Bitcoin mining networks may face tough changes on the underside for the primary time in almost 4 years. The difficulties may very well be decreased by 9% over the subsequent 5 days. This would be the most sharpest since July 2021, when China's mining ban triggered a 50% collapse on the international hashrate.

Over the previous two weeks, the full computing energy to guard the Bitcoin blockchain has dropped by almost 30%, in line with knowledge from Mempool.area.

GlassNode metrics present that the community hashrate is barely under 700 exhaushes per second (EH/s) in comparison with the current excessive of EH/s.

As we speak's Bitcoin miners rely totally on ASIC (application-specific built-in circuit) {hardware}. Within the early years of community historical past, CPUs and GPUs have been ample to mine cash. Profitability requires a customized constructed machine that consumes a big energy of over 7,000 watts and runs on a 220 volt system with excessive amperes.

Bitcoin Protocol re-adjusting the mining issue for each 2,016 blocks to take care of a block manufacturing fee of roughly 10 minutes. If there are few machines competing for block rewards, the community responds by decreasing the problem of compensation. This time, the response is anticipated to be extra pronounced.

Profitability Metrics Write Mining Stress

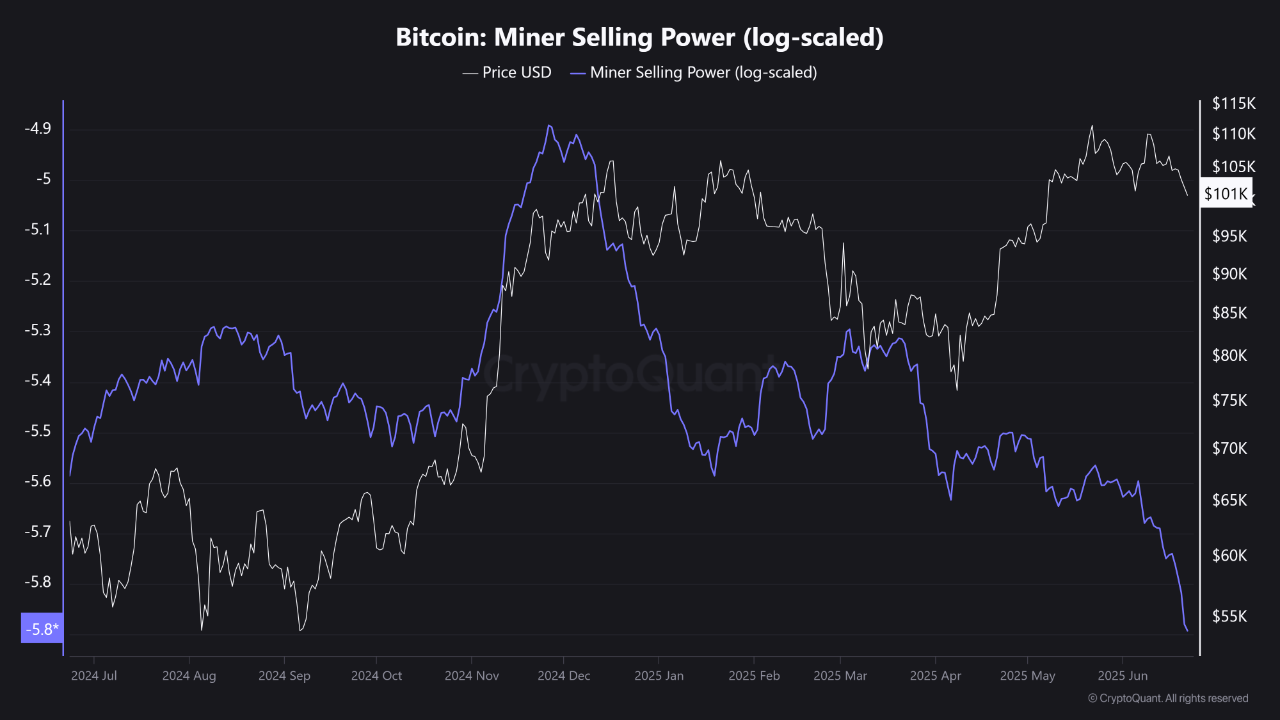

Knowledge from encrypted contributor IT know-how exhibits that Bitcoin miners are “very low wages.” Analysts say the market is floating within the stage of pressured gross sales from the mining enterprise.

In current weeks, sustainability metrics have fallen deep into detrimental territory, growing gross sales energy. In different phrases, miners have let go of their holdings and are leaving their mining.

Miners have been closely compensated throughout the interval throughout which Bitcoin was traded between March and Could within the vary of $90,000-$105,000. Nonetheless, since early June, profitability has been virtually fully eroded.

Cryptoquant's Bitcoin: Minor gross sales energy (log-scaled) The chart reveals a recession in miners' gross sales energy. The metric explaining how a lot Bitcoin miners can offload to the market has reached a brand new low.

Bitcoin Minor Gross sales Energy Chart. Supply: Cryptoquant

As of June twenty fourth, issue and hashrate values run at 390 Th/s and a single miner that consumes 7,215 watts of energy produces simply $11.76 per day at $0.05/kWh. Mining one Bitcoin beneath these circumstances takes over 14 years to five, 156 days.

Mining energy slides as geopolitical variations chunk

On June 22, america launched a focused airstrike on Iran's nuclear services. Though it has not been formally confirmed, it’s believed that the facility plant could have been affected.

Iran legalized Bitcoin mining in 2019, creating a substantial community utilizing subsidies from fossil fuels and nuclear energy vegetation. At its peak, Iran accounted for round 4.5% of the world's Bitcoin hashrate. This determine is approaching 3.1%.

After the US strike, there have been a number of stories of energy outages and digital community disruptions from each Iran and neighboring Israel. Outages may have affected mining services and broken them as a consequence of energy losses or pressured them to be shut down.

Some analysts noticed a pointy decline in Bitcoin hashrate earlier this week, with the community's computational energy down by 8% between Sunday and Thursday. The hashrate reportedly fell from 943.6 million thahash to 865.1 million th/s from 1 second (TH/s).

The market has beforehand backed up in opposition to the background of President Donald Trump's announcement of the “full ceasefire” settlement between Iran and Israel. Phrases from Trump helped restore buyers' belief, pushing Bitcoin again previous the $106,000 stage on Monday. On the time of this report, the biggest coin by market capitalization has modified palms at round $105,300.