Bitcoin's worth has risen lower than $ 100,000 within the preliminary blues marked with a crash within the curler coaster for the final seven days. Flagship Cryptocurrency has been revived as much as $ 108,000 over the previous few days.

This latest resurrection shouldn’t be significantly mirrored within the blockchain, and the newest on -chain information means that the dealer shouldn’t be prepared to wager on the value of Bitcoin. The favored market evaluation platform has now had a possible impression on this situation.

Discount of financing price will increase brief -term positioning: glass nodes replicate

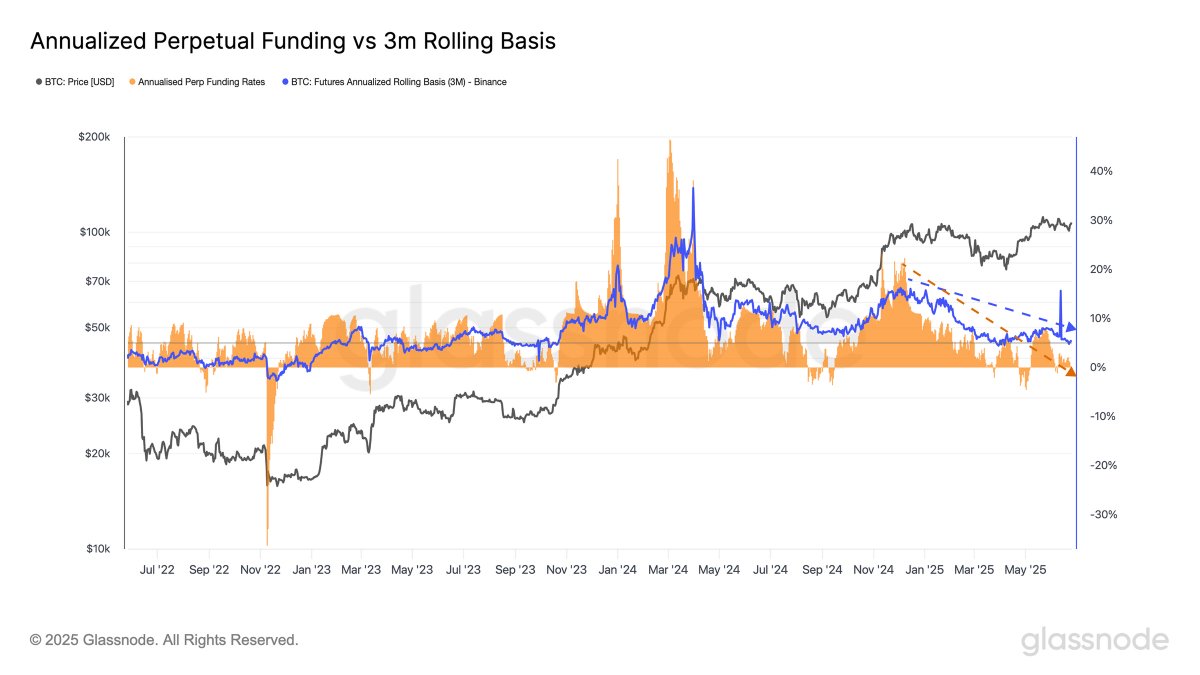

Within the June 27 posts on the X platform, GlassNode, an entire chain evaluation firm, seems to have been educated within the decline in Bitcoin's funds for the previous few months. The associated indicators listed below are “annual perp financing charges” and “binance 3 months (3m) future annual rolling -based” metrics.

The annual perp financing price is a serious indicator of normal funds between lengthy and brief merchants within the Perpetual Future Market. This indicator supplies well timed perception into feelings and leverage within the Cryptocurrency spinoff market.

If the speed of financing is excessive or optimistic, it implies that lengthy -range merchants pay brief positions to merchants. Normally, this path of this periodic cost suggests robust robust emotions available in the market. In the meantime, the adverse worth of the metrics implies that a brief dealer pays cash to an extended dealer.

Alternatively, the annual rolling base of three months (3m) is to purchase cryptocurrency within the spot market to estimate the annual returns and promote encryption futures contracts that expire in three months. Normally, futures contracts are traded at the next worth than spot property. That is the distinction that the dealer can use for revenue.

Supply: @glassnode on X

As could be seen within the chart above, the annual funding price and three -month (3m) annual rolling base have decreased since November. GlassNode stated, “Regardless of excessive reward actions, the urge for food for lengthy publicity is light, which will increase consideration and displays extra impartial or brief -term positioning.

In essence, the discount of financing price and three -month rolling requirements point out that brief merchants are repeatedly crowded with derivatives. There was a cautious strategy to the market from the merchants, but it surely was a silver lining that the institutional pattern and macroeconomic local weather within the US -based Bitcoin trade buying and selling funds have been improved.

Subsequently, even when the speed of financing continues to fall, the market can see brief stress even when the macroeconomic surroundings and the influx of institutional capital are steadily maintained. This potential situation is supported by the truth that the market tends to maneuver in the wrong way of the group.

Bitcoin worth at a look

On the time of this text, the value of BTC is about $ 107,180 and has not proven a giant motion for the final 24 hours.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Istock's essential picture, TradingView chart

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We assist the strict sourcing customary and every web page is diligent within the high know-how consultants and the seasoned editor's workforce. This course of ensures the integrity, relevance and worth of the reader's content material.