Bitcoin has held practically $112,100 over the previous week, up about 1%. The transfer from $107,200 to $112,100 signifies that September was kicked off with reduction after a drop of greater than 6% in August. Merchants welcomed the bounce, however the large image nonetheless leaned negatively.

Bitcoin is down about 9% every month, with contemporary indicators suggesting that bears haven’t but been made. The issue is straightforward. Can Bitcoin defend $112,000 or will the pattern roll again?

Long run holders are slicing again whereas whales return to trade

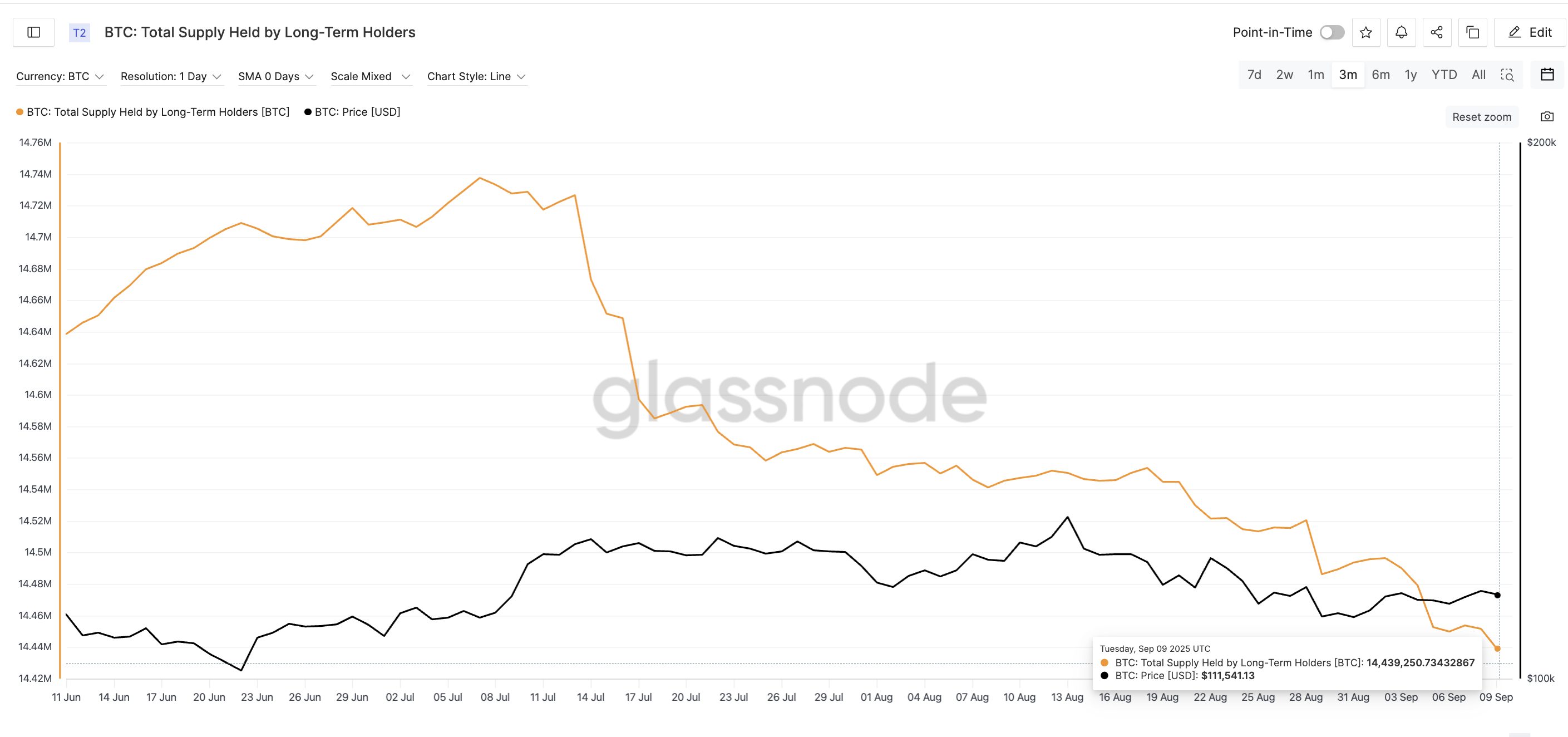

The primary warning signal comes from long-term holders. These wallets often construct certainty and are not often bought to weak point. Nonetheless, the picture modified since mid-July.

On July thirteenth, they held 1,472 million BTC. By early September, the quantity had slid to a low of 14.43 million BTC in three months.

About 290,000 BTC just isn’t a small particular person to go away sturdy fingers. Even affected person house owners present that they scale back threat and promote to rebounds at every value.

