The decisive break in Bitcoin past the psychologically vital $95,000 mark has injected contemporary optimism into the market, not less than amongst miners.

This vital milestone has on-chain information that has brought about minor emotional adjustments and exhibits a major enhance in BTC minor reserves over the previous few days.

Miners guess on BTC the other way up as reserves soar from the annual low

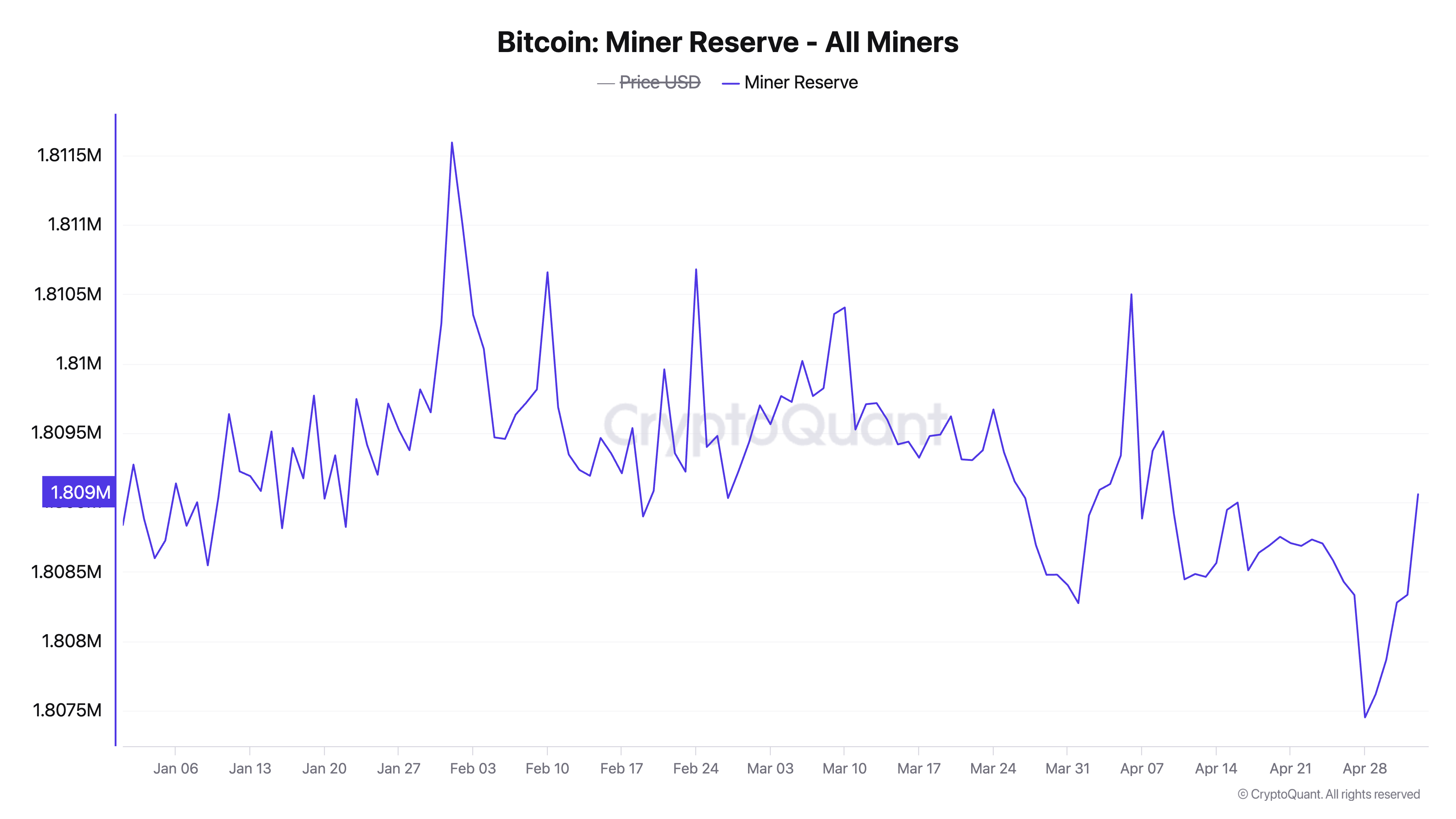

Bitcoin's minor reserves started rising on April 29, shortly after BTC was closed above the $95,000 threshold, based on Cryptoquant.

