Bitcoin has been buying and selling 29% beneath its October highs this week, when the bellwether digital asset topped $126,000 per coin, leaving its most ardent supporters to reckon with the disagreeable actuality that valuable metals like gold are being robbed of consideration. Nonetheless, many crypto fanatics stay satisfied that after gold loses its momentum, Bitcoin would be the subsequent to make a dramatic comeback.

Treasured metals again flex as Bitcoin bulls argue it's well worth the wait

Social media platforms like X are consistently bickering over Bitcoin's worth motion and gold's eye-catching strikes. On a five-year foundation, Bitcoin nonetheless outperforms gold, rising 189% in comparison with gold's 158%, however the hole is narrowing by the day. Including to the discomfort, silver has outperformed Bitcoin in five-year efficiency and is already forward of the curve after rising 261% within the final 60 months.

As of 10 a.m. ET on Thursday, January 22, gold was buying and selling at $4,833 per ounce, and silver was buying and selling at $93.53 per ounce. On the similar time, Bitcoin ( BTC) is hovering round $89,098 per coin, down 8% over the previous week. As for X, Bitcoin advocates are pushing again, arguing that Bitcoin's present poor efficiency doesn’t mechanically spell doom.

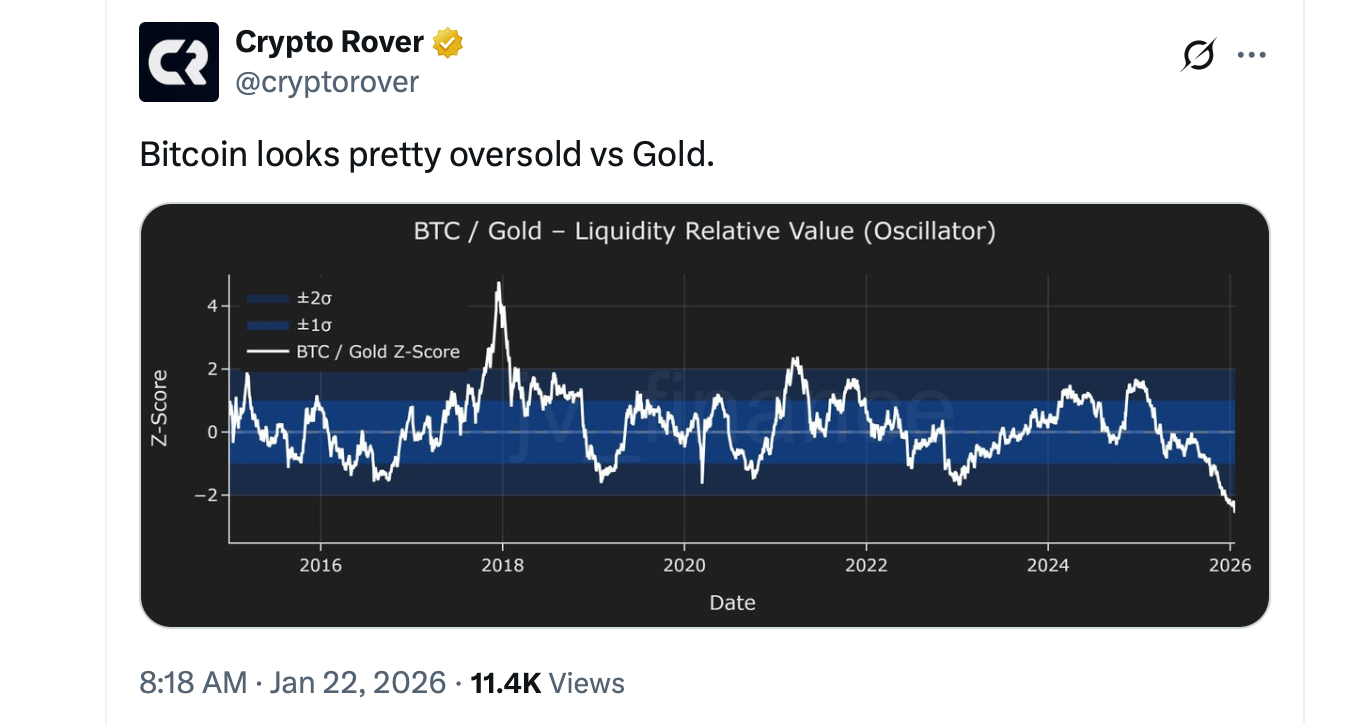

“Whereas gold is rising, BTC I don't imply a wrestle BTC “Which means capital is selecting what dangers it needs to take at present,” one X person wrote on Thursday. The choice adjustments every day. ” One other commentator was extra pointed, arguing that Bitcoin is “criminally oversold in comparison with gold.”

James Verify, also referred to as Checkmate and co-founder of CheckonChain, argues that some Bitcoin holders run out of endurance each time gold strikes as anticipated, including that each Bitcoin and gold are prone to rise for the long run as fiat currencies are steadily shedding buying energy. “There are Bitcoiners on the market who couldn’t survive six months of rising gold costs,” Checkmate mentioned. “Their confidence melted as they watched gold report a standard constructive 12 months for corn (after Bitcoin, by the way in which, recorded two in a row).”

He added:

“Peter Schiff has been feeling this manner for 17 years, and he'll be feeling that means once more very quickly. He actually grew silver hair ready for silver to go up. If he's feeling notably salty, he can go purchase gold cash. Put the highest in and also you're again to your regular program. Each cash are up fairly a bit, so personal each. Fiat has no backside.”

