Ethereum (ETH) trades across the $2,200 vary and was born from the latest DIP of beneath $2,000. On this place, the ETH alerts that it’s underestimated based mostly on its historic efficiency.

Ethereum (ETH) has been actively buying and selling over the previous three months as whales have been strategically caught up in past their positions. The choice to keep away from holding and promoting close to native tops is likely one of the causes for the weaknesses of ETH costs.

Whales, in the meantime, have tried to reabsorb ETH at a cheaper price, usually decrease averages. Holders with a $3,500 accumulation had been first handed out the cash and returned to purchase extra of the $2,500 vary.

Consumers who first accrued ETH at $3,500 used energetic gross sales and repurchase to cut back their value base. $3,200.

Actively traded whales are offered close to the highest 2,500 native and are repurchasing low. As ETH confirmed a long-term downward development, most ETH rallies had been used to redistribute cash. ETH has additionally dropped to 0.025 BTC, with merchants nonetheless conserving alerts for added value dips.

ETH enters a low-cost zone

At practically $2,000, ETH is at the moment pertaining to a zone that’s undervalued based mostly on market value and realised value ratio. Lively gross sales allowed the whales to retain the next realized worth, however their present market worth was comparatively low.

The market worth of the realised worth (MVRV) ratio provides a low value sign if it falls under 1. Worth means the potential of shopping for at a degree near the typical buy value for each retail and whale consumers.

Nevertheless, accumulation at this degree doesn’t assure a rally, as there are additionally bearish predictions for extra ETH give up.

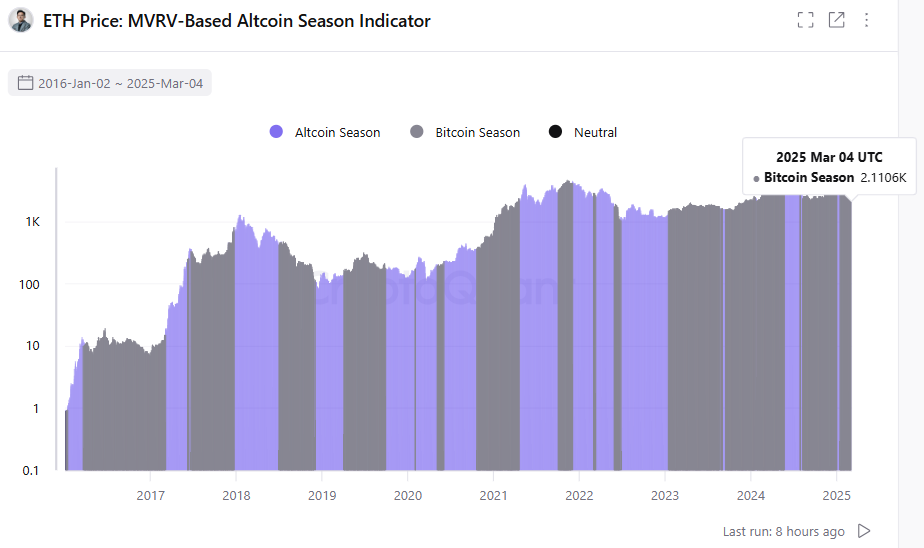

Ethereum's present MVRV chart additionally reveals that the market is traditionally the Bitcoin season. The present values recommend that ETH and AltCoins could also be cheaper in comparison with earlier cycles.

ETH realised costs additionally present the bitcoin season, the place Altcoins are underrated. |Supply: Cryptoquant

Present value ranges stay not a assure of gatherings as some Altcoins lose enchantment and may make demand restructuring tough.

ETH stays a controversial bid

ETH has been displaying indicators that it was offered for a number of weeks, however this has not led to a value improve. One motive for that is makes an attempt to make earnings quicker whereas repurchase the low stress system. The ETH whales had been hoping to satisfy as much as over $4,000 and later tried to decrease the typical admission value.

Regardless of the weak point in value, ETH is getting into extra storage addresses. ETH retains its usefulness as a part of the Defi Ecosystem and can be utilized as a collateral or liquidity token. ETH noticed a peak inflow at its accrued tackle in January.

In whole, greater than 19M ETH is held on the accrued tackle. ETH is comparatively extra accessible than BTC and displays quite a lot of behaviors for proprietor cohorts.

Ethereum (ETH) flows into the tackle of accumulation, however whales aren’t performing as long-term holders. |Supply: Cryptoquant

Total, small holders of 100-1000 ETH are attaining high costs of over $2,600. A few of the largest ETH whales that would additionally accommodate Defi addresses and swimming pools have lowest realised costs of round $2,300. Within the case of ETH, the bigger the whales you personal, the extra Realized value.

The present guess ETH priced at $2,775, suggesting that some stakers might be underwater. The $2,800 degree is taken into account one of many promoting factors that a big cohort of homeowners could determine to promote. Primarily based on present information, stained ETH can be current in underrated zones. Climbing over $2,800 is useful to the complete ETH defi ecosystem, resulting in elevated worth, safer mortgage alternatives and better income.

ETH is at the moment beneath stress on account of a lack of perception within the usefulness of the community. ETH nonetheless has a number of legacy initiatives, however the chain has not reached the extent of development it has been promised. The Ethereum Basis's method is taken into account too summary and results in a value hiatus.