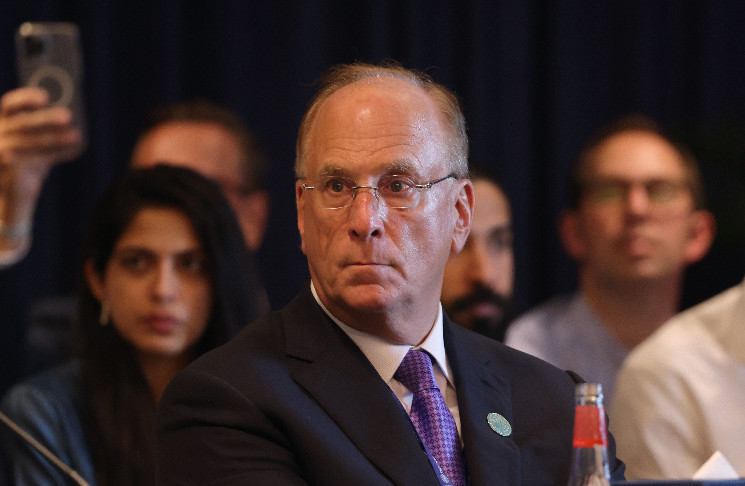

Nonetheless, BlackRock CEO Larry Fink, who is a large fan of digital property, however mentioned he has not blinded the potential for dangers to the US from Bitcoin (BTC).

“The US has benefited from the greenback as a worldwide reserve foreign money for many years,” Fink mentioned in an annual letter to shareholders, but it surely doesn't assure that it’ll final without end.

“I'm clearly not an anti-digital asset,” continues Fink. “However two issues are true on the identical time: distributed funds are extraordinary innovation. It makes the market sooner, cheaper and extra clear.

Fink's letter comes at a time of excessive market uncertainty and uncertainty amongst buyers relating to the nation's financial situation amid a coverage change set by US President Donald Trump. Fink mentioned that with a purpose to stability the nation's deficit, buyers have to diversify their portfolios so as to add non-public market property along with shares and bonds.

Fink doubled his dedication and perception in digital property, saying he believes that tokenized funds shall be as well-known amongst buyers as funding commerce funds (ETFs) so long as the business can generate higher infrastructure for digital identification.

“Each inventory, each bond, each fund – each asset – will be tokenized. If that’s the case, it’s going to revolutionize your funding,” he wrote. “Tokenization shouldn’t be sufficient if we’re severe about constructing an environment friendly and accessible monetary system. Digital verification must be resolved too.”

In January 2024, BlackRock turned one of many publishers to launch Spot Bitcoin ETFs. Their product, Ishares Bitcoin Belief (IBIT), has change into probably the most profitable ETF within the historical past of the asset class. As of at this time, the fund has processed practically $50 billion in property, half of which comes from retail buyers. The asset supervisor has additionally issued Buidl, a tokenized cash market fund that’s anticipated to exceed $2 billion by April, making it the most important tokenized fund presently accessible available on the market.