Hyperliquid didn't depend on hype cycles or advertising blitzes to get into the highlight. It designed a technique to improve relevance and compelled the cryptocurrency business to reevaluate how far on-chain buying and selling infrastructure has come.

What’s hyper liquid?

At its core, Hyperliquid is a decentralized alternate (DEX) constructed particularly for perpetual futures buying and selling. In contrast to earlier DEX platforms that relied on automated market makers and off-chain order matching, Hyperliquid operates a very on-chain central restrict order ebook, the place trades, liquidations, and fund disbursements are recorded instantly on the blockchain.

The design purpose was easy however bold. The thought was to keep up non-custodial settlement whereas offering the execution high quality, market depth, and responsiveness that merchants anticipate from a centralized alternate. In observe, this meant replicating skilled buying and selling mechanisms on-chain slightly than compromising on pace or value discovery.

who constructed it

Hyperliquid is developed by Hyperliquid Labs and led by Jeff Yan, a former high-frequency dealer with expertise at Hudson River Buying and selling. Mr. Yang then ran a market-making operation for cryptocurrencies, however after the collapse of FTX uncovered the dangers of centralized management in derivatives buying and selling, he turned his consideration to alternate infrastructure.

This challenge took an unconventional path from the start. Hyperliquid didn’t elevate enterprise capital, as an alternative selecting to self-fund its improvement. This resolution shapes the platform's governance construction, incentives, and long-term priorities, and centralizes management within the arms of builders slightly than exterior traders.

The place hyperliquid works

Hyperliquid runs by itself standalone Layer 1 (L1) blockchain, slightly than Ethereum or any current rollup. Customers should bridge their belongings (mostly stablecoins corresponding to USDC) to the community earlier than they will commerce. As soon as funds are deposited, buying and selling actions are successfully gas-free from the person's perspective, and charges are abstracted on the protocol degree.

There is no such thing as a central headquarters and no identification necessities. The variety of validators is proscribed in comparison with older blockchains, reflecting a deliberate trade-off that prioritizes throughput and low latency over most decentralization.

Why merchants paid consideration

Hyperliquid's rise coincided with a resurgence in demand for derivatives buying and selling following the collapse of a number of centralized exchanges (CEXs). Merchants need leverage with out the danger of custody, and Hyperliquid has arrived, providing quick execution, low charges, and on-chain funds.

The platform's interface and mechanics are acquainted to skilled merchants, decreasing the educational curve that has traditionally slowed the adoption of decentralized exchanges. For a lot of, this was the primary on-chain venue that functioned extra like knowledgeable buying and selling platform than an experimental various.

