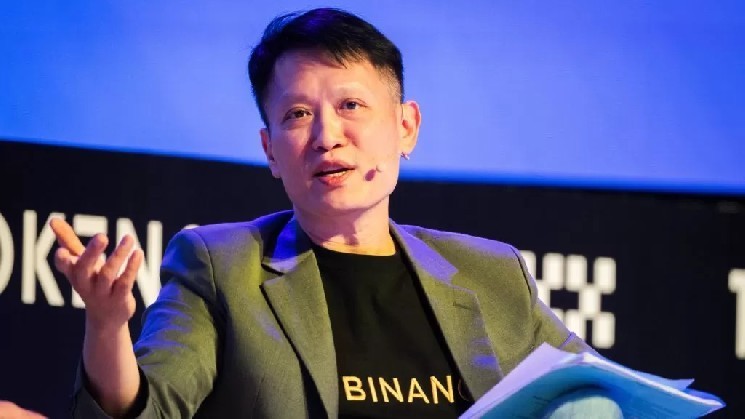

Richard Teng, who took over as CEO of Binance after founder CZ stepped down, talked in regards to the huge “10.10 crash'' that occurred in October final 12 months. Teng denied allegations that Binance was concerned within the mass liquidation that rocked the cryptocurrency market.

Talking on the Consensus Hong Kong occasion, Binance CEO Richard Teng stated that Binance was indirectly chargeable for the large-scale crypto liquidation on October 10, and that the large-scale liquidation affected all exchanges.

Richard Teng stated that the historic mass liquidation incident that occurred on October 10 final 12 months was not restricted to Binance.

Following the introduction of uncommon earth ingredient laws by China and the announcement of recent tariffs by america, the market skilled a major decline, resulting in large-scale liquidations on all exchanges.

At this level, Teng emphasised that in contrast to different exchanges, Binance is offering a specific amount of assist to affected customers.

“In the course of the October mass liquidation, all exchanges skilled promoting stress on cryptocurrencies. On account of the mass liquidation, some customers suffered losses, and Binance supplied assist to those customers. In distinction, different exchanges didn’t take such measures.”

Teng identified that about 75% of liquidations are because of points reminiscent of steady coin lack of worth or delays in asset switch, and most of them happen in a brief time period.

On that day, the US inventory market noticed $150 billion price of liquidations, whereas the cryptocurrency market noticed $19 billion price of liquidations.

The Binance CEO famous that macroeconomic uncertainty and geopolitical tensions proceed to impression the market, however institutional demand stays robust.

“Regardless of the latest market downturn, institutional traders are nonetheless coming into the crypto house. This implies good traders are pouring cash into the market.”

Though retail demand for cryptocurrencies is barely weaker in comparison with final 12 months, institutional and company funding stays robust.

*This isn’t funding recommendation.