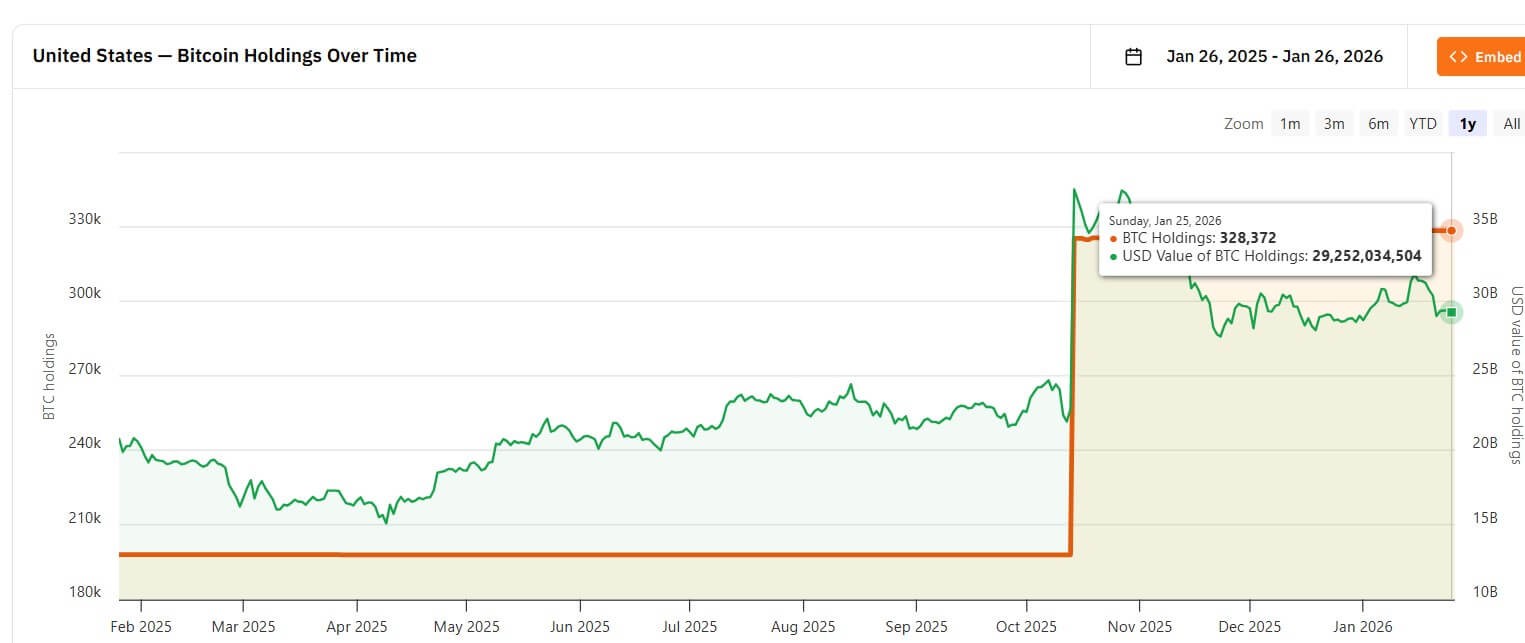

For almost a 12 months, the U.S. authorities has been present process a historic shift in its Bitcoin holdings, transferring from a messy case-by-case stock of seized cryptocurrencies to a nationwide strategic stockpile.

This ambition, typically framed as a “digital Fort Knox,” is at present present process a take a look at of credibility following allegations that round $40 million in cryptocurrencies had been siphoned off from seized government-linked wallets.

Even when the reported losses are small in comparison with the roughly $28 billion in Bitcoin that the USA is extensively believed to regulate, this episode cuts into the core premise of the brand new posture. This raises questions on whether or not Washington can handle a sovereign-sized Bitcoin stability sheet with reserve-grade safety and auditable controls.

Suspected insider breach

Over the weekend, blockchain researcher Zach

ZachXBT linked the theft costs to John D'Aguita, also referred to as Rix, who maintains household ties to executives at Command Providers and Assist (CMDSS), a non-public firm contracted to help the US Marshals Service (USMS) with crypto seizure operations.

Dean D'Aguita serves as president of CMDSS, in line with firm filings. The corporate, primarily based in Haymarket, Virginia, contracts with USSMS to handle and get rid of sure varieties of digital foreign money seized.

ZachXBT mentioned he was in a position to join John D'Aguita to the theft costs after what he known as a “band-on-band” altercation on Telegram. The dispute concerned two people trying to show their wealth by evaluating their pockets balances.

The dispute allegedly culminated when an individual recognized as “Lick” shared screens of his Exodus pockets and transferred massive sums of cash in actual time.

This screen-sharing exercise supplied proof that ZachXBT was monitoring a cluster of addresses related to over $90 million in suspected illicit flows. Roughly $24.9 million of this quantity was transferred from U.S.-controlled wallets in March 2024.

