Bitcoin's value efficiency within the fourth quarter of 2025 has been a serious supply of concern for the cryptocurrency {industry}, and rightly so. Sooner or later previously few weeks, it regarded like the highest cryptocurrency would end the 12 months deep within the pink zone.

Over the previous week, Bitcoin value has proven wholesome indicators of restoration, regaining the numerous $90,000 assist degree. In response to a cryptocurrency knowledgeable, the market chief could also be performing higher than the present charts point out.

How is BTC already priced?

In a submit on social media platform This can be a query Bitcoin buyers continually face.

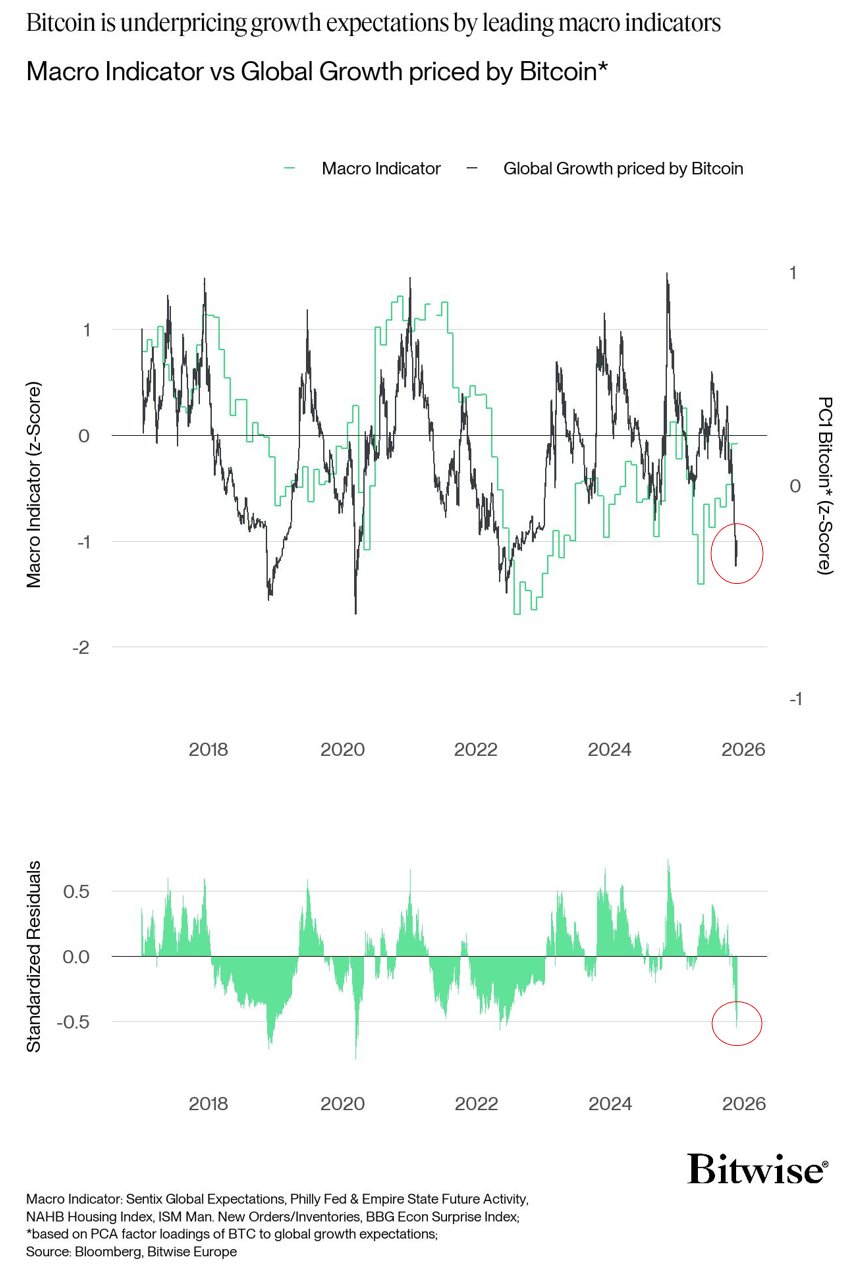

In response to macro analysts, the flagship cryptocurrency is pricing within the weakest international progress outlook since 2022 (marked by Federal Reserve tightening and the collapse of FTX) and 2020 (a interval when the Covid-19 pandemic was at its peak).

Dragosch stated that utilizing a collection of key macro research, he was in a position to decide the extent of world progress expectations that Bitcoin is already pricing into. “Bitcoin is actually pricing in a recessionary progress surroundings,” Bitwise researchers wrote.

Dragosch added:

Personally, I are typically a macro contrarian as a result of Bitcoin could also be underestimating or exceeding the prevailing macro outlook. The costs of all property are inherently macro sentiment. I believe that's additionally the place most alphas are made.

As talked about earlier, the final time macro expectations have been this pessimistic was 2020 and 2022. Bitcoin underperformed macro expectations earlier than mounting a robust rebound. Dragosch believes a replication of this state of affairs is at present underway.

Supply: @Andre_Dragosch on X“World progress expectations are anticipated to speed up from right here, following earlier financial stimulus, which factors to a re-acceleration via 2026,” the top of European analysis at Bitwise famous.

Dragosch famous that the final time there was such uneven danger reward was throughout the pandemic, when the value of Bitcoin first collapsed as a result of shocks in March 2020 after which surged sixfold by the top of the 12 months. This macro setup could be likened to a 'coiled spring or a ball in water'.

Bitcoin’s present trajectory seems to be taking the type of a “coiled spring,” in accordance with macro analysts. Which means the Bitcoin value is poised for violent strikes after being compressed for a time period. Dragosch concluded his evaluation by saying that buyers aren’t optimistic sufficient.

Bitcoin value at a look

As of this writing, the BTC value is round $90,880, with no important motion over the previous 24 hours.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

enhancing course of for focuses on offering completely researched, correct, and unbiased content material. We adhere to strict sourcing requirements and every web page undergoes diligent evaluate by our staff of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of the content material for readers.