Liquidity and market share

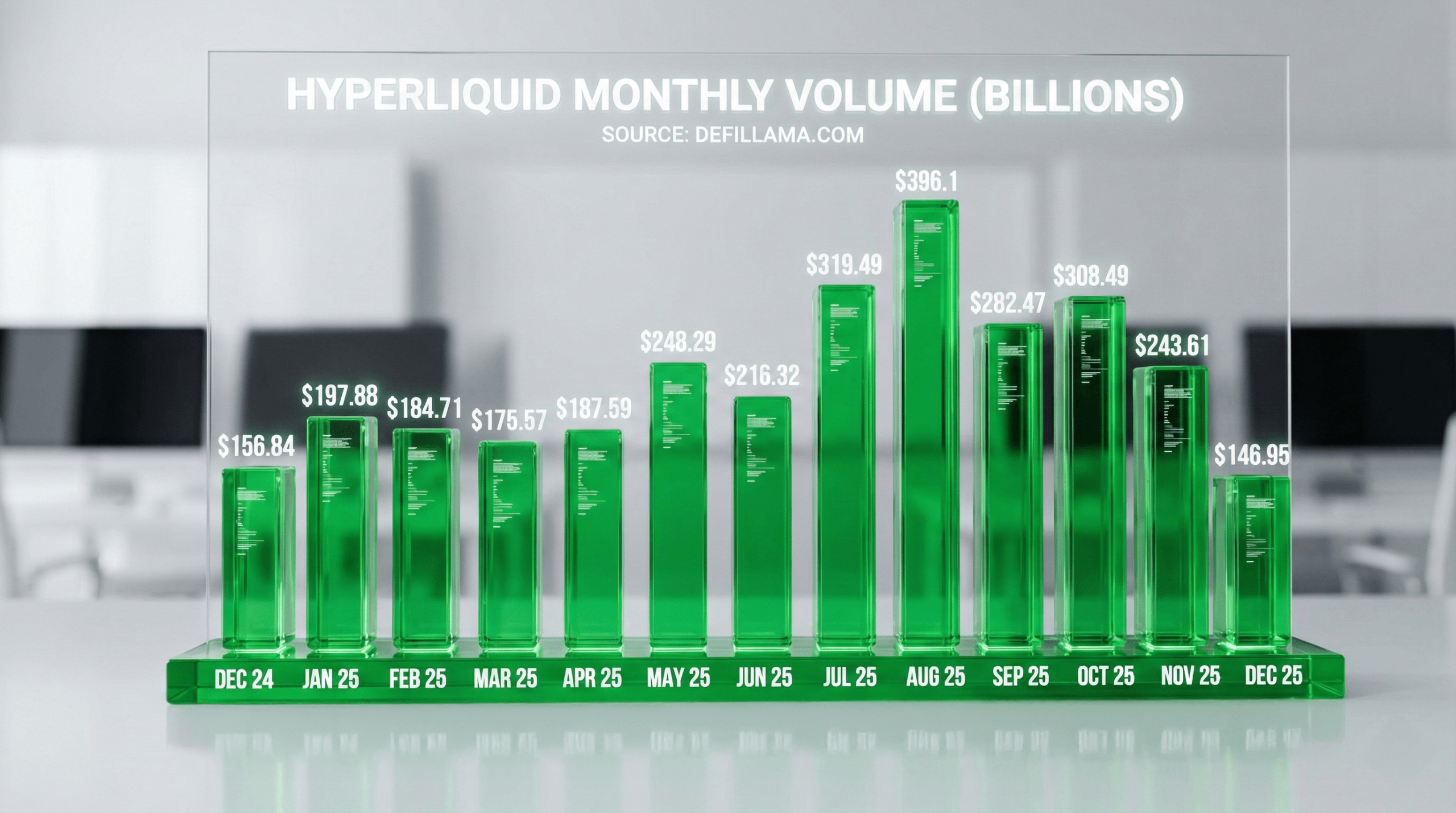

Liquidity adopted exercise. Market makers stepped in, the order ebook deepened, and spreads narrowed. By 2025, Hyperliquid constantly accounted for the biggest share of decentralized perpetual buying and selling quantity, typically dealing with billions of {dollars} in every day transactions.

HyperLiquid maintained its main place within the decentralized perpetual market all year long, though volumes fluctuated in response to broader market circumstances. At some factors, the corporate's futures buying and selling quantity reached double-digit percentages of Binance's, and this comparability highlighted how the terrestrial decentralized infrastructure is paying off.

