International cash provide surges, ETF progress and undeveloped retail demand might push Bitcoin up $122,000 to the previous.

Trump's 401(ok) rule change opens $12T in retirement capital from crypto funding.

Bitcoin ETFs which can be nearer to holding gold will assist lawsuits as reserve property.

Bitcoin has earned almost $120,000, the identical stage because it reached on July twenty third. Merchants are questioning if there’s gasoline to succeed in its highest ever excessive this yr.

Three principal forces can obtain this. And now, the brand new US coverage change may give Bitcoin the most important driving power of every little thing.

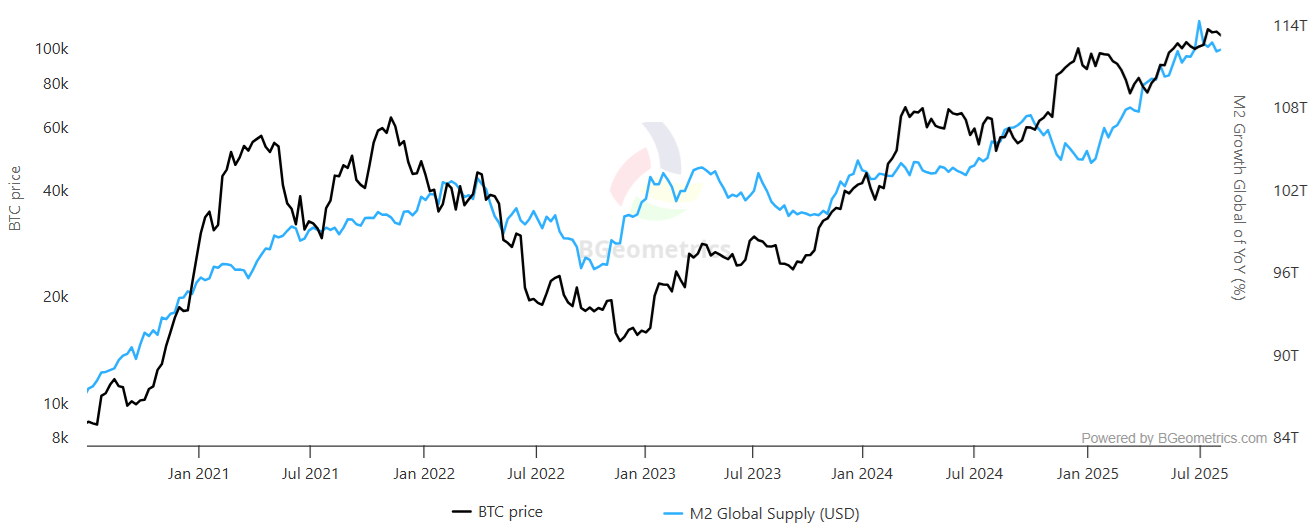

Cash Provide Surges might push Bitcoin excessive

International liquidity has reached file ranges. In July, the 21 largest central financial institution M2 cash provide reached $55.5 trillion. The US alone has achieved a finances deficit of $1.3 trillion in simply 9 months.

Such cash growth typically drives traders in direction of exhausting property like Bitcoin. Even well-known shares like Nvidia have grown in worth from $2.3 trillion to $4.4 trillion in March, with no main income jumps.

In this sort of market, liquidity is extra essential than conventional valuations.

Bitcoin ETFs are locked up in gold

Presently recognizing US Bitcoin ETFs $150 billion In property, in comparison with Gold's $18 billion. If Bitcoin ETFs overtake gold, sending a transparent message to huge traders and establishments that BTC is not a “risk-on” asset, however a critical preparation possibility can be a serious milestone.

Such a shift might open the door for sovereign wealth funds, extra public corporations and governments so as to add bitcoin to their holdings.

Retail traders are nonetheless lacking

Right here's the stunning half: Retail traders haven’t pushed this rally but.

Although Bitcoin has risen 116% over the previous yr, Crypto Buying and selling apps similar to Coinbase and Robinhood haven’t seen a surge in downloads in November 2024. So the most important wave of small traders should still be forward.

If retailers bounce in in 2025, historical past means that Bitcoin climbing can pace up shortly.

$12 trillion retirement shift

This week, US President Donald Trump signed an govt order that allowed cryptocurrency and different different property in his 401(ok) retirement account.

“I did it proper, this Trillions of locks may be unlocked in Resignation capital for Bitcoin Different Compliant Property,” stated Michael Heinrich, co-founder and CEO of 0G Labs. Bitise Cio Matt Hougan referred to as it “transformational for the trade.”

The US retirement pool is price round $12 trillion. If comparable guidelines prolong to IRAS, 403(b) and 457(b) plans, the overall might exceed $30 trillion.

What's subsequent?

Bitcoin nonetheless faces challenges, however the 2025 setup is difficult to disregard.

Report cash provide, ETFs are locked in gold, retailers are nonetheless on the sidelines, and with retirement capital at present taking part in, Bitcoin should still be seeing one of many strongest years.