Bitcoin has cruised at $108,610, up over 2% over the past 24 hours. In the meantime, the general digital foreign money market worth is $3.38 trillion. The value rise comes every week earlier than the Federal Open Market Committee (FOMC) gathering scheduled for June 18th.

Bitcoin refuses to downgrade credit. Exper says confidence is constructed

On Monday, June 9, 2025, Bitcoin (BTC) floated over $108,000, bringing $155,57 million in liquidation over the previous day to $155,570,000, with $81 million in BTC brief performs. “We shared with our information desk that the Bitcoin rebound from $10,000 on June 5 is speaking to resilience,” mentioned James Toledano, Chief Working Officer of Unity Pockets.

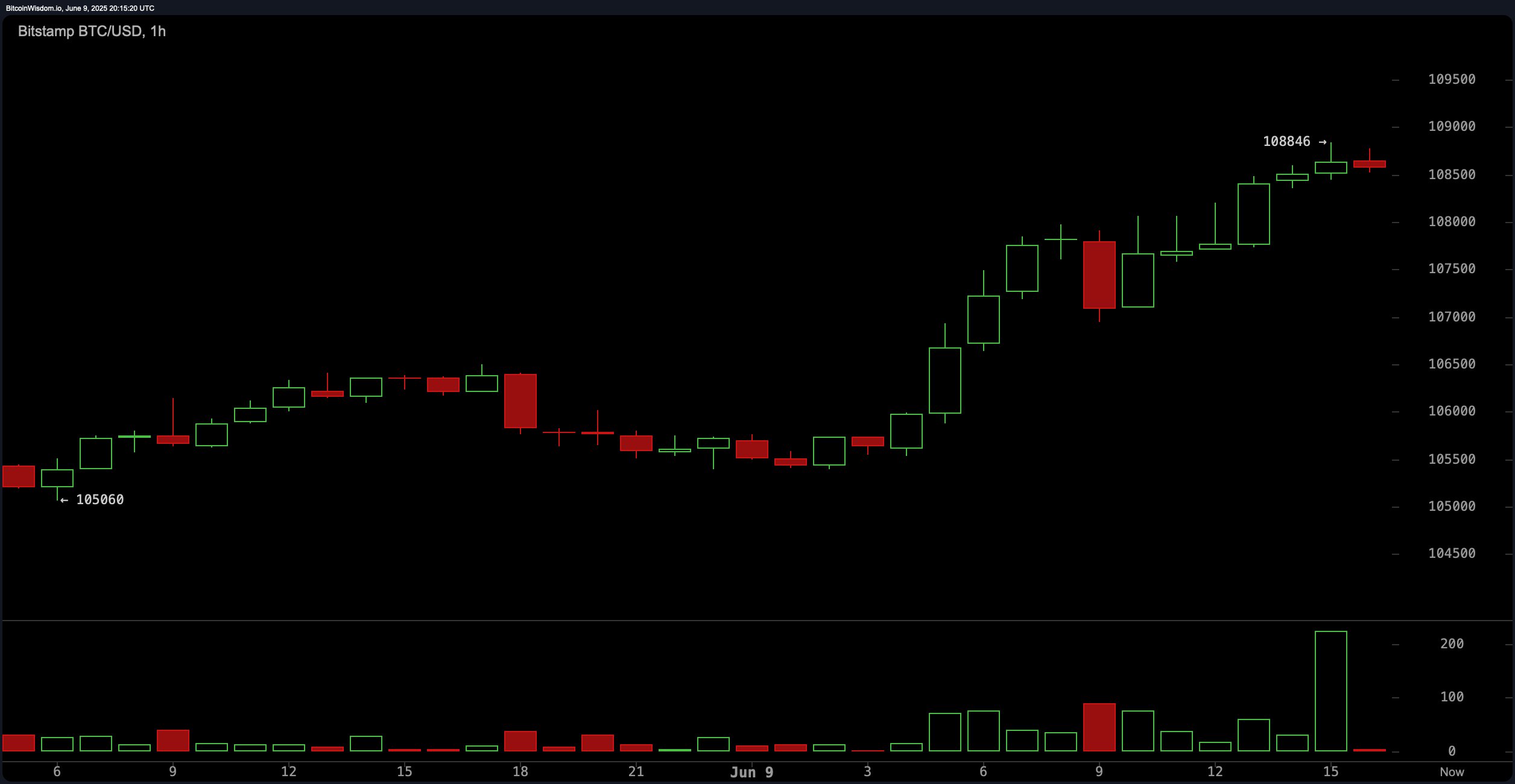

BTC/USD 1 hour chart on Monday, June ninth, 2025 at 4:15pm east time.

“The truth that the market didn’t reply to key macro components, similar to dropping its AAA credit standing, additionally signifies a rising confidence amongst traders,” defined Toledano. The Unity Pockets executives continued:

Moreover, expectations for a lower within the Federal Reserve's rates of interest most likely rekindled bullish positioning in July. Collectively, these components regain momentum after Friday's dip, suggesting that ongoing enhancements in institutional urge for food and investor confidence are the primary forces driving at present's restoration.

Brilliant climbing for Bitcoin precedes the upcoming FOMC assembly and July remains to be an possibility, however that’s definitely a consideration. Together with predictions from Polymarket and Kalshi, knowledge from the CME FedWatch software factors out that some charge change in June may be very low. The CME FedWatch software exhibits a 99.9% likelihood that the Fed will hold it the identical this month. However, in July, there’s a 14.9% likelihood of taking place, as CME futures acknowledged.

“Trying ahead, the Federal Reserve, significantly summer season rate of interest cuts of 25-50 foundation factors, may speed up Bitcoin climbing by making dangerous belongings extra enticing,” concluded Toledano. “Sustained ETF inflow and steady regulatory advances additionally strengthen the upward momentum. Nevertheless, BTC might want to overcome robust resistance, round $112,000 to $125,000, which may trigger short-term pullbacks earlier than new highs are examined.”

May there be a pullback to $92K?

Sergei Gorev, threat head at Youhodler, famous that each Bitcoin and Gold are responding to adjustments inside the US foreign money market. “(Bitcoin) citations are presently in a state of uncertainty,” Gorev mentioned in a memo she shared with Newsdesk. “However, many international merchants are progressively withdrawing from US currencies and transferring in the direction of extra harmful belongings, together with cryptocurrencies.”

Added by Gorev:

This has a constructive impact on the BTC alternate charge. In the meantime, costs on BTC charts are working very irregularly and there’s a risk of native value will increase now. When you have a picture of “head and shoulders” and carried out in that situation, a BTC value correction may result in corrections as much as the $92,000 per BTC degree.