As Bitcoin (BTC) integrates across the $110,000 degree, the technical indicators counsel that the present bull cycle of belongings could also be approaching conclusions.

In line with well-known on-line analysts Commerce shotMaiden's cryptocurrency approaches a possible market peak within the second half of 2025, and can then be revised considerably in 2026.

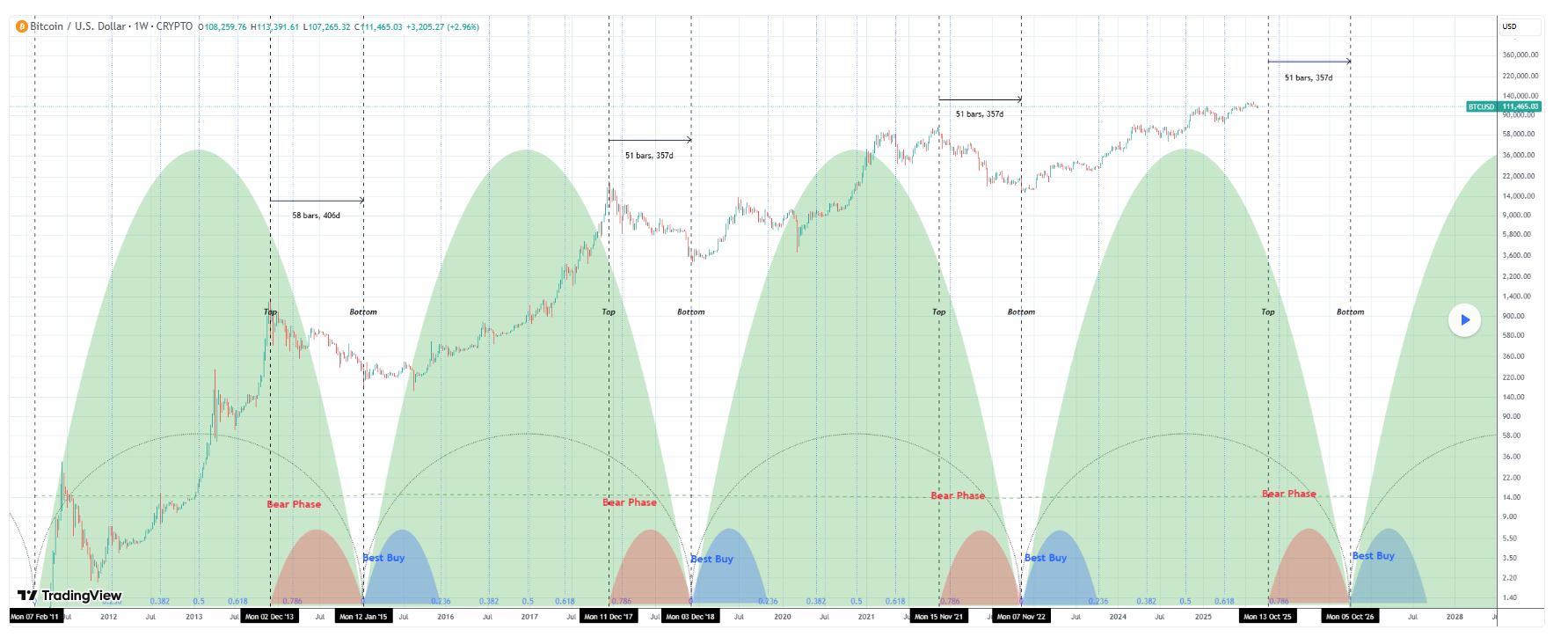

in TradingView In a September fifth put up, analysts famous that historic information exhibits that Bitcoin's market construction usually follows the repetitive rhythm of prime, bear stage and cycle backside. Every supercycle tended to shut with a time extension of 0.786 Fibonacci earlier than getting into an extended recession.

Primarily based on present cycle measurements, the subsequent main prime might happen within the week of October thirteenth, 2025. This timing coincides with earlier cycles that peaked simply earlier than shifting into every bear stage.

The evaluation additional means that the bear section could start after December 1, 2025, when the 0.786 Fibonacci marker was reached. If cycle symmetry holds, the naked market might develop to the supercycle backside, which is projected on October 5, 2026.

At that time, the very best long-term buy alternatives are anticipated to seem, per previous patterns wherein low cycles offered favorable entry factors forward of the subsequent main gathering.

Key Bitcoin worth ranges to observe

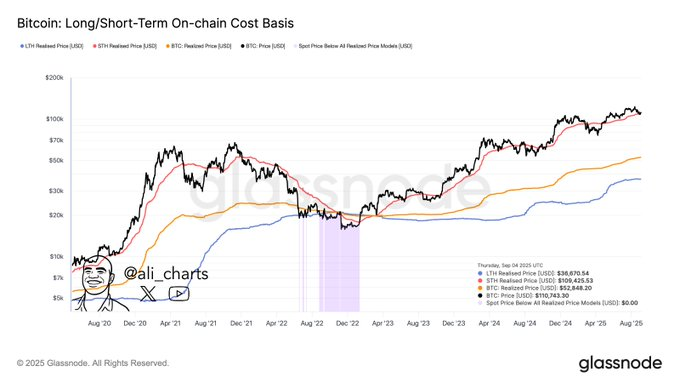

In the meantime, on-chain information shared by Ali Martinez highlighted key metrics for assessing Bitcoin's present bull market well being.

Traditionally, downtrends start when costs fall under the realised worth of short-term holders and type a deeper reversal once they slip below the realised worth of long-term holders. These ranges signify the typical value base of latest consumers and long-term buyers.

As of September 6, 2025, GlassNode information exhibits that short-term holders have a realised worth of $109,400, whereas long-term holders have a worth of $36,700.

With Bitcoin buying and selling under report highs, $109,400 has been a key help for viewing, whereas $36,700 is a deeper structural flooring that has traditionally been alongside the cycle backside.

Bitcoin worth evaluation

By press time, Bitcoin had been buying and selling at $110,774, a decline of about 1.7% within the final 24 hours, however nonetheless has a rise of 1.5%.

The market ought to maintain Bitcoin $110,000 in help to realize peace of thoughts that the rally might be sustainable within the coming weeks.

Featured Pictures through ShutterStock