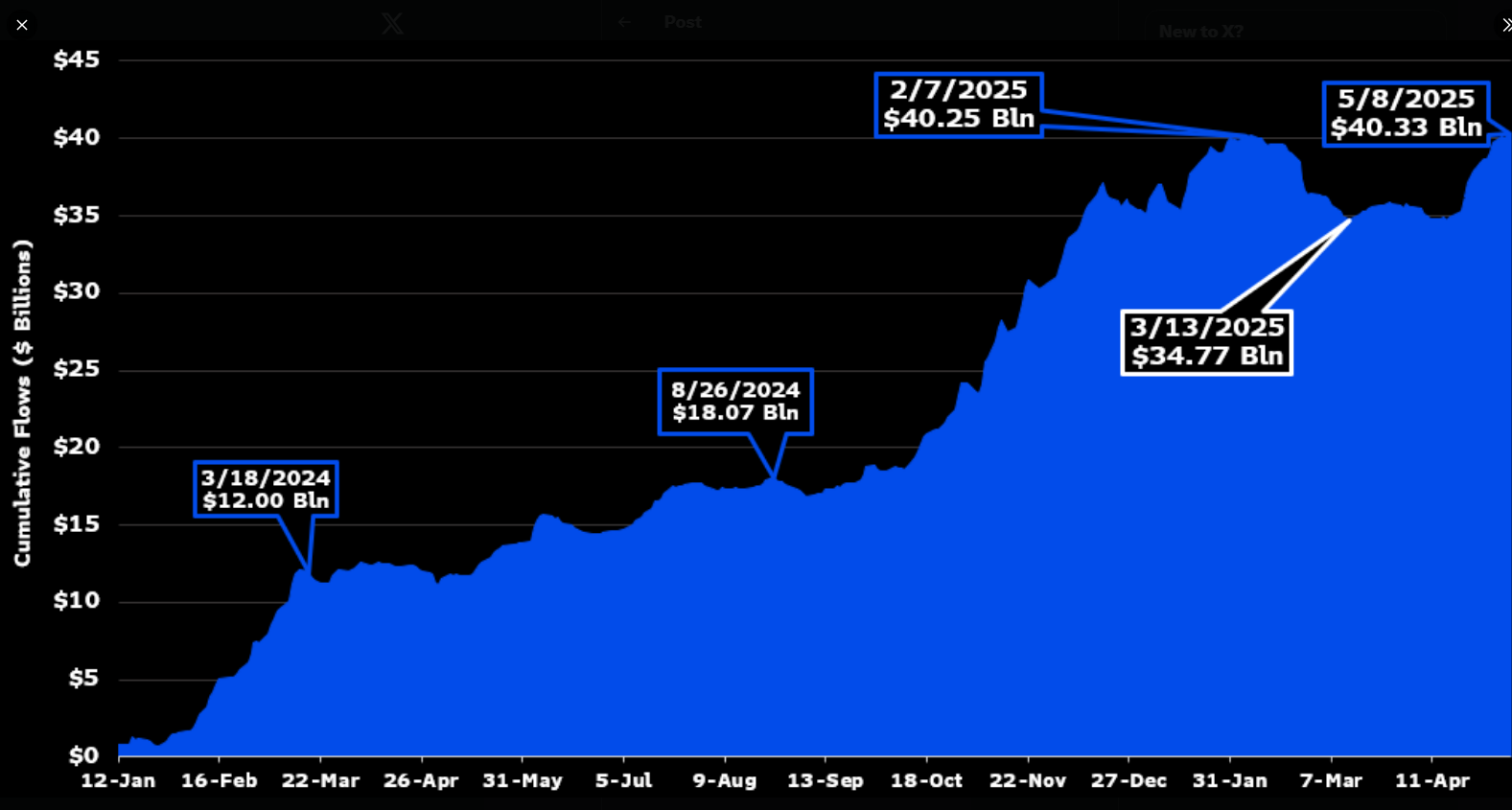

Primarily based on figures shared by Bloomberg analyst James Seyfert, Spot Bitcoin ETF has already attracted greater than $40 billion in lifetime inflows. On Could 8, 2025, buyers pumped new cash, bringing it to $40 billion in whole. That quantity signifies that people proceed to make use of regulated funds to buy Bitcoin. It additionally displays elevated confidence not solely from giant corporations but in addition from on a regular basis savers.

Spot ETF inflows might be a brand new hit

It jumped to $40.333 billion following the latest inflow on Could eighth. Funds alone had been added up over earlier data for the day. Traders have been placing cash into the product because it was launched in early 2024. Their enterprise palms proceed to boost the stream of ETFs at the same time as costs fluctuate.

After yesterday's influx, Spot Bitcoin ETFs are at the moment in a brand new, high-water market with lifetime stream. In response to Bloomberg information H/T @ericbalchunas pic.twitter.com/0gkpnlmprs, at the moment $40.33 billion

– James Seyfert (@jseyff) Could 9, 2025

Progress since launch

When the US discovered a Bitcoin ETF launched round March 2024, its whole lifespan was round $12 billion. By August 2024, that determine had risen to round $18 billion.

Quick ahead to March 2025, with the very best ever stream at practically $35 billion. They broke the $40 billion barrier in two extra months. That regular improve signifies that curiosity continues to fade in Bitcoin publicity within the type of plain vanilla funds or unadorned funding autos.

Institutional buyers push demand

It's accumulating by massive cash buyers. Relatively than chasing cash individually, asset managers and hedge funds use ETFs to spend money on Bitcoin. Analysts say they’ll add security tiers and hedges to their giant portfolios.

Moreover, these ETFs have to be strictly regulated, which introduces extra scrutiny from regulators. Some predict that this variation may make Bitcoin appear to be an everyday asset.

Followers are talking

Social media reactions had been scorching following the milestone. “Bitcoin controls,” one person posted. It's a line of slang that reveals Bitcoin is dominating different property. Others praised their means to realize buying by regulated channels. Some concern that slowing the worth of Bitcoin may sluggish the ETF stream, however they didn’t categorical any concern.

The rise above $40 billion clearly signifies that such ETFs have acquired a portion of the market. However they’re only one means that Bitcoin is held. Miners, open change merchants, and non-exchange transactions all switch bigger quantities.

Sooner or later, observers will see the stream of ETFs as emotional meter. If extra money is flowing, it could be an indication of recent confidence. When the tide goes away, it could point out that the customer is discovering a substitute.

Unsplash featured photos, TradingView charts