Token with out the hype

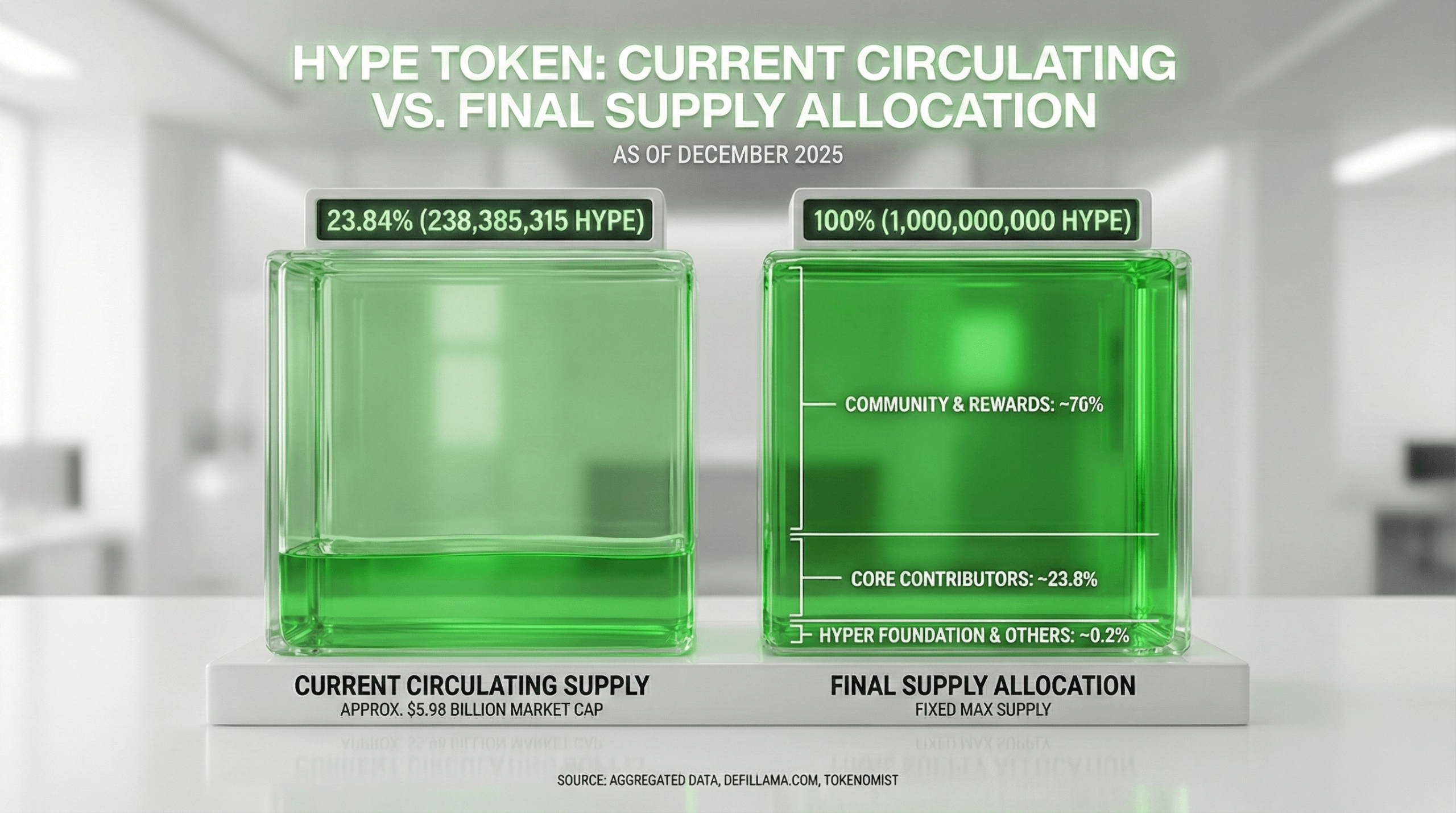

HyperLiquid launched its native token, HYPE, in late 2024 via a large-scale airdrop that primarily favored customers slightly than exterior traders. This token shall be used for governance and network-level features, and the protocol's income will primarily go in the direction of buybacks slightly than rewards for inflation buying and selling.

Though HYPE's market efficiency was notable in 2025, the alternate's development was pushed by buying and selling exercise and liquidity slightly than incentive farming or emissions-based applications.

Stress check and technical inspection

The platform confronted its first main stress check on the finish of 2024. At the moment, rumors of doable exploitation brought on a wave of fast withdrawals. No breaches occurred and transactions continued uninterrupted, reinforcing confidence within the system design.

In 2025, Hyperliquid sometimes encountered technical points, together with temporary outages and API interruptions. Though these incidents didn’t lead to everlasting buying and selling disruptions, they highlighted the operational challenges of operating high-performance infrastructure utterly on-chain.

Opponents enter the sector

Hyperliquid's success has sparked intense competitors. Established decentralized derivatives platforms corresponding to DYdX and GMX stay lively, whereas new era Perp DEXs have been launched with incentive-driven methods designed to seize quantity.

