Bitcoin (BTC) continues to commerce inside a slim worth vary, indicating restricted upward motion final week. On the time of writing, the worth of main cryptocurrencies was round $117,719, down 1% within the final 24 hours, representing a 4.2% decline, above $123,000, from the current all-time excessive.

On this worth efficiency, a current evaluation shared by contributor Borisvest Shed on Cryptoquant's Quicktake platform highlights the potential for underlying market dynamics affecting the present state of Bitcoin.

Analysts say Binance Futures information means that sure buying and selling patterns may form the short-term route of BTC regardless of volatility settling.

These observations prompted a debate on whether or not market makers deliberately keep management earlier than important worth transfers occurred.

Binance information suggests strategic positioning

Borisvest emphasised that open curiosity in Binance has remained secure between $13 billion and $14 billion over the previous 20 days. This stability signifies that new positions aren’t rising quickly, however current transactions are actively maintained.

“This sort of habits in a spread setting typically signifies silent accumulation or strategic stall,” the analyst wrote, suggesting that giant gamers could also be managing their publicity fastidiously throughout this integration section.

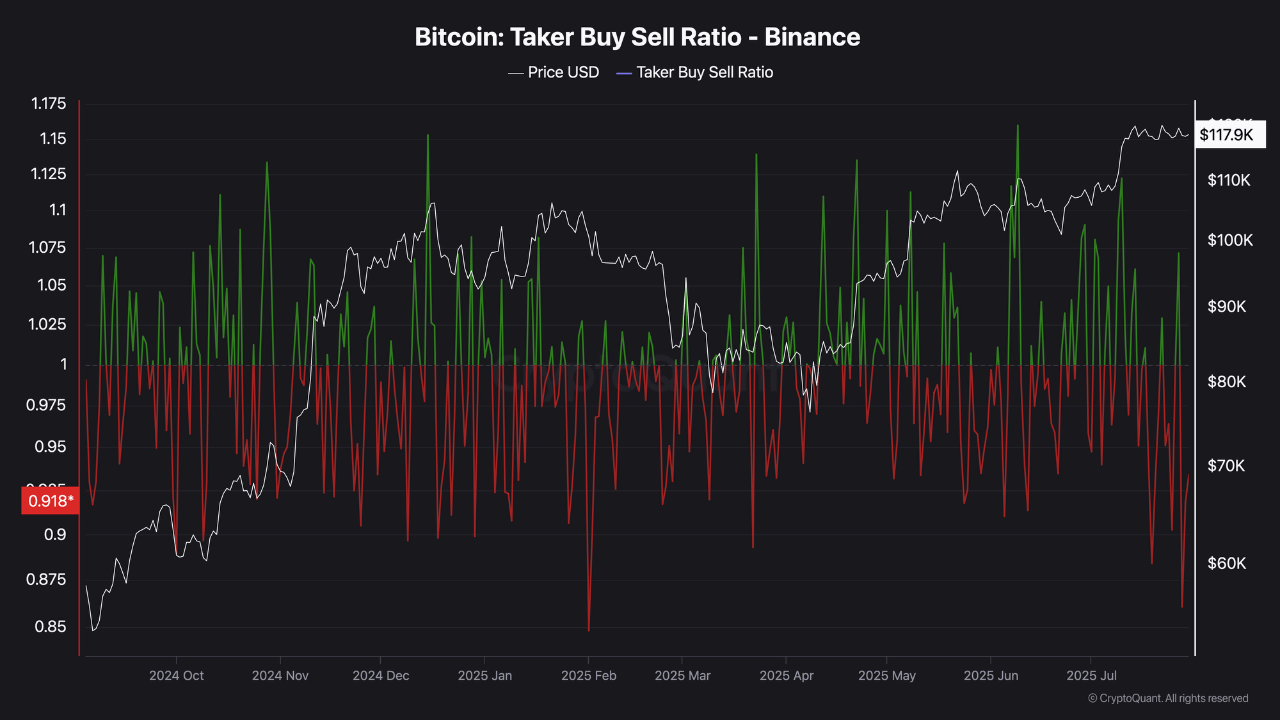

The taker buying and selling ratio, at present at 0.9, refers to a rise in gross sales stress from candidates available in the market. Nevertheless, Bitcoin costs haven’t skilled a pointy drop regardless of this exercise. This means that passive consumers are absorbing promote orders.

