- Over $380 million in Ethereum has flowed from exchanges over the previous week.

- The big ETH holders reversed the long-term downward development in pockets focus and elevated positions.

- On-chain knowledge suggests a rising confidence amongst buyers regardless of modest buying and selling volumes and ongoing market consideration.

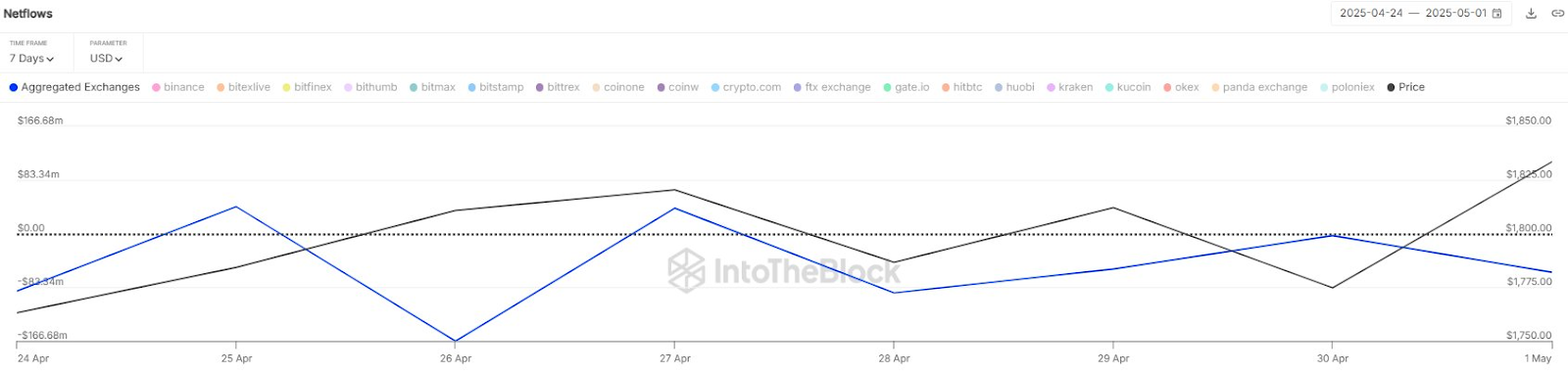

Ethereum (ETH) continues to circulation from centralized exchanges at a substantial pace. Prior to now seven days alone, web outflows have exceeded $380 million, in response to blockchain analytics agency IntotheBlock.

This discount in Change-Held ETH displays an independently-reliant enhance in investor accumulation and will level to tightening the availability narrative that traditionally precedes worth rise.

ETH accumulation lasts regardless of worth volatility

In response to the information, web circulation from Ethereum's trade was persistently destructive between April twenty fourth and Might 1st, with a very massive outflow recorded on April twenty sixth. This motion means that buyers used a short-term worth dip to purchase ETH and withdraw their very own rulings.

Regardless of weekly worth fluctuations, ETH ended the interval with a constructive notice and climbed over $1,840. Analysts interpret sustained trade outflows as an indication of bullishness, as decrease provide on exchanges reduces the danger of promoting strain and will create breakout circumstances if demand will increase.

