As Bitcoin (BTC) continues to face a bear market and dip beneath $100,000, a man-made intelligence mannequin has set the likelihood for the asset to achieve a brand new all-time excessive by the top of the yr.

Notably, as of this writing, Bitcoin is buying and selling at $95,731, down 0.5% previously 24 hours and down virtually 6% on the timeline. At present costs, the cryptocurrency is down about 25% from its all-time excessive of $126,000.

Bitcoin fundamentals hit new highs

To gauge the likelihood of Bitcoin hitting a brand new all-time excessive, Finvold sought perception from OpenAI's ChatGPT. ChatGPT outlined a number of catalysts for attaining this milestone.

The instrument famous that sturdy demand from institutional traders and inflows into exchange-traded funds (ETFs) may add $5 billion to $10 billion of shopping for strain, whereas macroeconomic tailwinds reminiscent of potential Fed easing and favorable financial information may carry threat property.

Traditionally, Bitcoin has proven year-end power following halvings, particularly when liquidity circumstances are supportive.

On the bearish aspect, ChatGPT famous that Bitcoin's latest dip beneath $100,000 suggests short-term weak spot. With just one.5 months left till 2025, BTC might want to rise by round 30% to interrupt above its all-time excessive.

Wider macro and market dangers, reminiscent of rate of interest fluctuations, geopolitical shocks and liquidity constraints, additional restrict upside room.

Likelihood that Bitcoin will hit a brand new all-time excessive

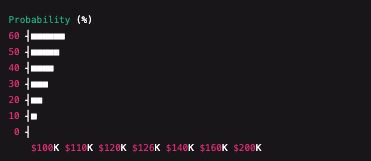

Technically, the AI estimates that there’s a 60% likelihood of it exceeding $100,000 within the quick time period, however solely a 35% likelihood of sustaining the rise to $126,000 within the remaining time.

Changes to institutional move and regulatory readability enhance these probabilities barely, however the compressed window tempers expectations.

The ultimate evaluation by ChatGPT is that there’s a 30-35% likelihood that Bitcoin will hit a brand new all-time excessive by December 31, 2025, whereas a 65-70% likelihood that it’ll fall beneath its earlier excessive or fall additional.

Whereas not not possible, the evaluation frames the chance as a roughly one-in-third situation, reflecting the fragile stability between technical patterns, macro components, and restricted time.

Featured picture by way of Shutterstock