Borisvest added that the funding fee, which hovered round 0.01, displays the strengths or lack of aggressive leverage from brief positions. Which means throughout the facility or giant numbers of merchants are progressively gaining positions, and often avoiding extremes that result in fast worth fluctuations.

Bitcoin draw back shakeout earlier than breakout

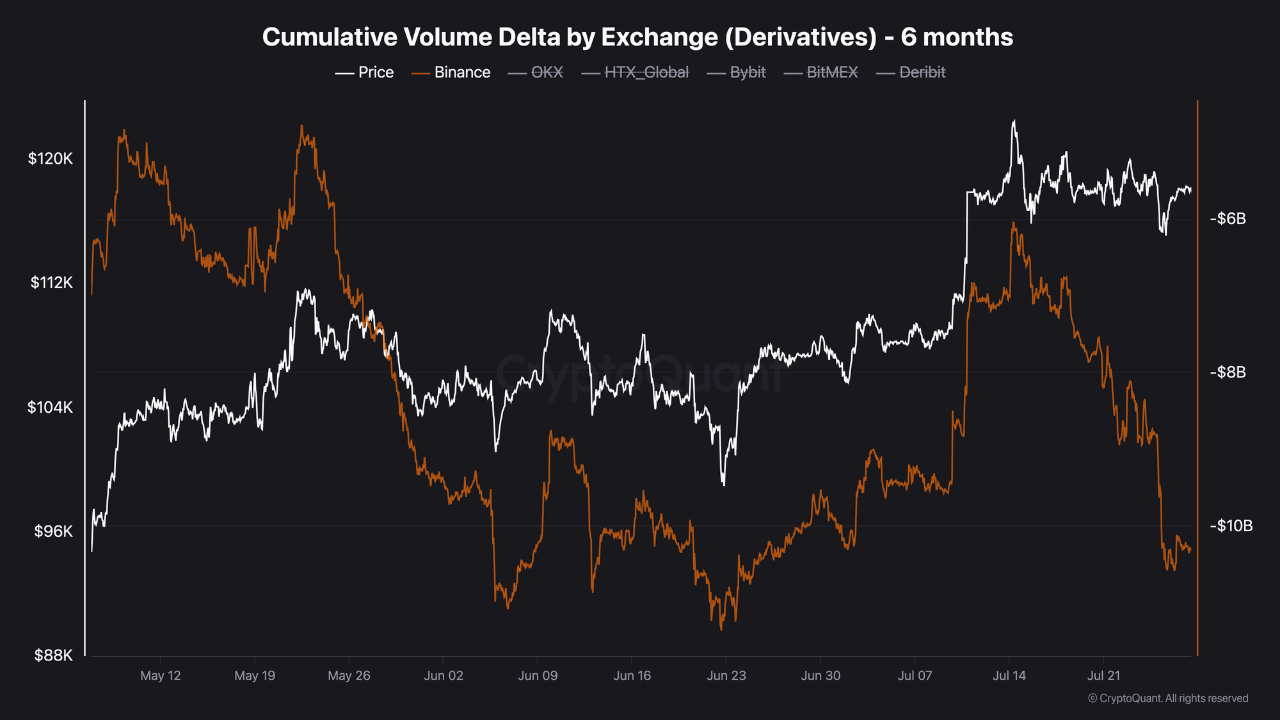

The evaluation additionally examined cumulative quantity Delta (CVD) information on binance. This means sustained gross sales within the futures market. Nevertheless, regardless of continued sell-side exercise, Bitcoin continues to withstand a big downward motion. In keeping with Borisvest, this might set the stage for a possible liquidity-driven shakeout.

He instructed that BTC may clear weak lengthy positions and entice even shorter curiosity to briefly immerse himself in $110,000. This might pave the way in which for stronger, extra sustainable breakouts sooner or later.

Whereas these metrics don’t assure instant breakouts or breakdowns, they level to a weak equilibrium in Bitcoin's market construction. Traditionally, the long-term integration section of BTC has typically preceded fast actions in both route.

Particular photographs created with Dall-E, TradingView chart