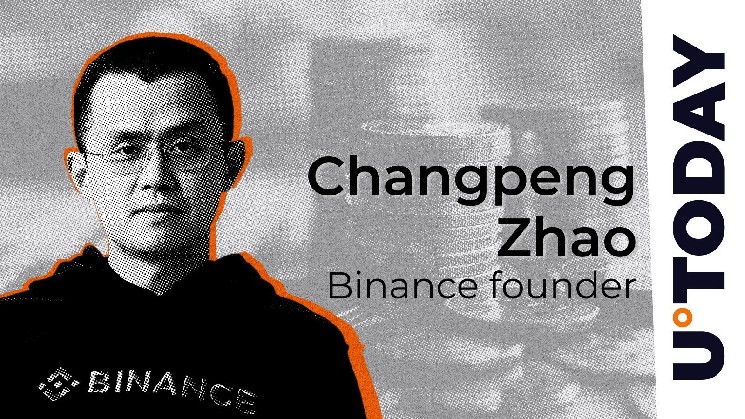

The latest plan by the Federal Housing Company to view Cryptocurrencies as a indifferent residence mortgage asset has acquired a bullish response from former Vinance CEO Changpeng Zhao.

The legislation that has develop into a scorching subject throughout the Crypto neighborhood has seen Binance's CZ weigh closely on the potential for Bitcoin's actual property market.

Following a latest publish from Zhao on Thursday, Crypto specialists have admitted the transfer is nice for the Crypto ecosystem. Ideally, Bitcoin, used as a mortgage asset, can solely make sense for extra use instances of Bitcoin, resulting in extra adoption.

0.1 BTC within the US

If the legislation is handed, demand for Bitcoin is predicted to extend considerably, with the token scarcity rising given the restricted provide. This in return will considerably enhance the worth of world-leading cryptocurrency by market capitalization.

Zhao believes that the bare 0.1 BTC may develop into the usual for brand spanking new wealth within the US, because the aftermath of this transfer will skyrocket the worth of Bitcoin.

Zhao confused that 0.1 BTC may in the end outweigh the typical American residence's worth because of the rise in inflation and charges which have plagued the US actual property market.

Whereas the present American dream is to personal a house, the potential influence of this transfer on the longer term worth of Bitcoin may add a dramatic twist to the basic American dream. In keeping with Zhao, proudly owning a minimum of 0.1 BTC may quickly develop into a dream for all People.

That is nice, BTC counts as a mortgage asset!

The present American dream is to personal a house.

The long run American dream is to personal 0.1 BTC. That is greater than definitely worth the US residence. https://t.co/xv7nzdrma8

– CZ🔶BNB (@CZ_BINANCE) June 26, 2025

This remark from Binance's CZ has acquired combined reactions from X customers, with some critics dismissing Zhao's declare that 0.1 BTC is extra beneficial than the US residence, exaggerating it and tagging the story.

Nonetheless, different commentators have expressed their consensus with Zhao's predictions, pushing additional their perception that Bitcoin is heading for the moon.

When fingers cross the official implementation of the foundations, the crypto ecosystem seems to be excited by the potential alternative to make use of crypto holdings as collateral for single-family mortgages. This gives residents with the chance to personal their properties on the threat of crypto-holding whereas sustaining their investments in crypto-holding.