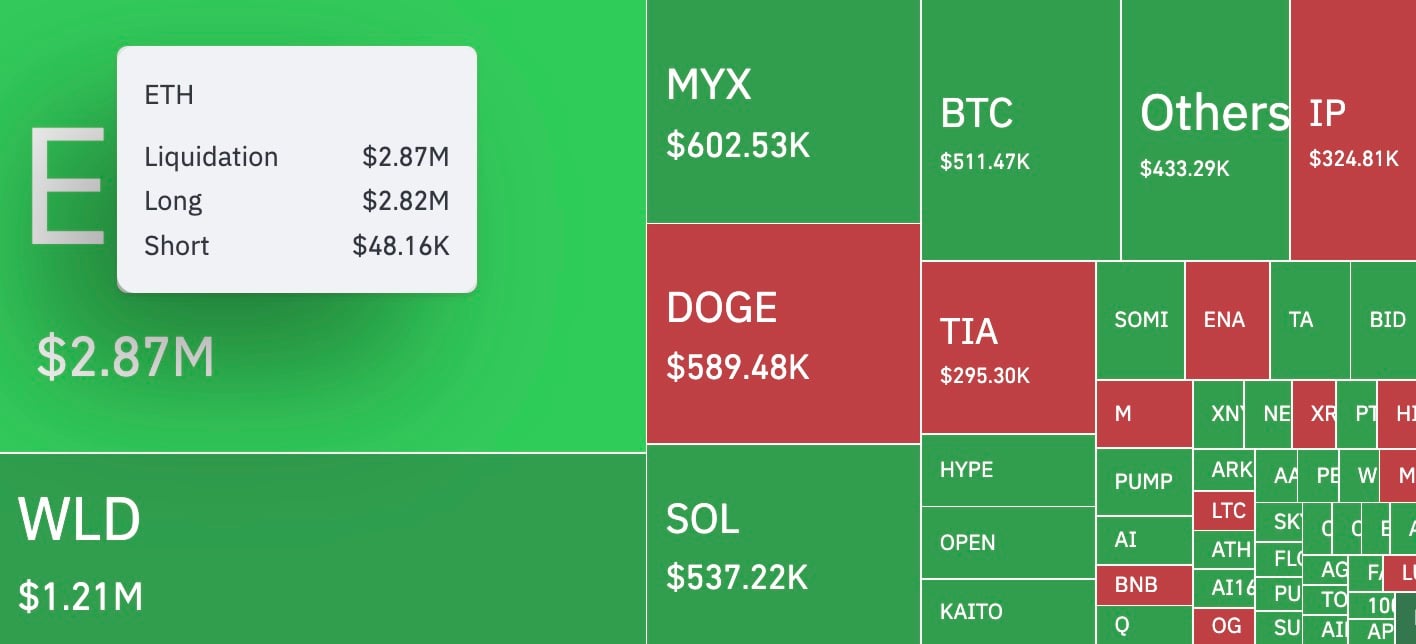

Tuesday's Ethereum buying and selling session within the derivatives market was a vivid indication of whether or not the order guide could possibly be balanced rapidly. In keeping with Coinglas, the $2.87 million ETH place was settled over an hour, with nearly 99% of that determine being lengthy.

The lengthy liquidation of recent knowledge is $2.82 million, indicating a one-time liquidation in comparison with simply $48,160. This can be a 5,855% imbalance, and this transfer stands out amongst different main cryptocurrencies.

This skew coincided with seen spikes on the 1 minute value chart. The ETH fell to round $4,328 earlier than recovering rapidly. Nonetheless, the discount is ample to trigger a flood of margin calls, primarily to its benefits.

Paradoxically, the following rebounds pushed again costs above $4,350 per ETH inside minutes.

General, the crypto market has seen extra balanced pictures, with Bitcoin recording a complete liquidation of round $511,000 and Solana $537,000. Over the course of 24 hours, liquidation reached $341.46 million, $139.91 million, $201.55 million, and $201.55 million in shorts and longs.

Ethereum (ETH) value response

Ethereum's spot value remained steady at round $4,353 at press. The principle message behind this occasion exhibits how rapidly leverage can thaw throughout small value modifications, even when the general pattern seems strong.

Within the case of ETH, this was extra like a localized reset than a change of course, however for somebody, I misplaced a good portion of my deposit.