Tokenized U.S. Treasury funds have attracted roughly $770 million in new inflows over the previous 11 days, indicating rising investor confidence in digital actual world asset (RWA) merchandise, in keeping with the most recent market information from rwa.xyz.

Investor demand for tokenized authorities bonds will attain document ranges in 2025

In 2025, tokenized authorities bonds are rapidly rising as one of many hottest improvements in digital finance. These on-chain merchandise symbolize real-world U.S. Treasury securities issued and traded via a blockchain community, offering traders with quick settlement, clear possession, and programmable yield entry.

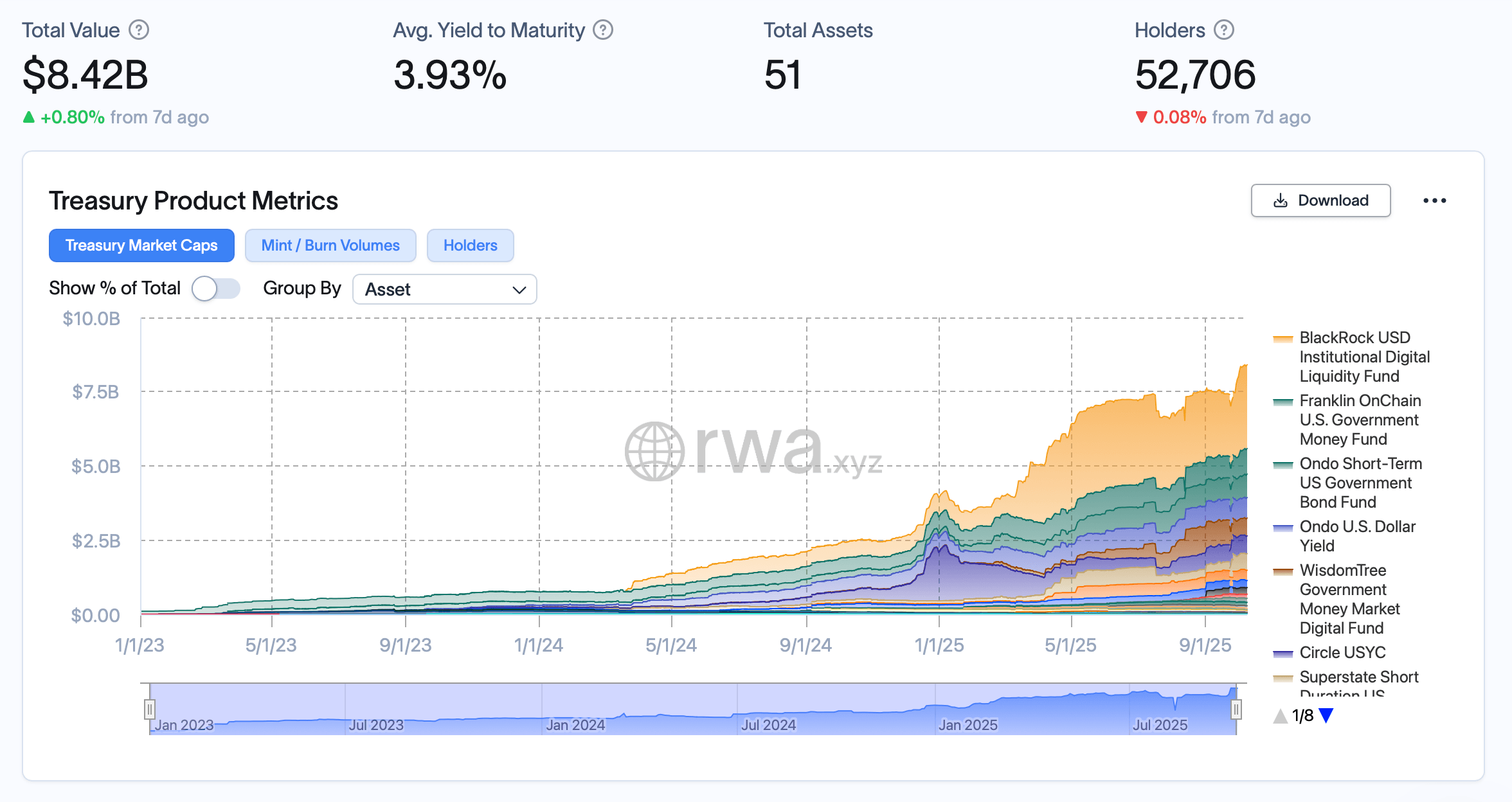

By bridging conventional finance (TradFi) and decentralized finance (DeFi), tokenized Treasuries are redefining how traders entry secure, yield-producing belongings, turning U.S. Treasuries into digital, fractional, globally tradable tokens. At present, the worth locked in all tokenized treasury funds is $8.42 billion.

Contained in the $770 million tokenized treasury surge

Among the many prime performers for the reason that final replace on Oct. 1, BlackRock's USD Institutional Digital Liquidity Fund (ticker: BUIDL) surged $329 million over the identical interval, making it one of many single largest contributors to total inflows, in keeping with Rwa.xyz statistics.

This continued rise highlights the accelerated adoption of tokenized cash market and treasury merchandise as institutional and digital asset traders search on-chain options that generate secure yields backed by U.S. authorities securities.

On October 1, Ondo's U.S. Quick-Time period Treasury Bond Fund (OUSG) was ranked second after BlackRock's BUIDL Fund. Nevertheless, over the subsequent 11 days, OUSG slipped to 3rd place in whole tokenized treasury lock worth (TVL), however nonetheless attracted a outstanding $62.4 million in new inflows.

BENJI, Franklin Templeton’s on-chain cash market fund, moved to second place amongst tokenized monetary merchandise following a major enhance in TVL from $717.4 million to $861.05 million. Ondo’s US greenback yield (USDY), which ranks fourth amongst tokenized treasury and yield merchandise, maintained a relentless TVL of $689 million.

Rounding out the highest 5 tokenized monetary merchandise, WisdomTree’s USD Institutional Digital Fund (WTGXX) has elevated its TVL from $557.2 million to $600 million prior to now 11 days. This is a rise of $42.8 million. Among the many remaining tokenized treasury merchandise, Circle's United States Treasury Fund (USYC) skilled a pullback, lowering from $636.2 million to $597 million through the remark interval.

Tokenized U.S. Treasuries are proving to be greater than a distinct segment innovation as extra traders search secure, high-yielding belongings with out the friction of conventional intermediaries. Market analysts predict that the tokenized authorities bond market may soar to trillions of {dollars}, ushering in a pivotal enlargement section for actual world belongings (RWA).

🔍 Fast FAQ: Tokenized US Treasuries and RWA Market Progress

- What’s Tokenized U.S. Treasuries?These are digital representations of U.S. authorities bonds issued on a blockchain community, permitting for sooner, extra clear, and programmable yield entry.

- Why are traders shifting to tokenized treasury funds?Buyers are interested in secure yield-producing belongings that mix the protection of conventional U.S. Treasurys with on-chain effectivity and liquidity.

- Which funds will lead the tokenized authorities bond market in 2025?Blackrock's BUIDL, Franklin Templeton's BENJI, and Ondo's OUSG prime the listing of inflows and whole worth locked (TVL).

- 4. How large can a tokenized treasury division develop?Analysts anticipate the tokenized authorities bond market to develop additional sooner or later.This marks a large progress section for digital actual world belongings (RWA).