Bitcoin is approaching a key macro occasion as US lawmakers scramble to keep away from one other shutdown of the federal authorities earlier than the January 30 funding deadline. Markets enter this era beneath strain following the failure of January's bull market and a pointy shift in sentiment.

Traditionally, Bitcoin has not served as a dependable hedge throughout US authorities shutdowns. Relatively, worth actions are likely to comply with present market momentum.

Why the US authorities shutdown is again on the agenda

The brand new shutdown danger stems from Congress' failure to finalize a number of fiscal 12 months 2026 spending payments. The momentary funding is ready to run out on January 30, and negotiations stay stalled, notably over funding for the Division of Homeland Safety.

Breaking information: Senate Minority Chief Durbin opposes DHS funding, rising danger of partial authorities shutdown

🔴Stay updates: https://t.co/aPYdSrzjFu pic.twitter.com/DHxfaCZmPz

— Al Jazeera Breaking Information (@AJENews) January 25, 2026

If lawmakers don't move a brand new persevering with decision or year-round funding by the deadline, components of the federal authorities will start shutting down instantly. The market is presently treating January thirtieth as a binary macro occasion.

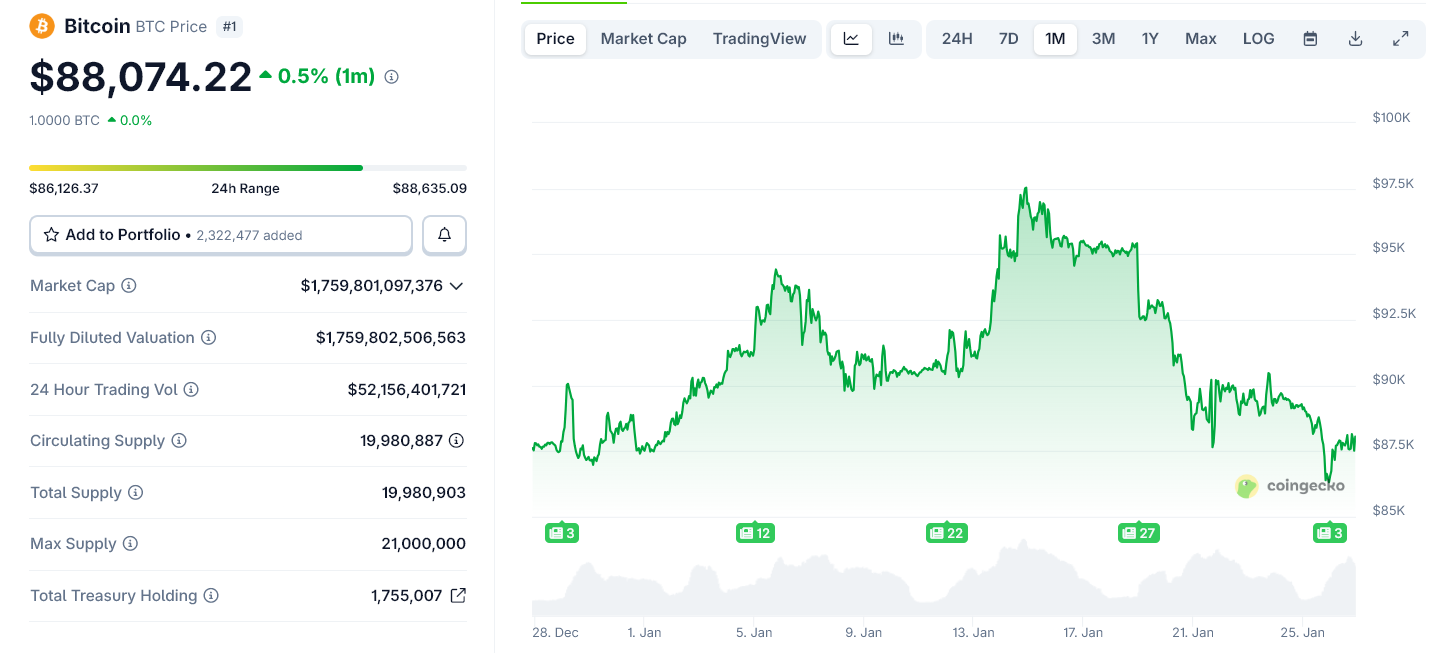

Bitcoin worth developments throughout January 2026 are already reflecting elevated vulnerability. Bitcoin briefly rose towards the $95,000 to $98,000 vary in mid-month, however was unable to keep up that stage and reversed sharply.

Bitcoin worth chart for January 2026. Supply: CoinGecko

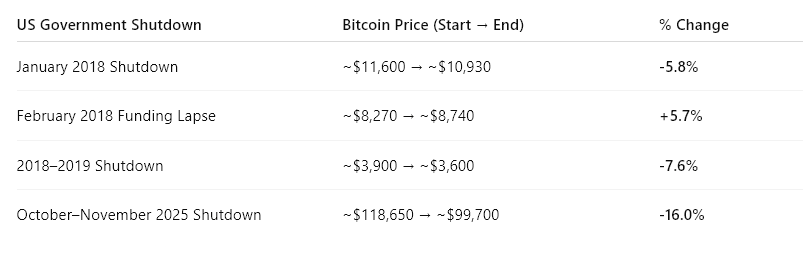

Shutdown historical past exhibits clear Bitcoin sample

Bitcoin's historic efficiency in the course of the US authorities shutdown does little to assist the bullish narrative.

Over the last 4 closure occasions over the previous decade, Bitcoin has declined or prolonged an present downward pattern in three instances.

