At the moment, the one folks shopping for the largest cryptocurrencies as costs plummet are the very giant traders, or whales, with greater than 10,000 Bitcoins.

In line with on-chain knowledge, all different holder teams have pressed the promote button.

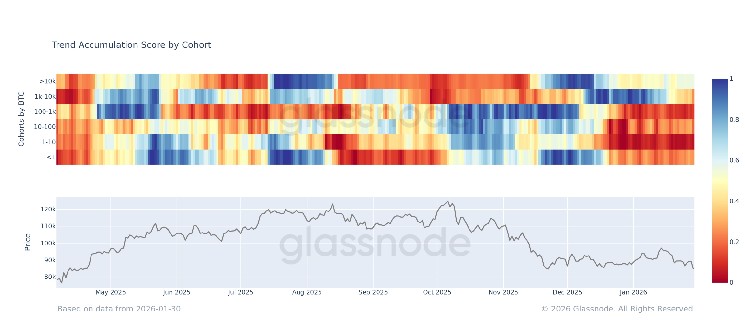

This divergence is highlighted by Glassnode's cumulative development rating by pockets cohort, which measures the relative conduct of various entity sizes based mostly on each Bitcoin balances and volumes acquired over the previous 15 days. A rating near 1 signifies a purchase, and a price near 0 signifies a promote.

Bitcoin accumulation development (Glassnode)

The most important whale is in a “mild accumulation” part, sustaining a impartial to barely optimistic steadiness development since Bitcoin fell to $80,000 in late November, in keeping with Glassnode knowledge. Throughout this era, the value has been virtually steady, buying and selling inside the vary of $80,000 to $97,000 till the top of January.

Bitcoin is presently buying and selling close to $78,000, in keeping with CoinDesk knowledge.

In distinction, the smaller cohorts are all internet sellers, particularly these with fewer than 10 retail holders. $BTC. This group has been on a sell-off for over a month, reflecting continued draw back and threat aversion amongst small members.

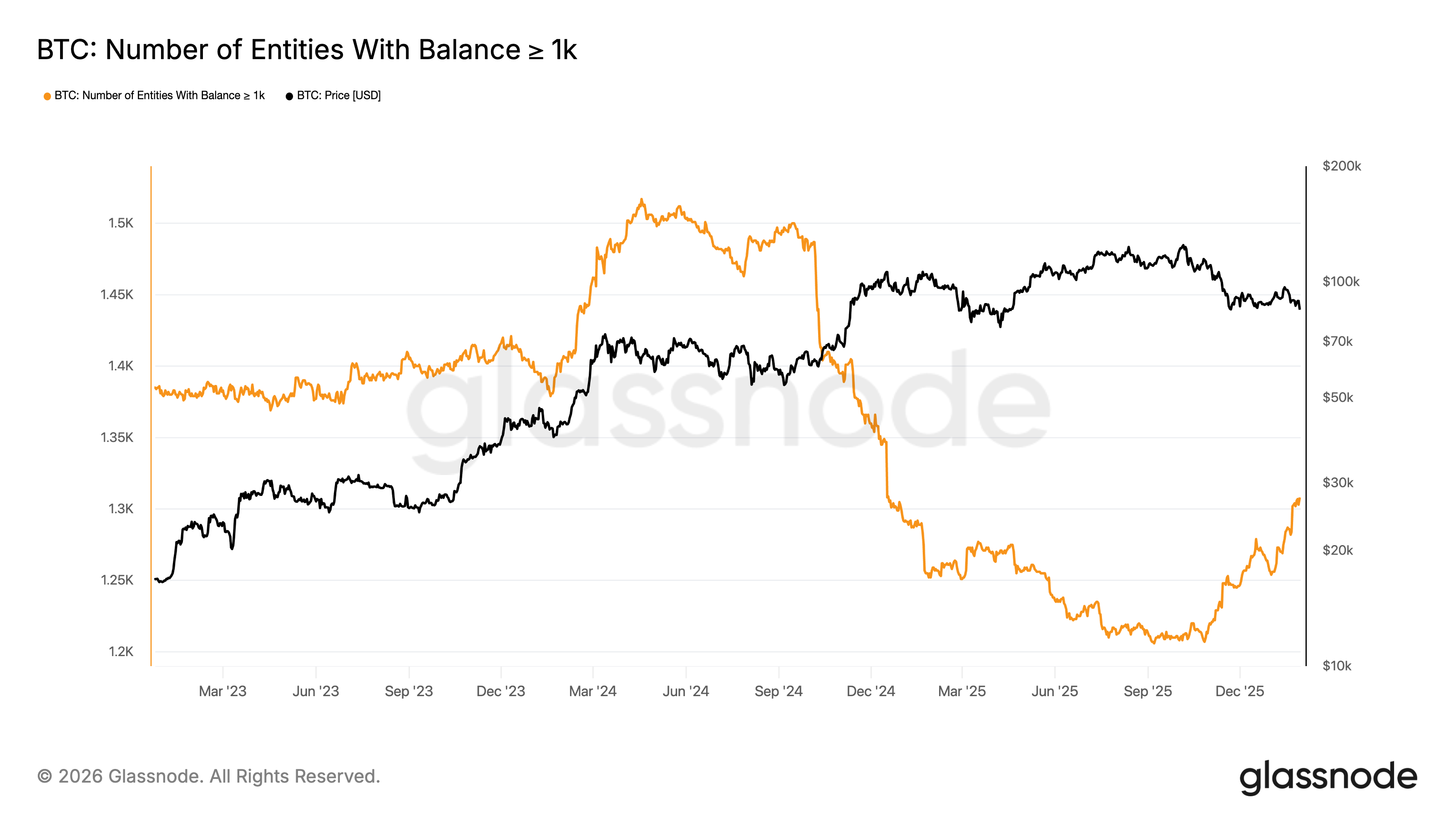

Variety of distinctive entities that maintain no less than 1,000 on the similar time $BTC The quantity elevated to 1,303 from 1,207 in October.

Variety of entities with steadiness 1k $BTC (glass node)

The expansion of this group since Bitcoin hit an all-time excessive in October suggests that enormous holders are embracing a correction. Owns no less than 1,000 whales $BTC is now again to its December 2024 excessive, reinforcing the view that enormous firms are absorbing provide whereas smaller holders proceed to exit.