Binance continues to attract out greater Stablecoin deposits, reaching file ranges of ERC-20 reserves. Change is the chief in leveraged buying and selling. Right here, stubcoins are the important thing to constructing new positions.

Binance continues to be the chief of Stablecoin Remerves as most merchants selected market operators as their fundamental buying and selling venue. The inflow of Stablecoins boosted the spinoff market and set the stage for peak liquidity accessible.

The influx of stubcoin into Binance was vertical in the previous few months of 2024, however development slowed within the first quarter of 2024. Regardless of the slowdown available in the market, stubcoin provide stays excessive, with belongings standing by the chance to commerce. Stablecoins have expanded as a method to scale back danger. Throughout this market cycle, stubcoin provide is rising, even because the crypto market struggles with a 30% drawdown from its peak.

Binance's Stablecoins expanded to above the bull market in 2021, based mostly on demand for spinoff buying and selling positions. |Supply: Cryptoquant

The inflow of stubcoins reached primarily spinoff exchanges, with provide peaking at tokens above 47B. Since most actions relied on the leveraged location of BTC and ETH, spot exchanges attracted a a lot decrease share of Stablecoin's gross sales.

Stablecoin inflows improve spinoff transactions

The whole provide of stubcoin on the trade reached numerous kinds of 45B tokens, with USDT and USDC nonetheless being the commonest. Binance carries over 33B tokens, together with centrally managed FDUSD. Binance's USDC totals $3.38 billion, USDT $29.4 billion, and FDUSD one other $1.5 billion. The trade additionally has essentially the most energetic buying and selling pair of USDT, incomes $16.7 billion in 24-hour quantity.

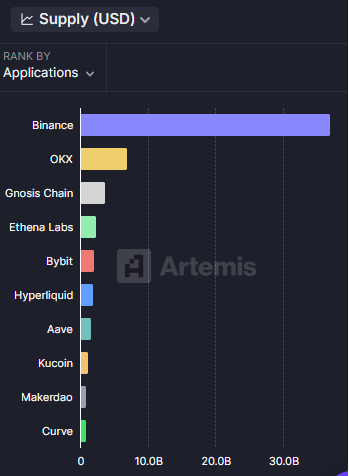

Binance Buying and selling is the primary use case for Stablecoins, with as much as $330 billion inflows from USDT, USDC, FDUSD and different main dollar-based tokens. |Supply: Artemis

The trade displays regional restrictions and is rising the usage of regulated USDC tokens within the Eurozone whereas discontinuing USDT merchandise. This shift has not affected the final inflow of tokens. Binance has achieved greater than $1.7 billion in day by day buying and selling volumes, boosted by native BNB tokens and the worth of a number of Stablecoin markets.

The market additionally has 5.34% of all USDC transactions, and has essentially the most energetic buying and selling pair in opposition to BTC. The current inflow of stubcoin has primarily elevated the liquidity and spot market within the derivatives BTC market. Inflows into centralized exchanges comply with the final enlargement of steady rocks to tokens above 229B, relying on which belongings are counted. Most stubcoins are coated in {dollars}, with the choice foreign money being round $2 billion.

Stablecoins is one among Binance's main reserve belongings. The trade carries over $133 billion in whole belongings based mostly on the transparency report. USDT reserve is 104% of the consumer's invoice. The USDC market is much more over-species, claiming that 161% of customers. Extra reserves improve with charges, liquidation prices and different user-based funds.

Binance remains to be there too studying Carries an important share of the open income of belongings, with the belongings being centralized trade, derivatives.

BNB Sensible Chain Carries 7bs with Stablecoins

A decentralized binance ecosystem carries 7B or extra with bridge or native stubcoins. This chain is the fourth largest community with steady provide enlargement.

Over 53% of all stubcoins are nonetheless in Ethereum. The ERC-20 stub cash are additionally essentially the most regularly deposited. Tron carries over 28% of whole provide, whereas Solana has over 10B in USDC or 5.4% of whole provide.

Three main Stablecoins on the BNB chain, USDT, USDC and FDUSD represent a provide of roughly 5.9b, exceeding 2.2b within the final 12 months. The remainder of the stability is for different small bridge-type stablecoins.

The BNB Sensible Chain is used for easy transfers and funds through Stablecoins. USDT Switch makes that $4.5 billiontravelling round $500 million in USDC, FDUSD has round $60 million in day by day transfers. Most senders in BNB Sensible chains favor USDT, the primary supply of liquidity for fee or decentralized swap.

For now, the expansion of the BNB good chain has lagged behind the success of Binance's derivatives market.