Most Bitcoin choices are clustered within the $100,000 to $120,000 vary, with some merchants betting as a lot as $300,000 on the moonshot.

abstract

- Bitcoin choices collect cluster between $100,000 and $120,000, exhibiting quiet optimism

- Some merchants are betting on a $300,000 moonshot, unlikely however low cost

- Analysts say optimistic ETF inflows are behind BTC’s bullish momentum

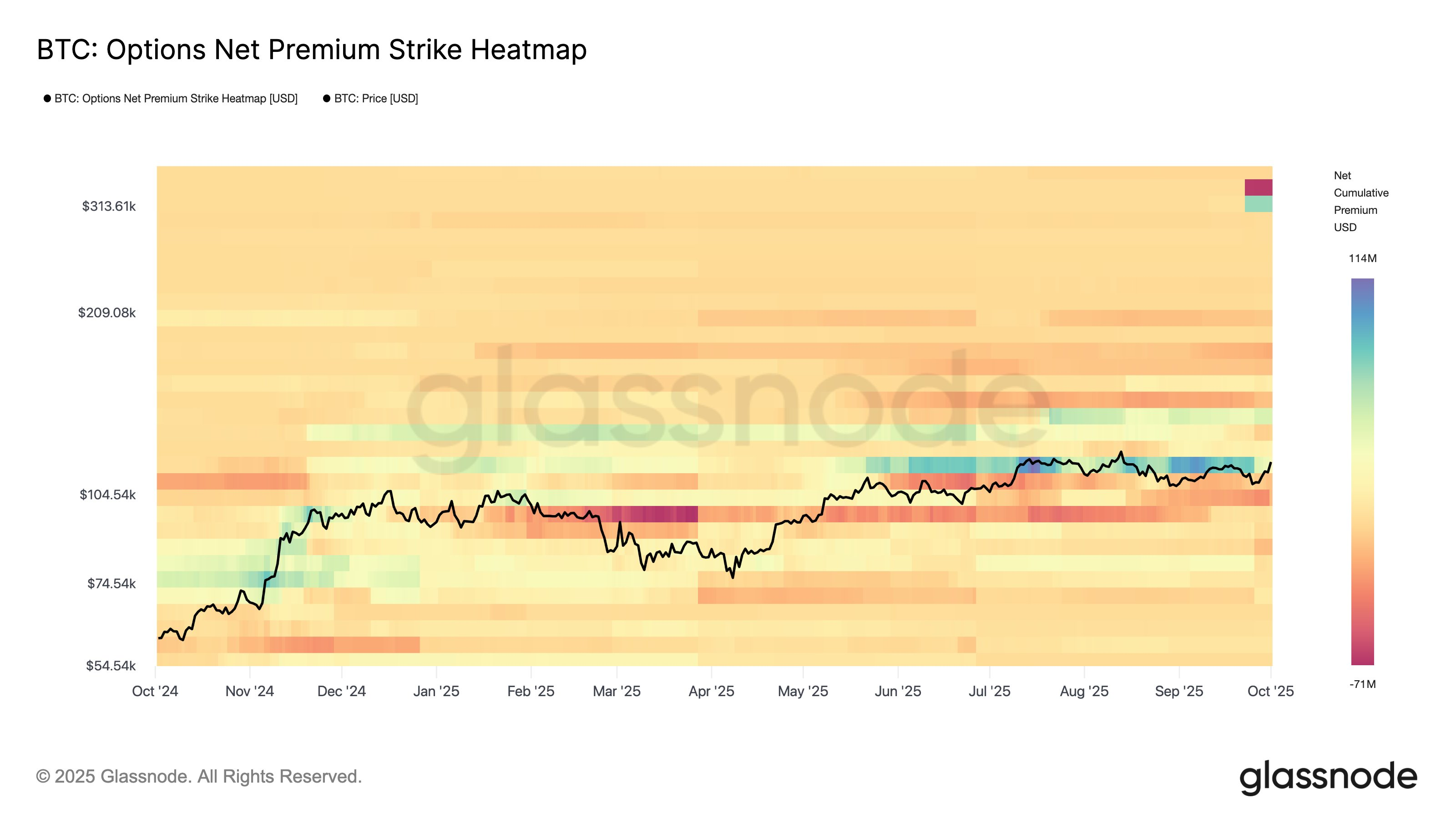

Bitcoin Choices Market reveals BET concentrated across the present value of $120,000, with speculative outliers indicating demand for reverse publicity. On Thursday, Oct. 2, Bitcoin choices gained within the $100,000 to $120,000 vary, near present costs, GlassNode knowledge exhibits.

BTC Possibility Internet Premium Strike Heatmap | Supply: GlassNode

On the similar time, there’s a focus of $130,000 calls, indicating that the market is actively trending. Moreover, curiosity in Moonshot's money-of-the-money choice can be approaching $300,000. Though these calls are unlikely to be worthwhile, they’re comparatively low cost and mirror a rising curiosity in upside publicity.

Total, choices market circumstances recommend that the majority merchants count on Bitcoin (BTC) to proceed buying and selling between $100,000 and $120,000. As with moonshot bets, gentle curiosity of round $130,000 suggests cautious optimism.

You might also like: This is the reason gold and Bitcoin are surging when US shares are slack

Bitcoin choices mirror optimistic ETF flows

A motive for optimism is the continued influx of institutional capital, each by way of treasury firms and ETFs. Macro uncertainty, particularly with the US authorities shutdown, has pulled capital away from shares, benefiting gold and Bitcoin.

In keeping with B2Binpay analysts, the ability capital was the possible motive behind Bitcoin's rally previous $120,000. In different phrases, internet Bitcoin ETF inflows reached $1.3 billion on October 2nd, reflecting a broader optimistic development over the previous few weeks.

“Going ahead, we count on Bitcoin to check $130,000-140,000 in a base case supported by restoration in ETF flows and easing Fed expectations. If macro tightening returns, dangers stay sharp correction to $105,000-110,000.”

If ETF inflows keep momentum within the fourth quarter, it might sign the beginning of a brand new bullish cycle, B2Binpay analysts informed Crypto.Information.

learn extra: Can a authorities shutdown have a serious impression on the crypto house?