- Bitcoin trade reserves have reached new lows, indicating sturdy accumulation by long-term holders.

- The value is beneath $106,000 and the value might drop even additional if the client is unable to regain management.

- Analysts hope for a attainable rebound in early June if the $100,000 resistance breaks quickly.

The Bitcoin trade reserve has fallen to a brand new low, indicating a continued accumulation from long-term holders and institutional buyers. Encrypted knowledge reveals that Bitcoin trade reserves have fallen to a contemporary low of almost 2.43 million BTC as they proceed their long-term downtrend.

Simply In: BTC Change Reserves hits contemporary new lows. pic.twitter.com/xxtagdf6ud

– Whale Insider (@WhaleInsider) June 1, 2025

This decline signifies that long-term holders and establishments are nonetheless accumulating, which reduces strain on short-term promoting. The huge decline in reserves is in line with growing buyers' preferences for refrigeration and independence.

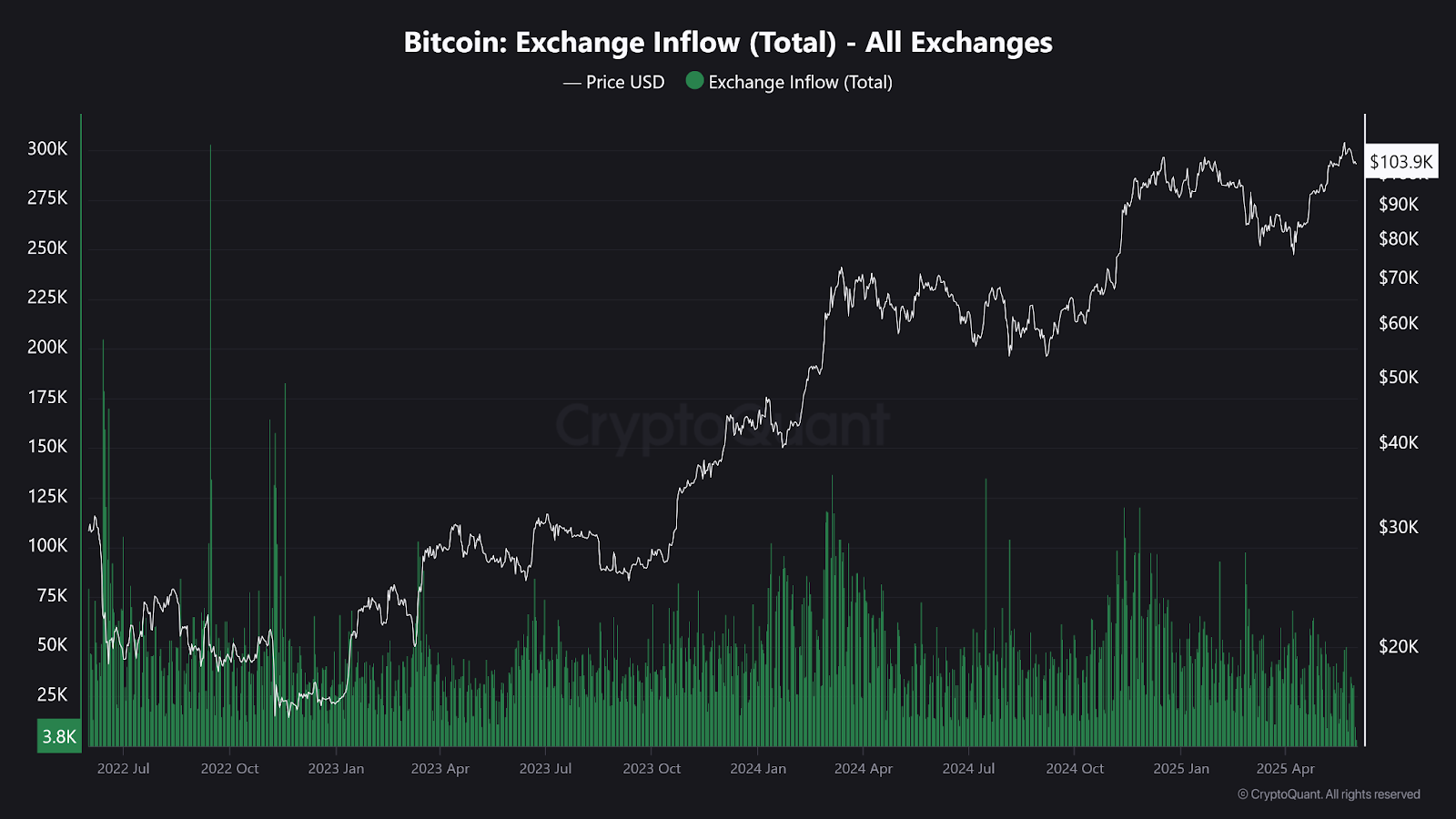

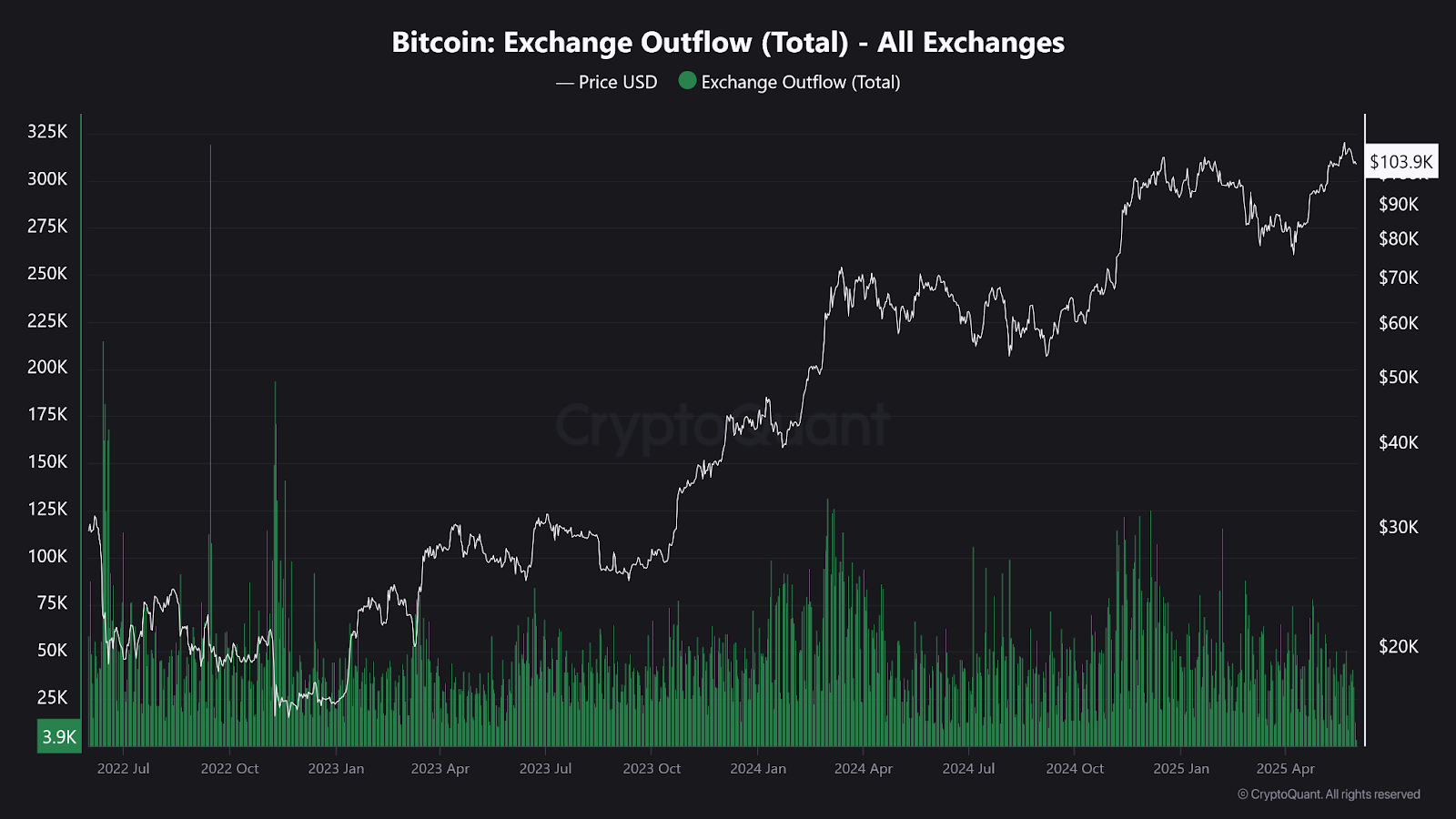

General, the full trade influx price is inconsistent, however the newest chart reveals that the value is $104,000, making every day influx exercise very poor at 3.8K BTC. The dearth of aggressive trade deposits signifies that the vendor is retreating. In the meantime, the spill is excessive even at 3.9k BTC, which helps bullish papers of long-term accumulation.

Supply: Cryptoquant

Supply: Cryptoquant

Bitcoin has been buying and selling at $104,078 after a 2.60% loss within the final 24 hours, and gross sales actions have additionally slowed down. Equally, every day buying and selling volumes have fallen by 2.24%, indicating that there’s much less profit-taking play at this present worth decline.

Analyst commentary: June rebound remains to be seen

Market sentiment is blended whereas trade provide is declining. Bitcoin has elevated by greater than 10% over the previous seven months for the reason that first week of every month, in response to Crypto analyst Pattatrades. He expects the sample to repeat in June. This development might proceed for the following few days, and the market might even recuperate.

