Bitcoin seems to be getting into a quiet accumulation section as promoting stress on exchanges eases, new knowledge from on-chain analytics platform CryptoQuant reveals.

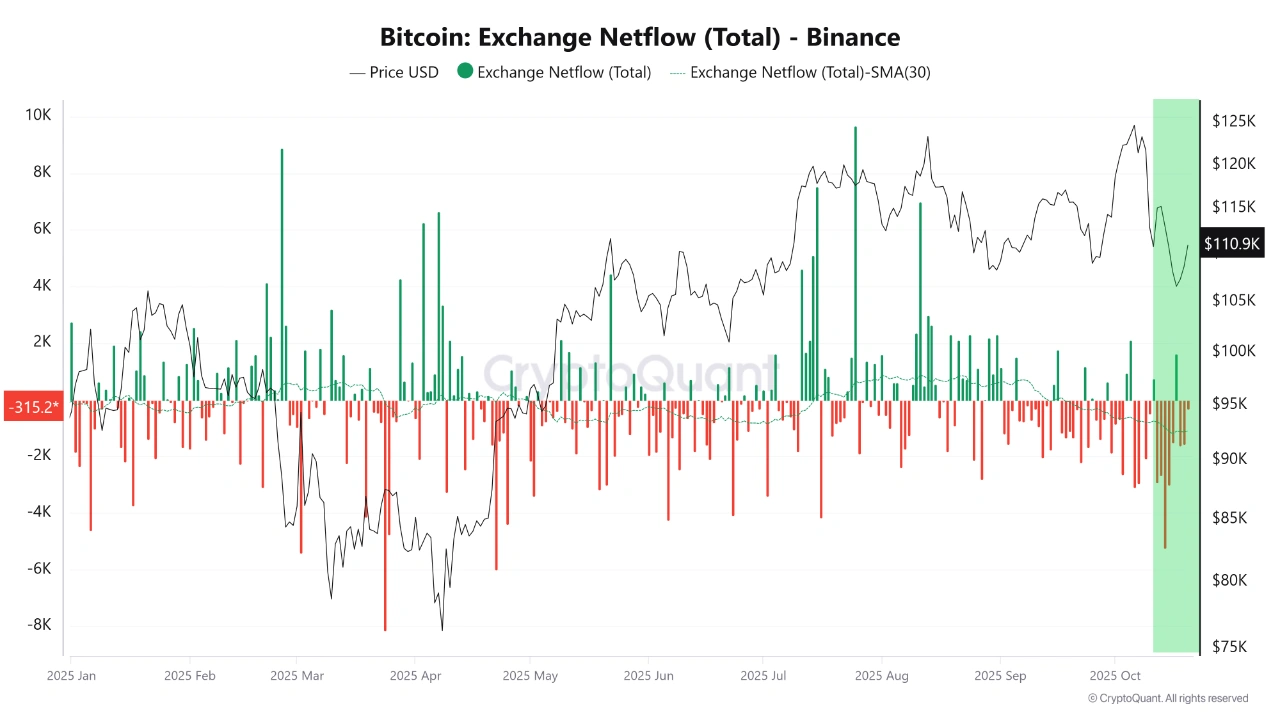

The 30-day shifting common of Bitcoin web flows on Binance has turned sharply unfavorable in current weeks, indicating that extra Bitcoin is leaving the platform than flowing into it.

In line with CryptoQuant’s newest evaluation, the persistent unfavorable pattern signifies buyers are taking extra holding positions than promoting, which might not be unrelated to new acquisitions of BTC by institutional buyers and Saylor’s technique.

Bitcoin change netflow on Binance. Supply: CryptoQuant

Investor removes BTC from change

The most recent knowledge comes greater than per week after the crypto market suffered a serious correction, wiping out round $19 billion in derivatives positions and briefly taking Ethena Labs' USDe stablecoin off its greenback peg.

Analysts at CryptoQuant famous that short-term sentiment stays fragile regardless of netflow developments portray a unique image. They famous that whereas day by day inflows and outflows are noisy, wanting on the 30-day common gives a clearer image, including: “The pattern may be very unfavorable, indicating accumulation.”

This sample suggests buyers are holding onto belongings from exchanges relatively than exiting the market altogether, and analysts say historic knowledge reveals such strikes usually precede new upward momentum.

The transfer coincides with a decline within the change's Bitcoin reserves, which have been steadily declining since early October.

