Bitcoin (BTC) rebounded to $105,000 on Wednesday, falling briefly to $103,000. This restoration will steadily push world markets into risk-off mode as tensions within the Center East rise.

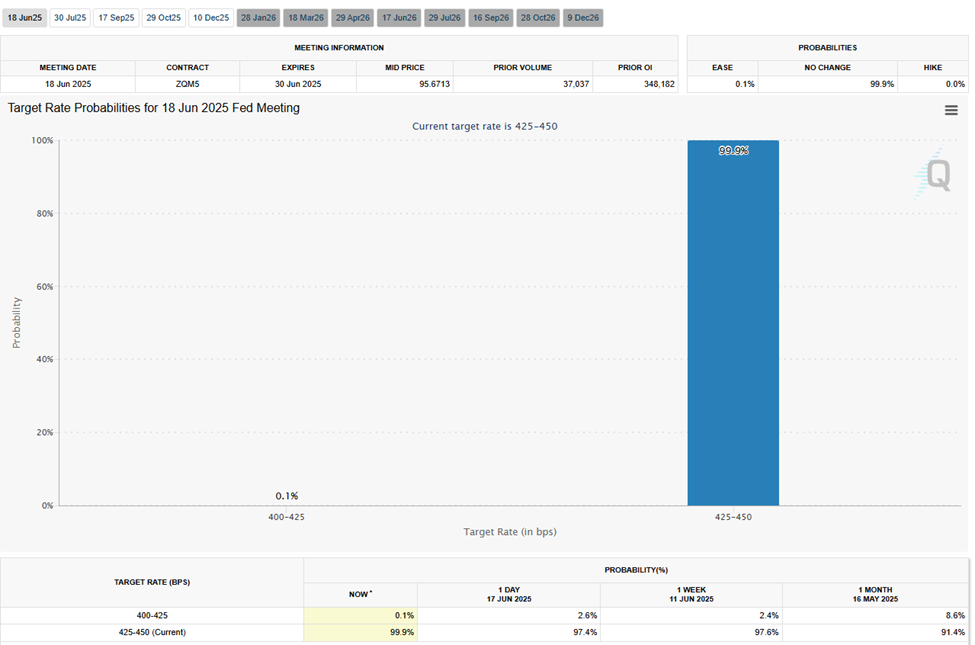

In the meantime, merchants and traders are aiming to find out rates of interest for the FOMC (Federal Open Market Committee) later right now. It is a US financial indicator that would transfer by way of the market.

Iran's menace to blockade of Straits of Hormuz causes worry of an oil shock

The surge in costs got here amid rising fears in regards to the oil shock. These fears come after Iran introduced that prior approval of all oil and LNG tankers passing by way of the Strait of Hormuz, a slender chokepoint that handles practically 20% of the world's oil commerce.

Iran's transfer escalates geopolitical dangers in already unstable areas. The overall notion is that the Strait of Hormuz motion is a part of a broader technique.

Defence Intelligence, a well-liked account for X (Twitter) that tracks worldwide points, extremists and politics, says Iran's strongest weapon shouldn’t be missiles, however its potential to shut the Strait of Hormuz and undermine world commerce.

In keeping with political commentator Brian Classenstein, the transfer does nothing to decrease fuel costs. Moreover, it doesn’t encourage FOMC to chop rates of interest.

This angle is attributed to the expectation that provide may nonetheless improve. Reuters just lately reported that OPEC+ is anticipated to extend by 411,000 barrels every day in July.

“The bigger oil demand within the OPEC+ financial system, Saudi Arabia particularly, may offset further provide from the group over the approaching months and help crude oil costs,” Reuters reported, citing Capital Economics analyst Hamad Hussain.

Nevertheless, others disagree with the chance that the oil shock could also be on the timer. Analysts warn that oil costs may skyrocket if the Strait of Hormuz is closed fully.

“An assault on Iran's oil manufacturing or export services will increase the worth of Brent crude to $100, and the closure of the Strait of Hormuz will result in costs within the vary of $120-130,” CNBC quoted Andy Lipou, president of Lipou Oil Associates.

That is in step with JPMorgan's forecast that disruptions in Iran's potential to provide world markets may surge oil to $120 and push CPI inflation to five%.

