Bitcoin fell 5.5% final week, falling from $110,000 to lower than $106,000 after escalating geopolitical tensions between Israel and Iran, making a “risk-off” temper available in the market.

Regardless of the falling costs, on-chain knowledge reveals a powerful anti-narrative. Though the value of the headline has fallen, the institutional and company demand for Bitcoin and altcoin may be very sturdy, indicating a excessive perception from the largest gamers available in the market.

4H chart with DMI and EMA50. Supply: TradingView

Establishments' ETF inflows proceed unabated

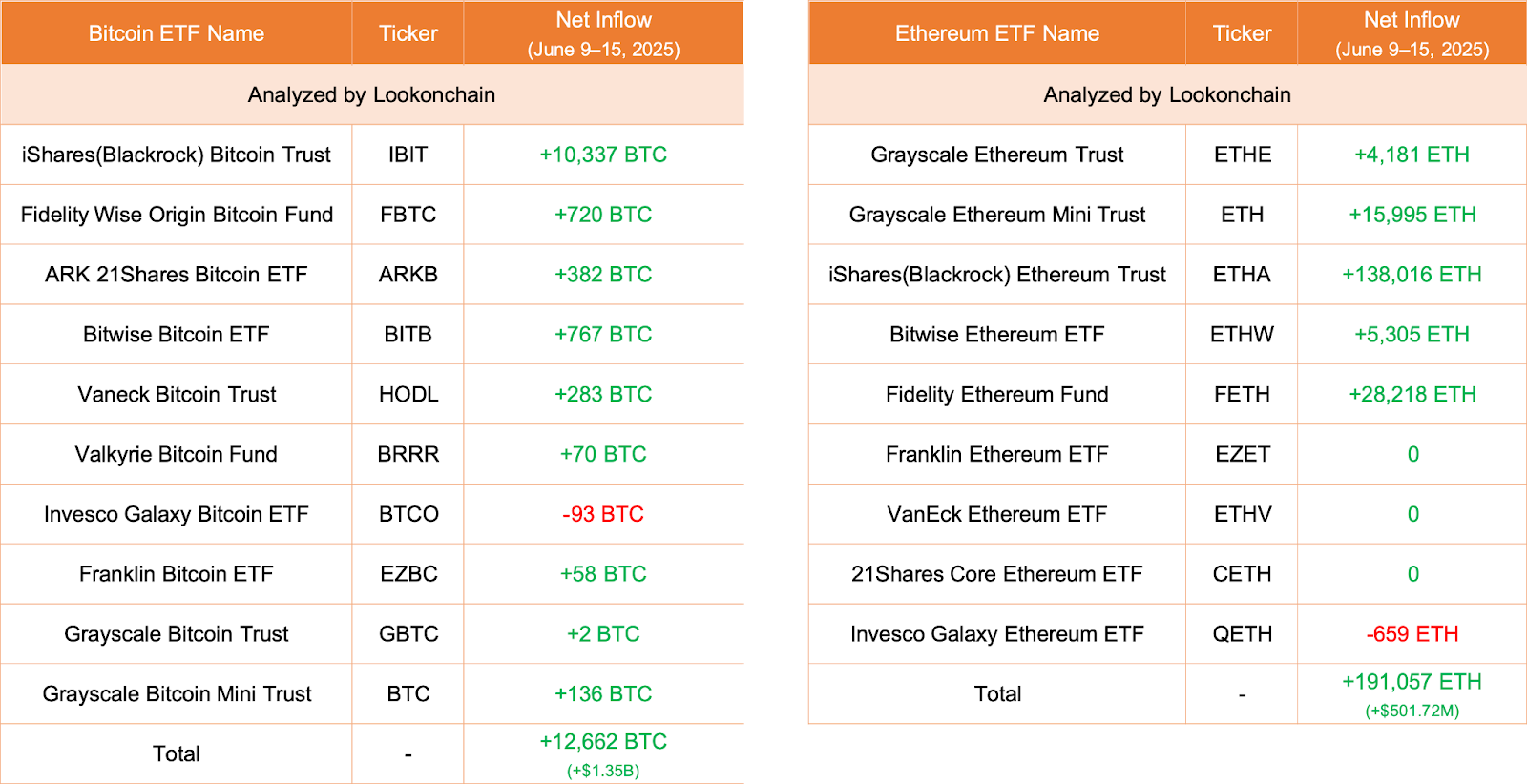

LookOnchain knowledge exhibits that Spot Bitcoin ETF noticed an enormous week of inflow. Ten Bitcoin ETFs totaled 12,662 BTC price $1.35 billion. BlackRock's iShares Bitcoin Belief has added 10,337 BTC ($1.1 billion). The Ethereum ETF additionally noticed an inflow of 191,057 ETH ($501.72M). Once more, iShares was dominated by 138,016 ETH (362.43m).

Bitcoin and Ethereum ETF inflows (June 9-15, 2025). sauce: Lookonchain

These large allocations from main firms point out ongoing demand from institutional gamers, even when crypto costs are pulled again.

Associated: For-profit students strategy as Bitcoin exams $110K ceiling

Whales accumulate bitcoin and ethereum

The Technique (MSTR) acquired 10,100 BTC ($105 million), whereas Metaplanet added 1,112 BTC ($116.5M). On the Ethereum facet, Sharplink bought 176,271 ETH ($462.95M). The beforehand profitable whales additionally bought 67,408 ETH price $136 million.

Chain switch knowledge confirmed ETH actions between Coinbase and Winter Mute Pockets, together with 26,000 ETH ($69 million) transactions. These indicators present a constructive accumulation from giant holders regardless of current volatility.