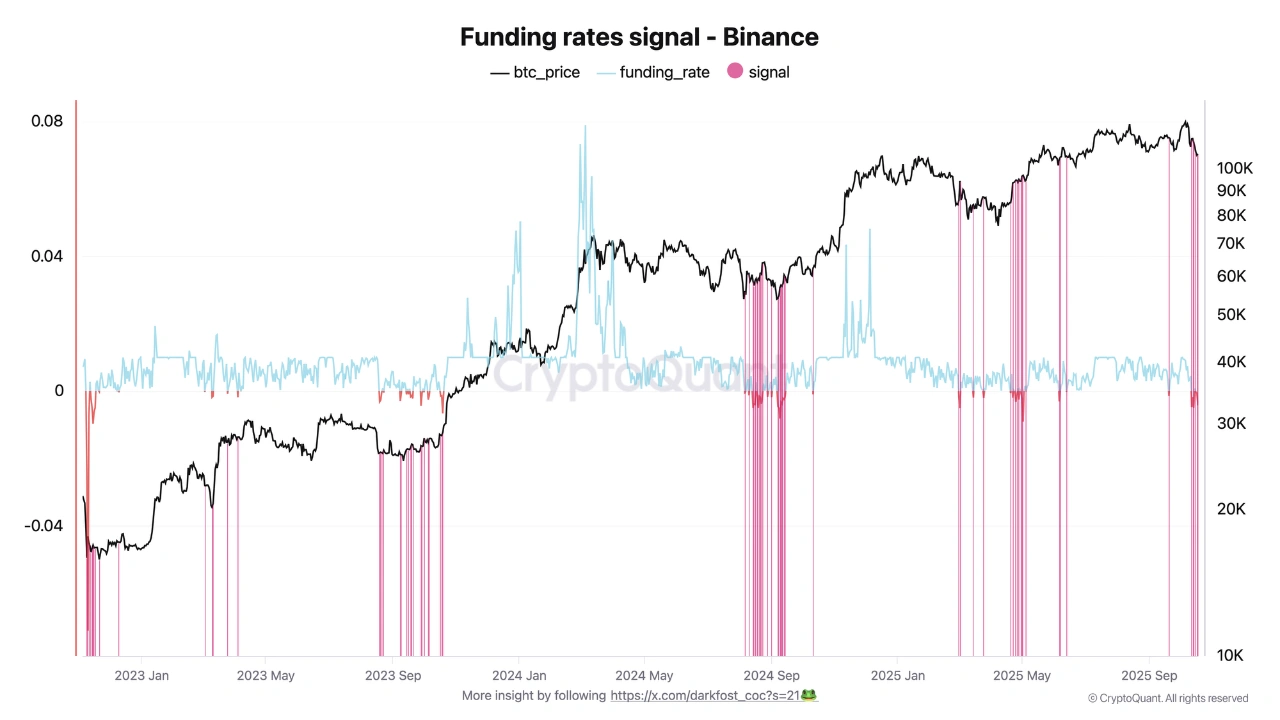

Funding price alerts on Binance. Supply: CryptoQuant

Derivatives knowledge suggests 'mistrust' stage

Separate evaluation from CryptoQuant reveals that the funding price has been unfavorable for six out of the previous seven days, hovering round -0.004%.

The funding price displays the quantity merchants pay to maintain their futures positions open. When these charges flip unfavorable, it means quick sellers are paying for lengthy merchants and is a transparent signal that the market is trending bearish.

Analysts say this sample usually marks a interval generally known as a “stage of mistrust,” when costs start to achieve footing however merchants stay skeptical about whether or not the restoration will proceed.

This stage of disbelief often happens after a serious correction. Traders who’ve suffered giant losses turn into cautious and are sluggish to re-enter the market. However that very same skepticism might spark a rally if costs begin to rise, forcing quick sellers who wager on additional declines to purchase again their positions.

If the present sample performs out, analysts imagine that heavy quick promoting out there might trigger a brief squeeze, pushing Bitcoin larger as positions are liquidated. As seen within the occasions of September 2024, Bitcoin fell to $54,000 after which rebounded above $100,000 for the primary time. Additionally, in 2025, BTC rose from $85,000 to $113,000 after which to $123,000.