For context, the reserve had fallen to an early yr decline of 1.8 million btc simply sooner or later in the past, turning the course again and displaying indicators of accumulation.

Bitcoin Minor Reserve. Supply: Cryptoquant

Bitcoin's Minor Reserve tracks the variety of cash held in miners' wallets. This represents a coin reserve that the miners haven’t but bought. As soon as that falls, miners transfer cash from their wallets, and are checking bearish emotions in direction of BTC, often to promote.

Conversely, when this metric rises as it’s now, it means that miners are holding extra mined cash.

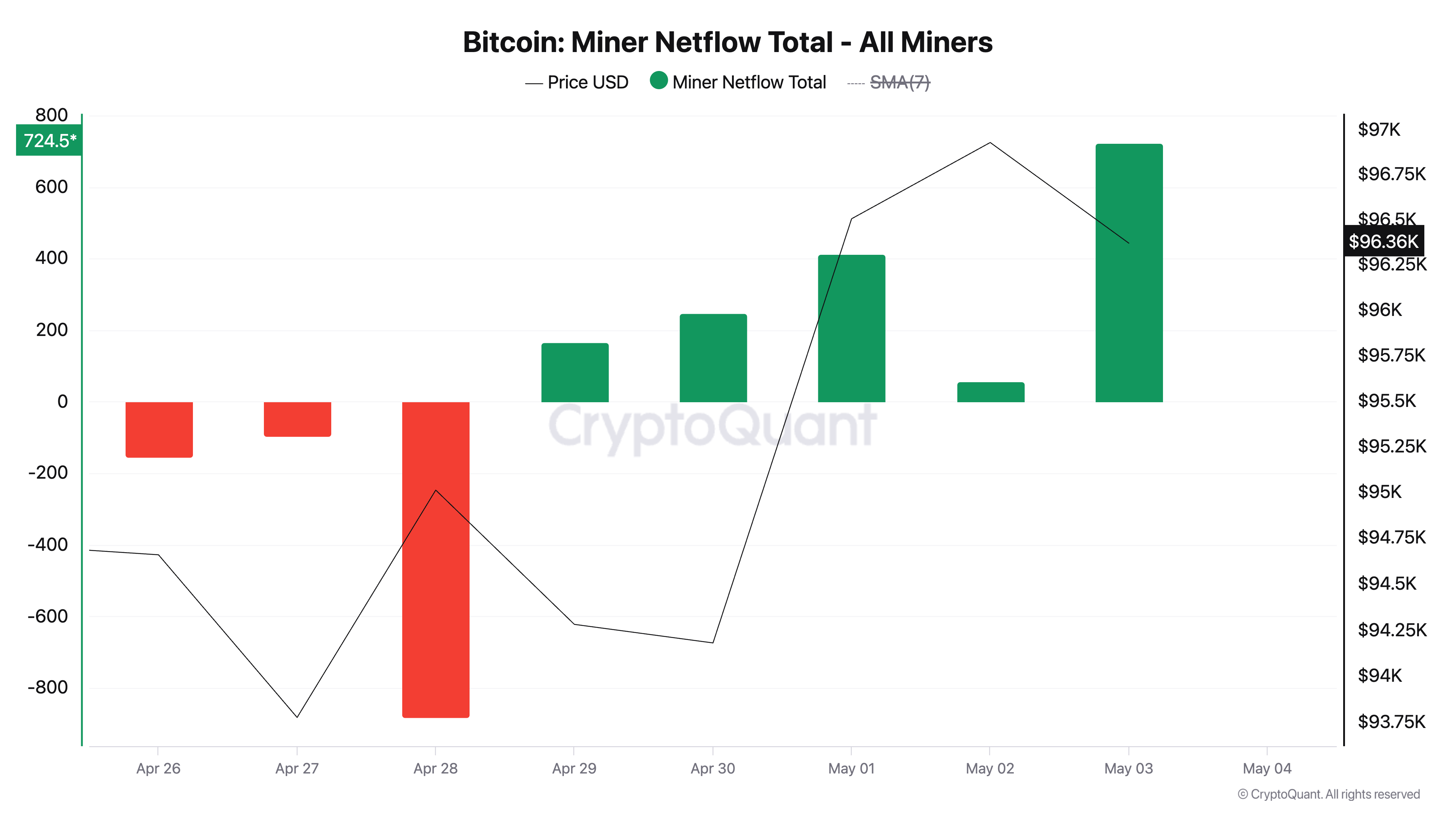

Moreover, bullish adjustments in minor sentiment are additional supported by constructive minor Netflow recorded since April twenty ninth.