Associated: Ethereum (ETH) Value Forecast June 18, 2025

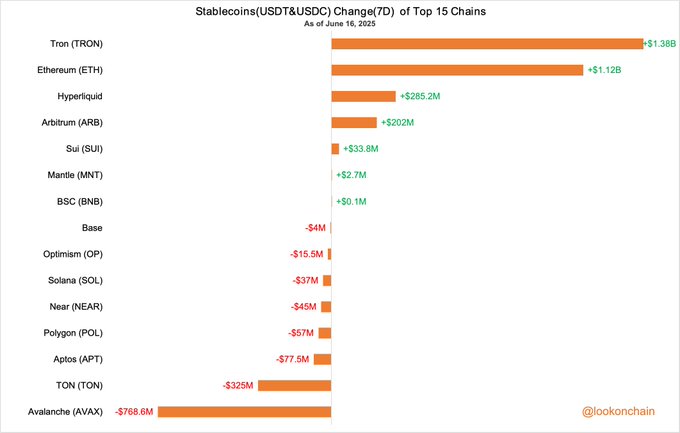

The full within the Stablecoin market elevated by $1.27 billion in per week. Tron has elevated USDT and USDC by $1.38 billion, whereas Ethereum provides $11.2 billion.

Seven-day adjustments by way of Stablecoin (USDT & USDC) chain – June 16, 2025. Supply: LookonChain

Conversely, the avalanche noticed the largest runoff and misplaced $768.6 million. Different networks corresponding to Ton and Aptos continued to have leaks of $325 million and $77.5 million, respectively.

Blended Photos for On-Chain Consumer Actions

Evaluation of on-chain person exercise exhibits extra advanced pictures throughout completely different blockchain ecosystems. Layer-2 community base has elevated every day energetic addresses by 77.35% and every day transactions by 5.84%. Avalanche additionally noticed a 74.94% bounce in transactions, however its energetic deal with fell by 18.77%.

Hyperliquid's TVL rose at 12.85%, the best among the many prime chains. Nevertheless, energetic addresses have decreased by 30.14% and transaction volumes have decreased by 53.89%.

Ethereum's TVL remained secure at $61.4 billion, however every day energetic addresses fell by 3.32%. Solana scored 1.44% on TVL, with a 9.62% enhance in customers, indicating sturdy community engagement.

Regardless of price-driven horrors, institutional curiosity, absurd expansions, and rising selective networks, it continued to assist a wider crypto ecosystem.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version shouldn’t be responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.