Nevertheless, the technical sign reveals hesitation. MACD has grow to be bearish with destructive histograms, however RSI has now reached 50.24 from its current excessive. Despite the fact that the long-term construction stays intact, these indicators recommend that they gradual momentum.

Supply: Buying and selling View

On the four-hour chart, Bitcoin moved by a number of worth ranges. The following vital vary of property was between $93,000 and $96,000, then $101,000 to $105,000 after being destroyed from the $83K-$86,000 vary. It at present collides between $106,000 and $112,000. Just lately, the value stage has returned to the underside fringe of the vary and is a pullback.

Market analyst Daan Crypto stated the Bulls must exceed $106,000 to keep away from additional downsides. He added that failing to regain this stage is more likely to end in deeper pullbacks within the coming weeks. In the meantime, different analysts imagine there’s a risk of bear strain that would reduce the value from $100,000 to $102,000.

$ Notable adjustments within the dynamics of the BTC market.

The Bulls will need to like this by regaining their native vary of over $106,000. In any other case, I feel there will likely be extra cooldowns subsequent week. https://t.co/zmvqqdc0eh pic.twitter.com/mjec8qkezq

– Daan Crypto Trades (@daancrypto) Might 30, 2025

Crypto-controversy urges Czech ministers to resign

Cryptocurrency can also be inflicting political waves outdoors of the market. Czech Minister of Justice Pavel Blazik resigned after revelation that his ministry had acquired a billion crowns of Bitcoin donations from convicted drug offenders.

Blazik stated he knew nothing concerning the donor's background or the illegality related to the donation, however he nonetheless stated he had resigned to guard the federal government's credibility. The choice was shortly supported by coalition leaders who emphasised the significance of institutional integrity.