On-chain knowledge reveals whale accumulation and steady exercise

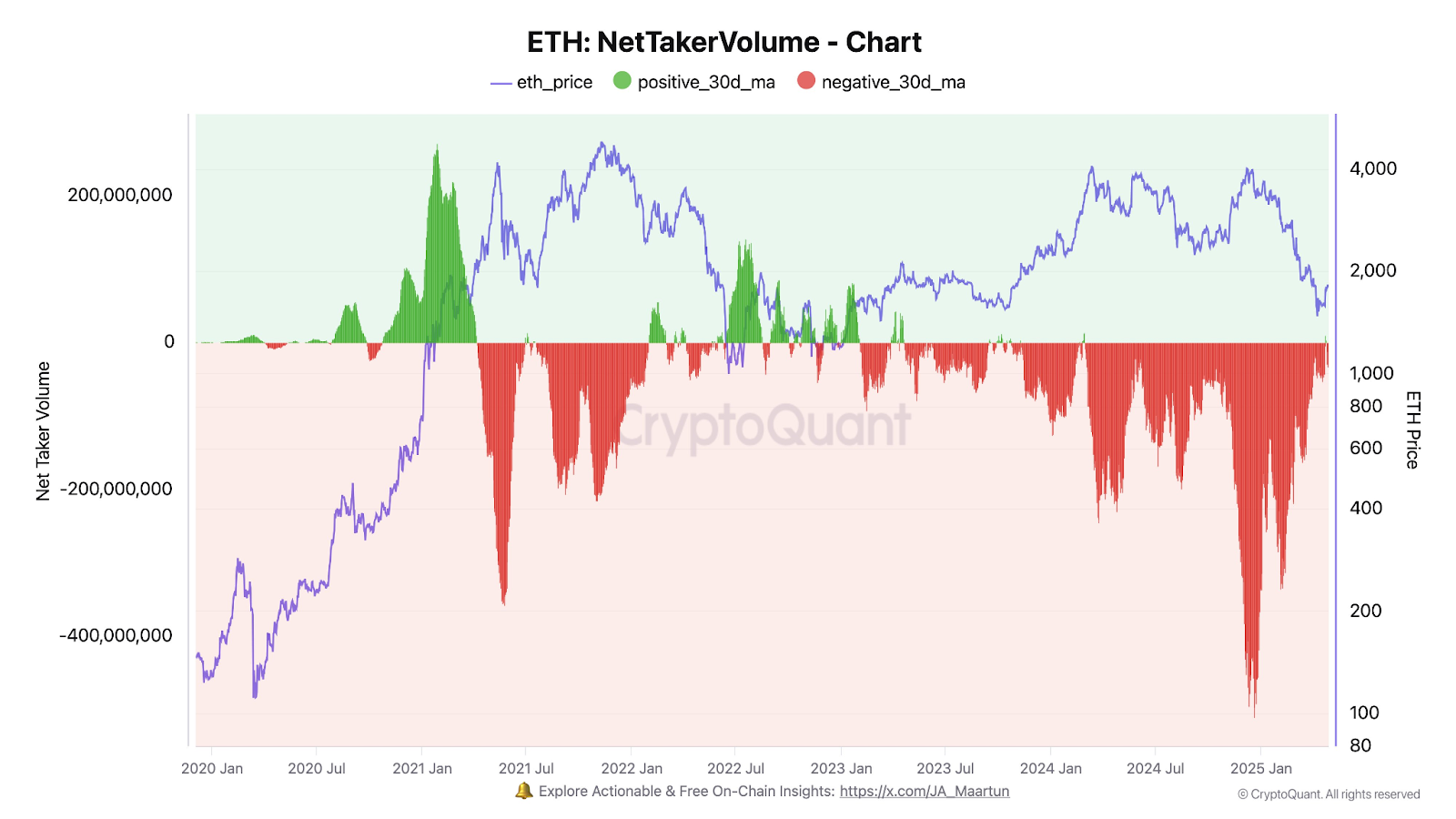

This development in spills helps the broader narrative that Ethereum can arrange for an enormous rebound after falling considerably under Bitcoin. Current knowledge from Cryptoquant reveals that the distribution of Ethereum provide by pockets dimension signifies that the biggest holders proceed to keep up their place or accumulate.

Cryptoquant analyst Darkost highlighted that since August 2024, wallets holding greater than 100,000 ETH have elevated by round 3%. He sees this as an indication of “good cash” positioning. He famous that the proportion of ETH held by massive wallets has steadily decreased since 2020, however that development seems to be reversing now.

Bullest on-chain knowledge pointing to potential Ethereum rally

Darkost additionally famous that regardless of the value drop in ETH, the variety of energetic addresses stays steady. He noticed appreciable gross sales strain within the derivatives market, which could possibly be eased. Specifically, web taker volumes examined constructive on April twenty third and twenty fourth, and if the development continues, it may mark the start of the underside course of.

Darkost emphasised that these metrics are opposite to the “Ethereum is lifeless” story. Primarily, ETH factors to aggressive knowledge within the chain regardless of at the moment buying and selling at over 62% of all-time 2021.

Easy methods to method ETH

Darkost concluded that though there are a number of inspired long-term indicators, on-chain knowledge nonetheless displays a chronic sense of pessimism round ETH. He additionally stated open curiosity has declined considerably, buying and selling quantity stays curtailed, each highlighting cautious market sentiment.

In his view, probably the most cautious method in the meanwhile is to attend for a transparent invalidation of bearish developments, or to have interaction in a dollar-cost common (DCA) technique at finest.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version will not be answerable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.