Binance Pockets, one of many extensively used Web3 providers, reached peak quantity on Wednesday. After OKX suspends the Dex Aggregator service, the pockets took over the site visitors.

Binance Pockets has develop into the preferred Web3 interplay software, bringing every day volumes to over $900 million. After OKX pockets stopped its Dex Aggregator service, the pockets took over Web3 site visitors and Dex exercise.

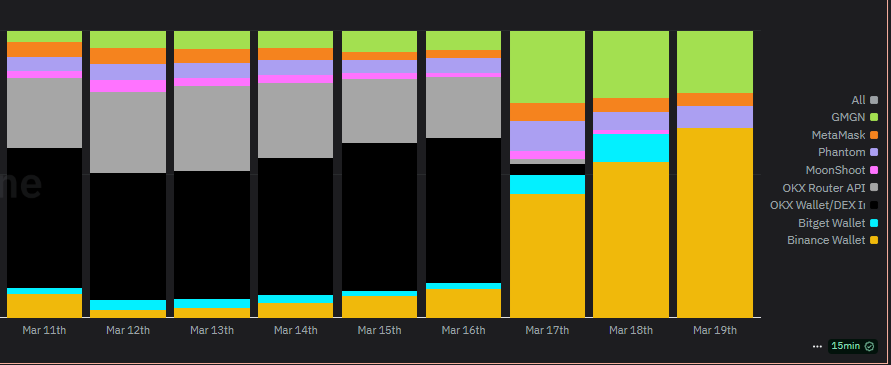

Over the previous two days, Binance Pockets has elevated its total every day person share. Shortly after the announcement by OKX, the pockets exceeded 54% of the market. A day later, the share has already grown to 66%.

Binance Pockets expanded its affect amongst different Web3 wallets after including new liquidity options. |Supply: Dune Analytics

The usage of Binance wallets additionally coincided with a basic improve in BNB good chain utilization and DEX exercise in PancakesWap. The shift could also be momentary as OKX merely paused its DEX aggregator to realize improved compliance. One other short-term cause for the elevated use of wallets was the launch of Binance's Bubblemaps (BMT) tokens. The property have been one of many trending tokens of the day, additional boosting pockets exercise.

One more reason for the rising use of Binance Pockets is the particular bonus interval with zero further buying and selling charges. The power to change fashionable memes at no further value has pushed the pockets into a significant place. This pockets additionally retains the benefit of getting a local chain that different Web3 wallets lack and depends on multi-chain entry.

Get pleasure from zero buying and selling charges for the subsequent 6 months with all swaps in ##binance pockets!

Begin buying and selling now! 🔥

– Binance Pockets (@binanceWallet) March 17, 2025

The Binance ecosystem is about to increase extra aggressively after Ethereum and Solana have proven indicators of person leaks. The pockets additionally provides new options, together with unique entry to TGE launches, token filtering, and choice capabilities.

OKX loses site visitors after Lazaro Hacker turns into a software to clean his funds

OKX Web3 wallets beforehand carried as much as 50% of their site visitors as a result of excessive demand for multi-chain entry and out there DEX. After eradicating the aggregator, the pockets share fell to three.6% of all actions.

As Web3 PocketsOKX was used anonymously and carried a number of the site visitors from the latest Bybit Hack. So OKX will increase the compliance mechanism. The OKX web3 pockets used a tokane that might obscure a number of the swap. OKX is attempting to safe a task in Defi House because it seems the protocol isn’t prepared to trace and freeze funds. Hacking actions.

OKX claimed that the Web3 platform is open to everybody, however latest exercise confirmed that the protocol may select to trace the fund, probably complicit within the losses. Though there is no such thing as a uniform standards for the Freeze Fund, OKX adjustments entry to filtering and combination transactions.

Binance shifts the stability of Web3 wallets

Sudden exercise spikes may additionally be linked to new capabilities that additional combine ecosystems. House owners of central change Binance Stability can now bid instantly on decentralized tokens.

Binance Alpha 2.0 It was launched in Chinese language-speaking areas and described the fast spikes of Web3 actions throughout Asian buying and selling hours. Binance's strategy to extending token choice with no checklist is just like a Coinbase-validated pool, offering curation entry to comparatively safe liquidity pairs.

BNB Sensible Chain has generated $1.63 million in charges over the past 24 hours, making it the sixth largest price generator of its historical past, surpassing Tron (TRX). The BNB Sensible Chain has additionally been raised additional Price In comparison with those compiled by Ethereum and Solana. The transition to new meme tokens signifies that there’s nonetheless a seek for extremely lively crypto property. Regardless of the sluggish Altcoin season, liquidity hubs and accessible infrastructure proceed to be key to sustaining exercise within the chain.

Presently, Binance and Coinbase are the one centralized exchanges with extremely lively native chains. This permits for centralized exercise and Web3 crossover. Over the previous few months, liquidity has principally been break up between CEX and DEX, however Binance has unleashed its peak person base and property and has returned to DEX actions.

Following using the Peak Pockets, Native Token BNB took a step again and traded for $618.84. Over the previous few days, BNB has maintained costs above $600. That is pushed primarily by new demand for meme tokens.

Binance has the additional advantage of mixing 4 mem tokens, along with every day alpha picks that shine together with your fingers. Different exchanges do not need an built-in ecosystem that gives prolonged lists of tokens and safe DEX aggregation.