This view resonated broadly throughout Bitcoin-focused social media circles. “Each gold rally ends in a Bitcoin supercycle,” Bitcoin Teddy of the X account wrote on Thursday. Others chimed in below the Checkmate thread, making enjoyable of Kim with tongue-in-cheek humor. “Our grandchildren will let you know how we dug shiny yellow rocks out of the bottom, made them into bricks, carried them with armed guards, paid cash to retailer them in safes,” mentioned Finiti of the X Account. “It's much like how we have a look at pigeons carrying letters now.”

Bitcoin supporter Anthony Pompliano mentioned he believes deflation is a significant component weighing on Bitcoin. BTC Right now, others took related views, arguing that gold must also take care of related forces. “In truth, I believe deflation is among the main headwinds for Bitcoin and a very good information level as to why Bitcoin has not outperformed over the previous 12 months,” Pompliano wrote on Thursday. One other person chimed in, emphasizing, “Gold ought to be going through the identical headwinds, however for some motive it isn't. It makes you suppose it can quickly.”

Additionally learn: Mirmican Capital: Gold development highlights US inventory market weak spot

For now, the battle between Bitcoin and valuable metals appears extra like a ready sport than a verdict. Whereas gold and silver are having fun with their second within the solar, Bitcoin is buying and selling properly beneath its October highs, testing the resolve of even its most vocal advocates. However amongst longtime holders, there’s an environment of impatience somewhat than panic, combined with the acquainted perception that rotations between belongings are short-term and infrequently well mannered.

Whether or not that confidence proves prescient stays an open query, however the debate itself highlights a deeper divide over timelines and beliefs. For some, the rise in gold is a sign to rethink danger. For others, it's only a prelude earlier than capital returns to Bitcoin. In the meantime, the talk rages on, memes fly freely, and either side appear positive of 1 factor. Which means, of their view, fiat currencies stay the weakest guess.

Continuously requested questions ❓

- Why is Bitcoin at present underperforming gold? Bitcoin is buying and selling properly beneath its October highs as some funds have moved into gold and silver. How lengthy it will final is debatable.

- How has Bitcoin in comparison with gold in 5 years? Over the previous 5 years, Bitcoin stays within the lead, rising 189% in comparison with gold's 158% rise. In the meantime, silver outperformed BTC For five years.

- Why are some buyers nonetheless bullish on Bitcoin?Many supporters consider that Bitcoin's present weak spot is short-term and that capital will reverse as soon as gold's rally subsides. That is debatable.

- What position does deflation play in Bitcoin worth fluctuations?Some analysts argue that deflation is weighing on Bitcoin's efficiency, though gold appears much less affected up to now.