In line with the corporate's newest quarter submission, Mara acquired a Terraphlox Bitcoin Miner price $73.3 million from Silicon Valley Chip Startup Auragin within the first half of 2025.

This text comes from Theminermag, an business publication of cryptocurrency mining, and focuses on the most recent information and analysis on the institutional Bitcoin mining firm.

The quantity was paid prematurely – $22.3 million within the first quarter and $51 million within the second quarter – represents nearly all of Mara's $188 million money outflows, representing nearly all of money outflows for vendor advances within the first half.

“For the six months ended June 30, 2025, the corporate promoted Auragin $73.3 million to buy merchandise. All of this was crammed by the tip of the interval with no remaining stability remaining.”

As of June 30, the Bitcoin mining big nonetheless had $51.4 million in an impressive buy dedication with Auragin, which is scheduled for supply in common installments till the rest of 2025.

Supply emphasizes deepening monetary and strategic relationships with Mala's Aurazine. Along with buying {hardware}, Mara invested $20 million in Auradine's most well-liked inventory in February, changing its earlier protected funding of $1.2 million into shares. Aurazine's whole holdings are presently $85.4 million, with Mara holding a seat on the startup's board of administrators.

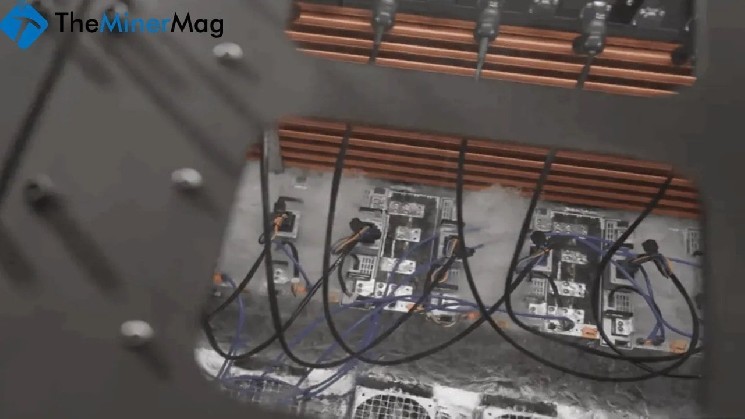

Through the half-cycle of 2020, Mara's personal mining fleet consisted nearly solely of Bitmain's Antminers. The pivot to Auragin exhibits a strategic shift in the direction of sourcing US-made mining gear. In the meantime, Bitmain is growing the US home manufacturing capability, strengthened by the import of digital parts amid looming uncertainty in commerce tariffs.

The unique article may be discovered right here.