Turning to the Fed with Bitcoin as a hedge and gold volatility climb

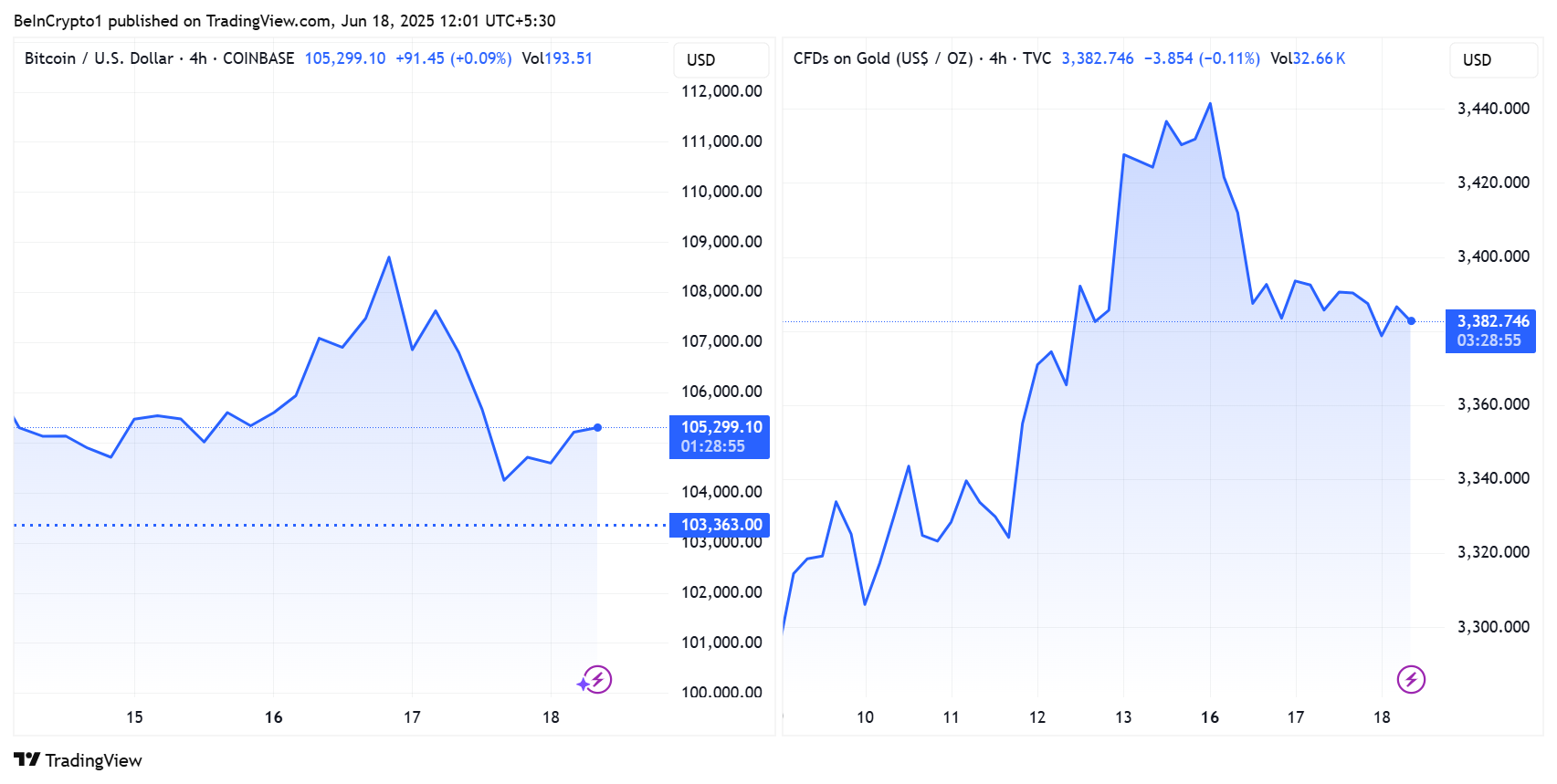

Whereas conventional markets have digested the importance of a worldwide provide chain shock, Bitcoin has regained its $105,000 threshold. Beincrypto knowledge exhibits that BTC was buying and selling at $105,299 on the time of this writing.

Pioneer's crypto advantages from perceptions as a hedge in opposition to inflation and geopolitical uncertainty, however gold costs see a rise in volatility as merchants flip to exhausting belongings.

Bitcoin and gold value efficiency. Supply: TradingView

Bitcoin and Gold are seeing new demand for protected havens as vitality prices threaten to beat world shopper costs.

The bounces, which ranged from $103,000 to $105,000 on Tuesday, remained firmly within the Bitcoin value throughout the month-to-month vary of $100,000 to $110,000, in line with analyst Daan Crypto Trades.

“The entire displacement of ~10% (low to excessive) is the smallest vary we've seen in a month,” the analyst wrote.

The timing of Iran's announcement is essential. The US FOMC is scheduled to make its subsequent rate of interest determination later right now, presenting this week as its most essential US financial indicator.

Based mostly on the CME FedWatch software, merchants don’t count on rapid charge modifications. However, traders will intently watch Fed Chairman Jerome Powell's speech on indicators of plans to cope with persistent inflation amid the geopolitical turmoil.

FOMC's rate of interest discount chance. Supply: CME FedWatch Instrument

As reported by Beincrypto, the market stays tense. Crypto traders have volatility because the Fed fights in opposition to inflation and avoiding market panic.

When oil is weaponized and the crypto market reacts in actual time, you may take a look at Bitcoin's resilience once more, particularly if the vitality market turns into much more spiral or the Fed informs of the Hawkish's tilt.