Bitcoin efficiency in the course of the previous 4 US authorities shutdowns

Solely as soon as, in February 2018, was a quick money scarcity coincided with an increase in inventory costs. This transfer occurred amidst a technical oversold rally, quite than as a response to the shutdown itself.

The broader sample is constant. Shutdowns are likely to act as catalysts for volatility quite than path. Bitcoin sometimes extends present developments quite than reversing them.

Minor knowledge exhibits stress, not power

Latest on-chain knowledge requires much more warning. Based on CryptoQuant, a number of massive U.S.-based mining firms have sharply lowered manufacturing in current days as winter storms pressured energy grid outages.

As winter storms batter america, Bitcoin mining firms are scaling again operations to assist the facility grid.

Their each day Bitcoin manufacturing has taken an enormous hit over the previous few days.

CLSK: 22 Bitcoin –> 12 Bitcoin

Riots: 16 –> 3

MARA: 45 –> 7 (extra unstable resulting from “solo” mining)… pic.twitter.com/SzgcbtgQ5V— Julio Moreno (@jjcmoreno) January 26, 2026

Each day Bitcoin manufacturing has fallen considerably throughout firms resembling CleanSpark, Riot Platforms, Marathon Digital, and IREN. Diminished manufacturing could quickly restrict provide on the promote aspect, however it additionally indicators operational stress throughout the mining sector.

Traditionally, miner provide constraints haven’t been adequate to offset broad macro-driven gross sales until demand situations are robust. Present demand indicators stay weak.

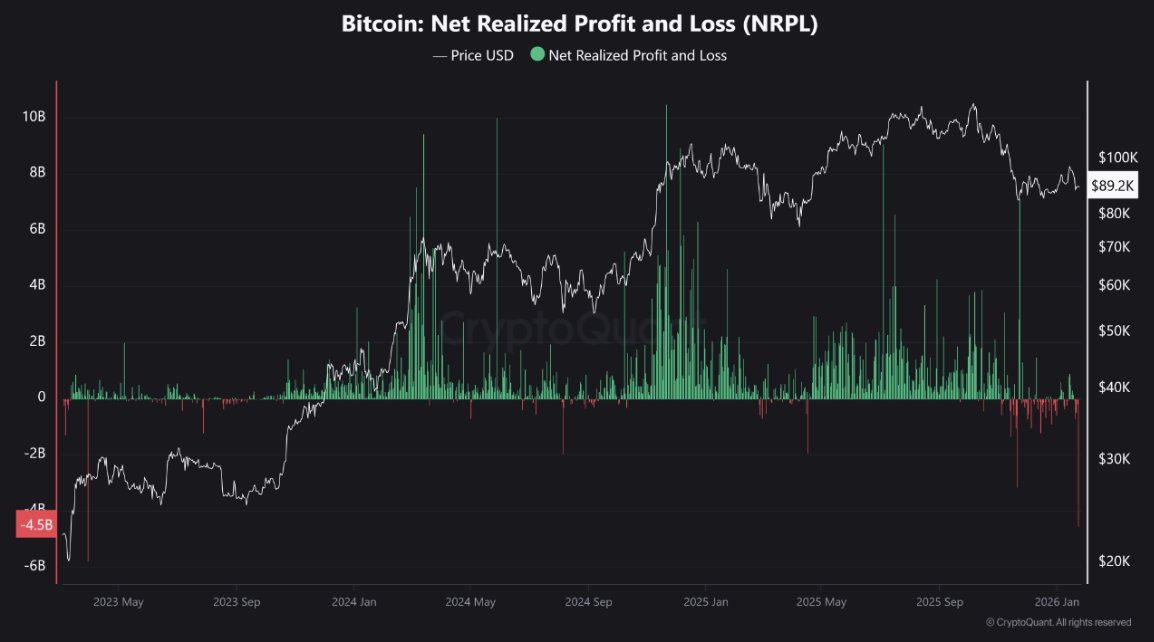

Realized losses are rising

Internet realized revenue and loss (NRPL) knowledge additional helps the defensive outlook. Realized losses have elevated in current weeks, and there was much less vital profit-taking than in early 2025.

Bitcoin internet realized positive factors and losses. Supply: CryptoQuant

This implies that traders are exiting positions at unfavorable costs quite than rotating capital with confidence. Such conduct sometimes coincides with distribution and danger aversion phases later within the cycle, quite than accumulation.

On this context, destructive macro headlines are likely to speed up draw back volatility quite than triggering sustained upside.

How will Bitcoin react on January thirtieth?

If the US authorities shuts down on January thirtieth, Bitcoin is prone to react extra as a danger asset than as a hedge.

The more than likely consequence is a short-term volatility spike with a downward bias. A major break above January's lows could be in line with historic closure conduct and present market construction. Any pullback is prone to be technical and short-lived until broader liquidity situations enhance.

It appears unlikely that there will likely be a pointy rise resulting from shutdown headlines alone. Bitcoin not often rallied throughout closures with out simultaneous constructive flows and sentiment adjustments, however that’s now not the case.

Bitcoin is not going to face any closure danger from a place of power. ETF outflows, elevated realized losses, miner stress, and rejected resistance ranges all point out cautious setup.

As January 30 approaches, closure dangers may act as a stress check for already fragile market confidence.

For now, historical past and knowledge counsel that Bitcoin's response will mirror present momentum quite than working towards it.

The put up Bitcoin faces new checks as danger of US authorities shutdown looms on January 30 appeared first on BeInCrypto.