Bitcoin Minor Netflow. Supply: Cryptoquant

Such actions additional mirror confidence within the upwards as miners, typically thought of long-term holders, select to build up slightly than liquidate.

There's a catch

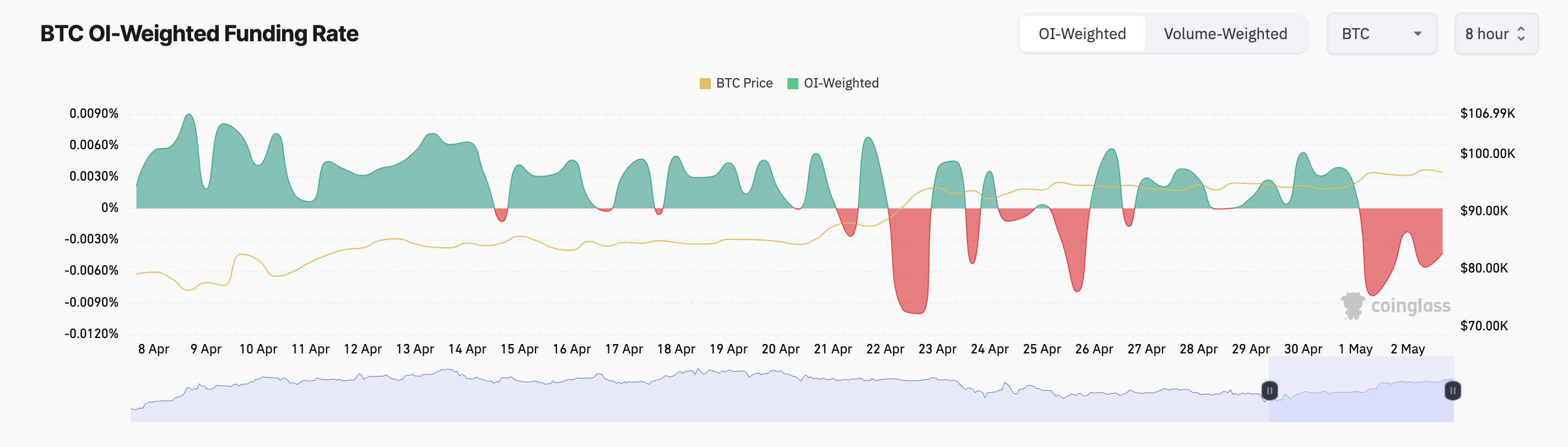

However feelings aren’t universally bullish. Whereas BTC Minor is backing from gross sales, spinoff information tells a unique story.

Within the futures market, BTC's funding price has remained unfavourable because the starting of Could, an indication that a good portion of merchants are betting on short-term value changes. On the time of urgent, the coin's funding price is -0.0056%.

BTC funding price. Supply: Coinglass

Funding charges are periodic funds exchanged between long-term and short-term merchants in everlasting futures contracts to take care of the contract value on the spot value.

Whether it is constructive, it signifies that merchants who maintain lengthy positions are paying for folks with quick positions, indicating that bullish sentiment dominates the market.

However, such unfavourable funding charges point out shorter bets than lengthy bets, suggesting bearish stress on BTC costs.

Breakouts or breakdowns as merchants and miners diverge

Minor habits could consult with renewed confidence, however spinoff, steady bearish emotions recommend that merchants stay vigilant about potential pullbacks.

If the buildup of cash is enhanced, BTC can lengthen income, outperform resistance by $98,515 and attempt to regain the worth mark of $102,080.

BTC value evaluation. Supply: TradingView

Nevertheless, should you win a bearish over a significant coin and witness a scarcity of demand, its value might fall beneath $95,000, reaching $92,910.