Accumulation meets disbelief

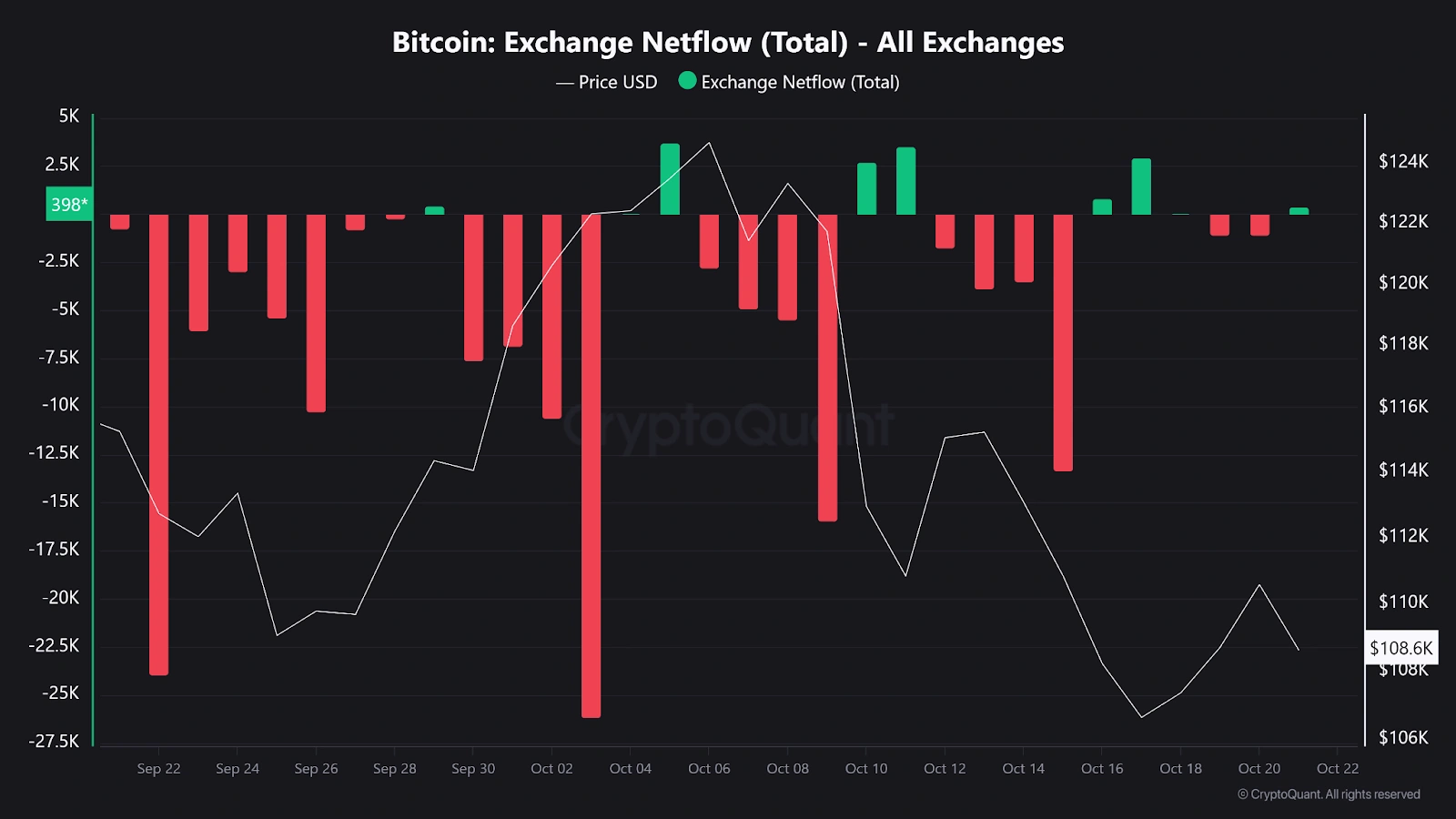

Historic knowledge reveals that unfavorable web flows usually precede value will increase, however this doesn’t assure it. Macro components, similar to the kind that brought on the earlier crash, can affect how a pattern interprets right into a sustained bull market.

Web stream of Bitcoin between exchanges. Supply: CryptoQuant

However for now, the 30-day knowledge means that the worst of the promoting stress could also be over, and the most recent knowledge on the platform now confirms that the worth of BTC is progressively rising, as the information factors out, and cash are actually flowing into exchanges.

If Bitcoin continues to lose cash from exchanges whereas quick merchants get overextended, the stage might be set for an excellent larger degree, and plenty of skeptics could not see it coming till it has already began.

CryptoQuant's evaluation concludes, “Day by day noise doesn’t outline the pattern. The 30-day common does. And proper now, that pattern is pointing within the route of accumulation.”