This situation has much less to do with exploiting superior protocols and extra to give attention to vulnerabilities associated to custody governance, contractor entry, and varieties of human failure modes that are usually much less scalable when actual cash and actual operational complexity collide.

In the meantime, this isn’t the primary time that the federal authorities's crypto asset custody operations have come beneath intense scrutiny. In October 2024, roughly $20 million was leaked from wallets associated to Bitfinex hack proceeds, however the majority of the funds had been recovered.

Fragmentation creates threat

Within the fashionable creativeness, the US authorities's roughly $28 billion Bitcoin place appears like a single stockpile behind a single set of controls.

Nevertheless, the fact of working these property is rather more fragmented.

Custody preparations for seized cryptocurrencies are a patchwork of presidency businesses, authorized statuses, and custody options. Funds can exist at totally different factors within the forfeiture pipeline, and “US holdings” will not be a single ledger entry, however reasonably a posh operational system.

This distinction is necessary as a result of safety in a multi-institutional mesh depends on course of self-discipline, constant requirements, and speedy motion of funds from non permanent seizure wallets to long-term chilly storage.

It’s because a single administrator may be protected by a fortress-like protocol.

Nevertheless, techniques involving a number of distributors and handoffs behave in another way. This depends on consistency of management throughout all nodes within the community, together with folks and contractors concerned within the course of.

This expands the assault floor as a result of ambiguity about which entity holds which keys and when.

Surveillance can subsequently creep into the gaps between establishments, between non permanent wallets and long-term storage, and between coverage aims and day-to-day operational realities.

In that context, this reported lack of $40 million takes on even larger significance because it represents a failure of the method.

Such storage failures recommend publicity in unknown places, particularly when the vulnerability is rooted in vendor governance or insider entry reasonably than a one-time technical exploit.

Contractor “hardtail” vulnerabilities

Contractors like CMDSS play a central function in understanding this threat profile as a result of they’re situated the place authorities storage techniques are most advanced.

A March 2025 Common Accounting Workplace (GAO) resolution confirmed that the USMS awarded CMDSS a contract to handle “class 2-4 cryptocurrencies.”

The GAO doc makes distinctions between asset courses that assist clarify why contractors are necessary.

Class 1 property are sometimes liquid and may be simply supported in customary chilly storage. In distinction, property in courses 2-4 are mentioned to be “much less fashionable” and require specialised processing involving bespoke software program or {hardware} wallets.

That’s the hardtail of crypto asset administration: not simply Bitcoin or just a few different liquidity tokens, however a protracted listing of property in a messy stock that arrives through foreclosures. Managing these property might require totally different blockchain operations, unfamiliar signature flows, and complicated liquidation necessities.

In follow, this implies counting on outdoors experience to handle probably the most tough facets of custody. Underneath this mannequin, governments are successfully outsourcing probably the most laborious elements of cryptocurrency operations.

GAO notes that contractors' use of presidency property for staking, borrowing, or funding is strictly prohibited.

Nevertheless, a contractual prohibition will not be a bodily restriction. If human controls are circumvented, personal key misuse can’t be prevented by itself.

That's why this allegation, framed as contractor ecosystem threat and social engineering reasonably than a protocol failure, carries extra weight than the precise allegation of theft. When system resiliency relies on self-discipline and handoffs throughout all distributors, the weakest nodes turn into probably the most enticing targets.

Notably, warnings about custody gaps are usually not new. The 2025 report highlighted that the USMS was unable to supply even a tough estimate of its BTC holdings and had beforehand relied on spreadsheets missing correct stock administration. A 2022 Division of Justice Workplace of Inspector Common audit explicitly warned that such gaps may result in lack of property.

Is the US ready to carry on?

Shifting U.S. coverage makes these operational gaps more and more harmful.

The White Home has directed the Treasury Division to handle custodial accounts that “should not promote” Bitcoin and has moved to create a Strategic Bitcoin Reserve and a separate digital asset stockpile.

This coverage change shifts the federal government's function from non permanent custodian, traditionally related to auctions and disposal of proof, to long-term custodian.

For years, crypto markets have handled the U.S. authorities's stash as a possible oversupply and a possible supply of promoting stress if the seized cash had been liquidated.

Nevertheless, the strategic reserve framework modifications the angle, because the central challenge turns into the reliability of detention.

If Bitcoin is handled as a reserve asset just like gold, customary buyers will implicitly demand vault-level safety, clear custody controls, constant administration, and auditable procedures.

This alleged theft of $40 million subsequently as soon as once more focuses consideration on whether or not the infrastructure supporting this ambition nonetheless resembles an advert hoc proof workflow or is being scaled up for long-term administration.

It’s because the big and well-known authorities holdings of Bitcoin is usually a prime goal for malicious actors trying to exploit a porous system. Cryptocurrency analyst Murtuza Service provider mentioned:

“If criminals imagine that seized funds shall be siphoned from authorities wallets, they could deal with forfeiture as a short lived inconvenience reasonably than an endpoint, particularly if cash laundering routes exist by way of exchanges or cross-chain hops.”