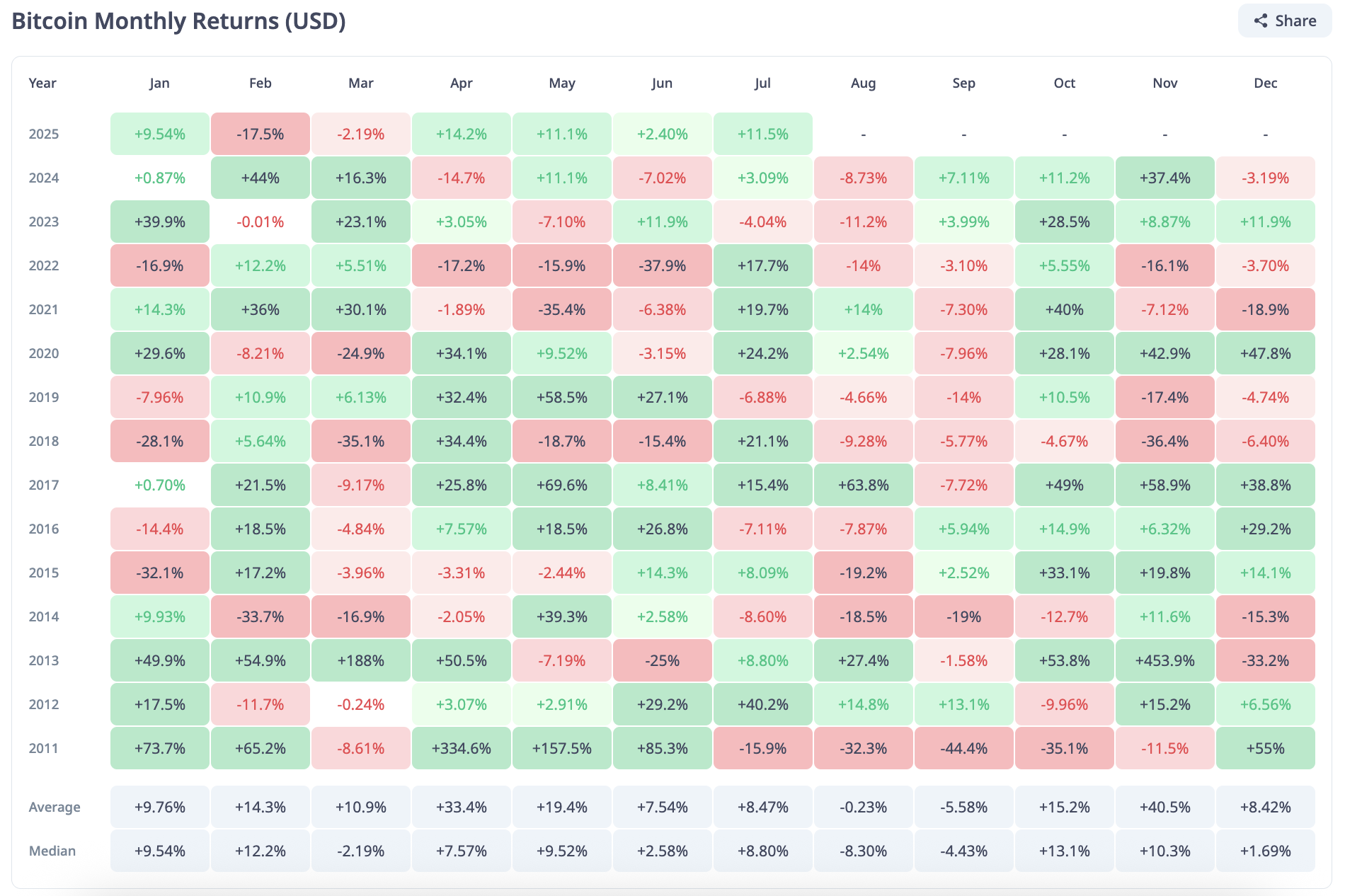

Bitcoin's highly effective July rally could give the Bulls a cause to smile, however the subsequent web page on the calendar brings a really totally different tone. From a statistical perspective, August is Bitcoin's worst-performing month, and worth historical past means that hassle could possibly be on the horizon.

Of all months, August has the bottom median return, at -8.3%. The common return price is not only -0.23%, and the sale might be repeated throughout this era, inflicting dampers to happen.

Numbers don't lie. In 2024, BTC fell by 8.73% in August. In 2023, the decline was 11.2%. And in 2022? One other 14%. This can be a large loss for the third yr in a row, wiping out earnings and turning the upward pattern round.

Traditionally, the one hope for a greater August, akin to +14% in 2021 and +2.54% in 2020, has come in the course of the bull cycle, similar to the present market situations.

BTC is at the moment buying and selling at round $119,000, ending July and is up 11.3% per thirty days. Nonetheless, the chart has already been flattened below the $120,000 resistance zone. With out new catalysts and quantity spikes, the outlook is heading in the direction of the tip of the month.

What's significantly harmful in August is that gross sales normally begin shortly. Traditionally, early August typically brings sharp pullbacks, particularly with sturdy jurisses over time. This can be a basic common reversal setup.

So, whereas July could shut on the inexperienced, August has a protracted observe report of adjusting moods. Except Bitcoin breaks this sample, the subsequent 30 days will enable BTC to enter the weakest seasonal interval, maybe rewriting the report e-book for all of the flawed causes.

For now, the Bulls have 9 days left till the calendar turns in opposition to them.