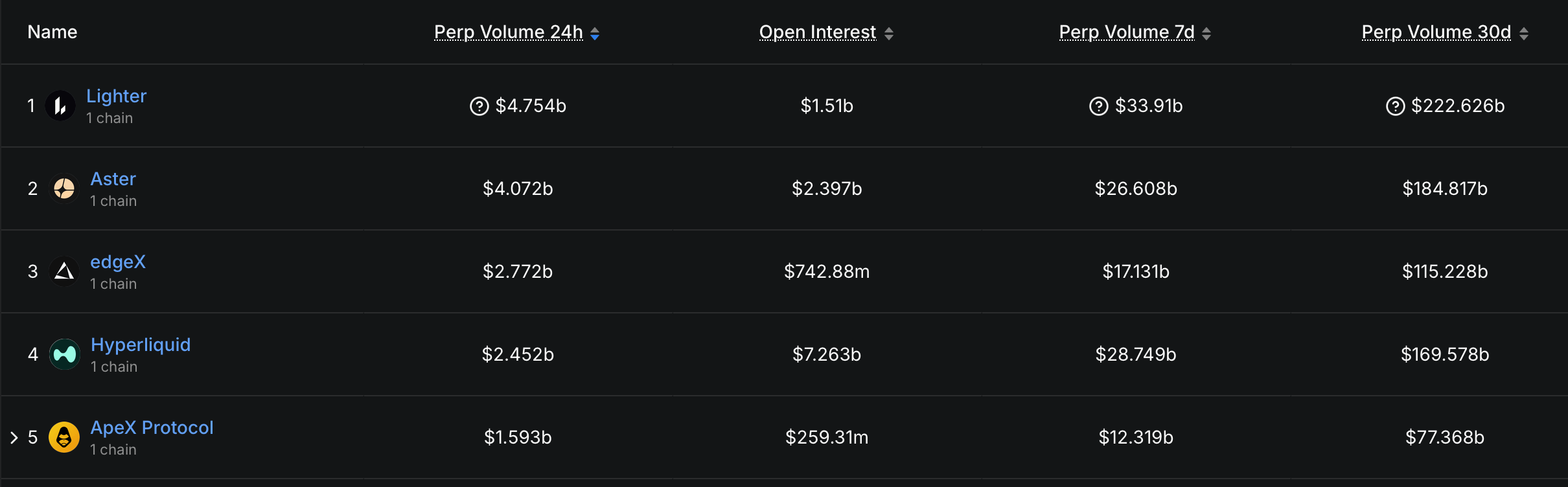

DEX quantity per December based on statistics from defillama.com. 30-day quantity exhibits that Reiter and Aster are outperforming Hyper Liquid.

New entrants relied on buying and selling rewards, zero-commission promotions, and airdrop hypothesis, sparking what grew to become generally known as the “PERP DEX Wars” of 2025. As competitors elevated, Hyperliquid's market share shrank, however it remained one of many largest decentralized prison organizations as a consequence of its liquidity and open curiosity.

Why hyperliquid is the theme for 2025

Hyperliquid grew to become a spotlight not as a result of it eradicated competitors, however as a result of it modified expectations. This demonstrated that decentralized exchanges can help institutional-scale derivatives buying and selling with out counting on off-chain shortcuts or custody dangers.

The platform's self-funded mannequin, subdued token footprint, and concentrate on infrastructure over incentives has made it a frequent reference in business analysis and commentary all year long.

what occurs subsequent

By the tip of 2025, Hyperliquid has advanced past a single buying and selling venue. With a rising EVM suitable atmosphere and an increasing ecosystem of third-party functions, the corporate has established itself as a buying and selling infrastructure slightly than a standalone alternate.

It stays unclear whether or not the corporate can keep its lead as its opponents mature. However in 2025, hyperliquid pressured the business to recalibrate its assumptions. And in cryptocurrencies, altering the baseline is commonly extra necessary than successful within the second.

Steadily requested questions ❓

- What’s hyperliquid?Hyperliquid is a decentralized alternate targeted on perpetual futures buying and selling on its proprietary layer 1 blockchain.

- Who based Hyperliquid?The platform is led by Jeff Yang, a former high-frequency dealer who constructed HyperLiquid after the failure of centralized exchanges uncovered custody dangers.

- Why did Hyperliquid achieve traction in 2025?It combines centralized execution with on-chain funds and self-custody.

- Does Hyperliquid require id verification?No, customers can commerce with out KYC by depositing belongings and connecting their wallets.