Lengthy-term Bitcoin holders drop provide: GlassNode

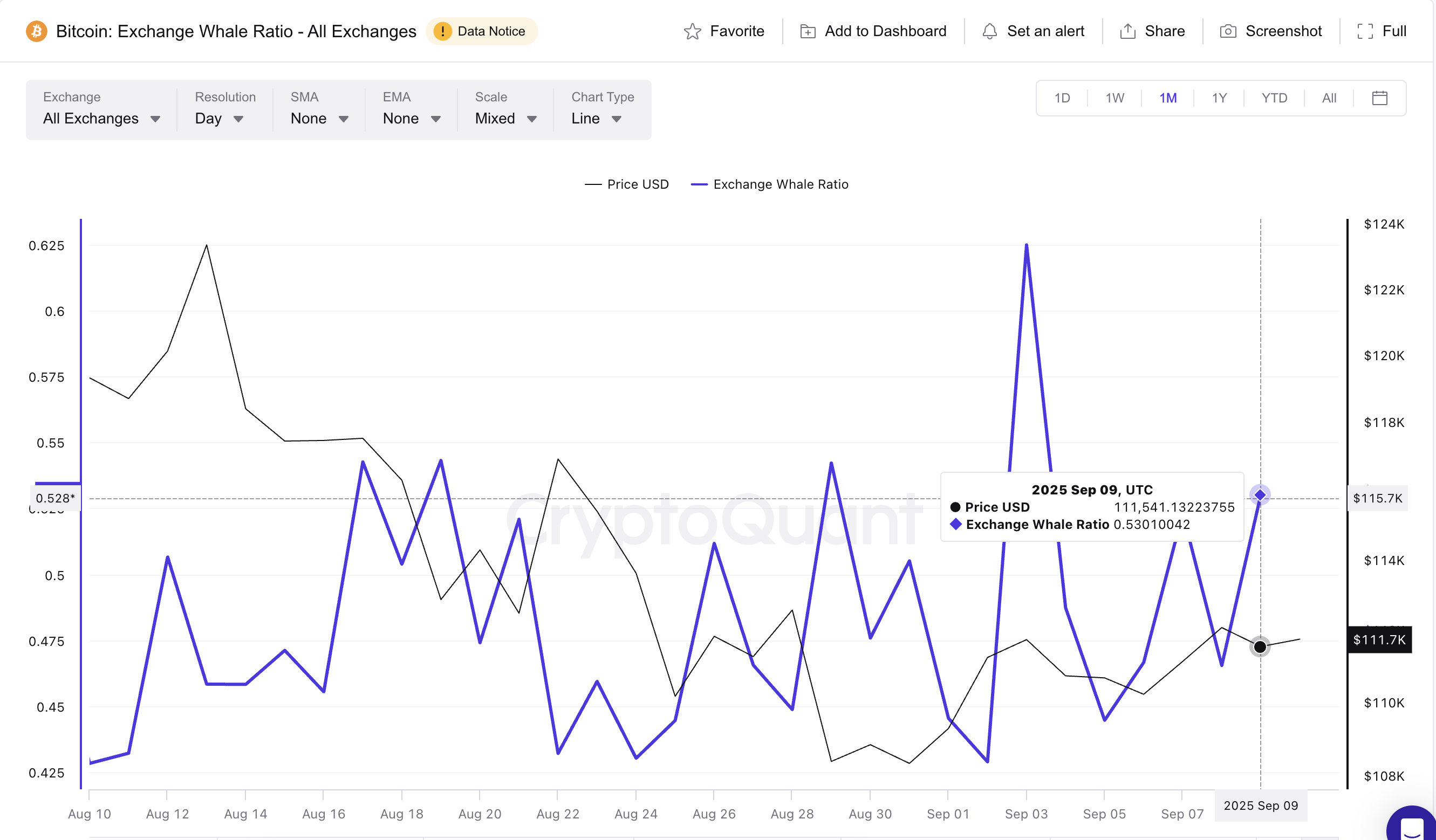

In the meantime, the whales are again within the highlight. The trade whale ratio tracks the quantity of inflows from the ten largest wallets, however rose from 0.44 on September fifth to 0.53 at press.

When it final reached an identical stage, on August twenty first, Bitcoin fell from $116,900 to $108,300 throughout the subsequent few days.

Bitcoin Zilla retains pushing BTC to trade: Encryption

I would like extra insights like this token? Join Editor Harsh Notariya's day by day crypto e-newsletter.

The month-to-month trade whale ratio chart additionally highlights attention-grabbing issues. The whale has not given up over the previous 30 days, indicating that it has moved BTC to trade even with the smallest value improve. A number of native indicator peaks can confirm this.

Lengthy-term holders who assemble and trim stashes and whales will not be a bullish combine that retains pushing cash into exchanges. It reveals that offer is prepared in case costs get even weaker.

The bearish divergence of the Bitcoin value chart helps the case

On-chain knowledge consists of Bitcoin value charts. Betcoin costs rose excessive between August twenty eighth and September eighth, with the relative power index (RSI) (gauge shopping for momentum) printed highs. This mismatch known as the divergence of hidden bears.

Bitcoin Value Evaluation: TradingView

In different phrases, the momentum seems to be enhancing, however the value motion doesn't proceed. It typically lowers the following leg.

For merchants, patterns often warn the draw back of constant traits. This might imply an extension of the month-to-month downward pattern in BTC, because it has dropped by nearly 9% over that timeframe.

The important thing stage to defending the value of Bitcoin is $110,500. That crack led to bearish divergence and gross sales strain would attain $107,200, and if strain builds up, even $103,500 might recur.

In the meantime, approaching over $113,500 neutralizes the RSI-led bearish and offers the Bulls again management.

Regardless of the September bounce, the value of dangerous Bitcoin has emerged with three warning indicators in BTC.