A day after President Trump publicly confirmed US airstrikes at Iranian army services, Bitcoin confirmed indicators of traders' hesitation, regardless of surpassing main help at $102,000. As of June 22, 2025, Bitcoin is buying and selling between $102,700 and $102,810 with a market capitalization of $2.04 trillion and a 24-hour commerce whole of $313.2 billion. Value Motion is unstable inside the $100,945 to $103,939 vary, highlighting a market that balances geopolitical danger with technical boundaries.

Bitcoin

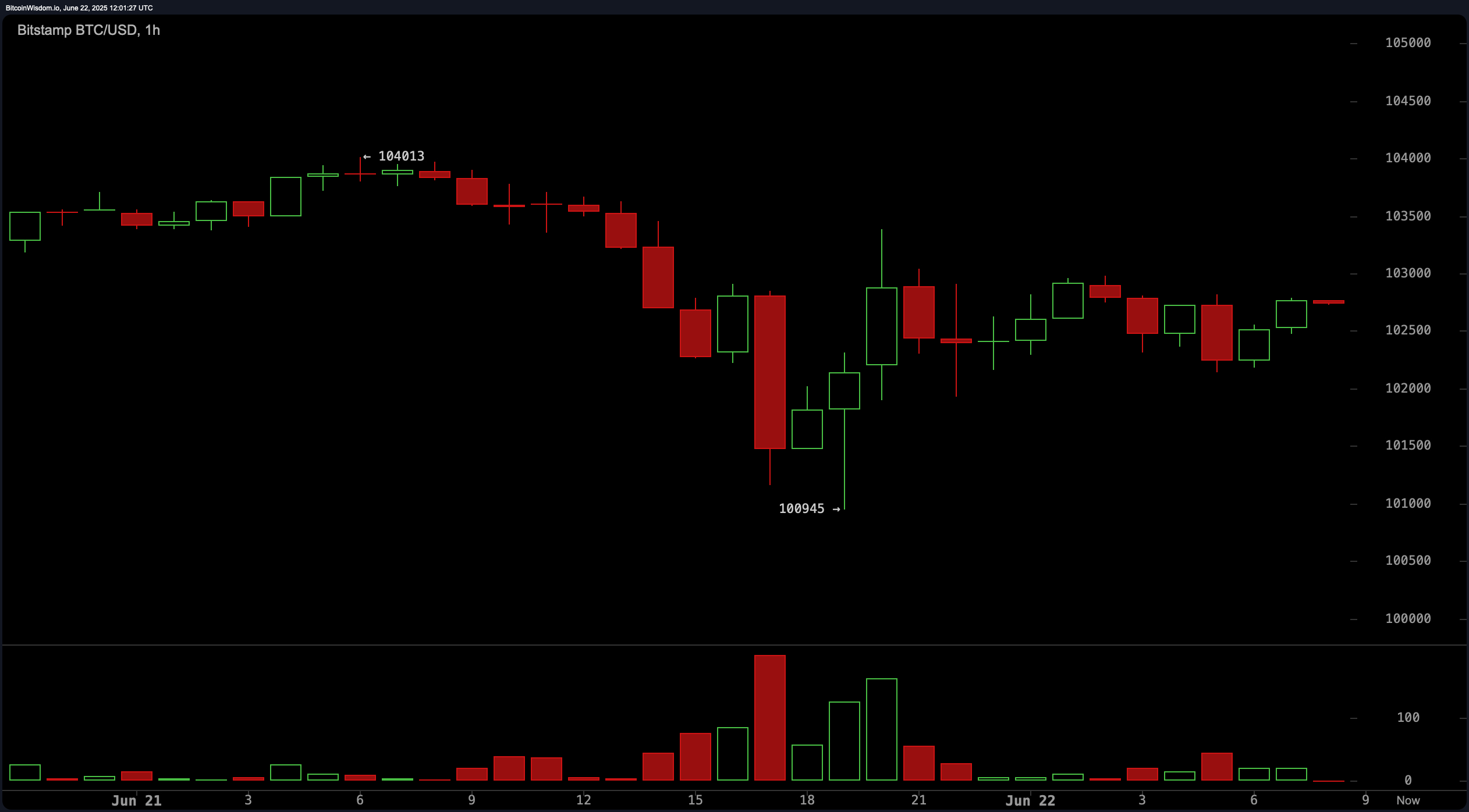

On the one-hour chart, Bitcoin is about to stabilize after dropping to $100,945. The seen integration sample suggests a double backside formation. Necklines close to $103,000 are essential. Breakouts above this degree, notably rising quantity will increase, might cowl the vary of $104,000 to $104,500. Nevertheless, if help shouldn’t be retained at $100,945, then the decrease targets of $98,500 to $99,000 will probably be doable. The amount picks up a inexperienced candle and suggests curiosity on short-term purchases, however lacks the idea typical of bullish reversal.

BTC/USD 1-hour chart on Sunday, June 22, 2025 through BitStamp.

The four-hour BTC/USD chart strengthens the final short-term downtrend, with help being highlighted once more at $100,945, with resistance forming between $104,000 and almost $105,000. The most recent sale options sharp quantity spikes, implying both retail panic or facility exits. A number of purchases have appeared, however the follow-through is weak. A $100,945 retest with decreased quantity might present an extended swing alternative, however failing to carry that zone might result in new bear legs.

BTC/USD 4-hour chart on Sunday, June 22, 2025 through BitStamp.

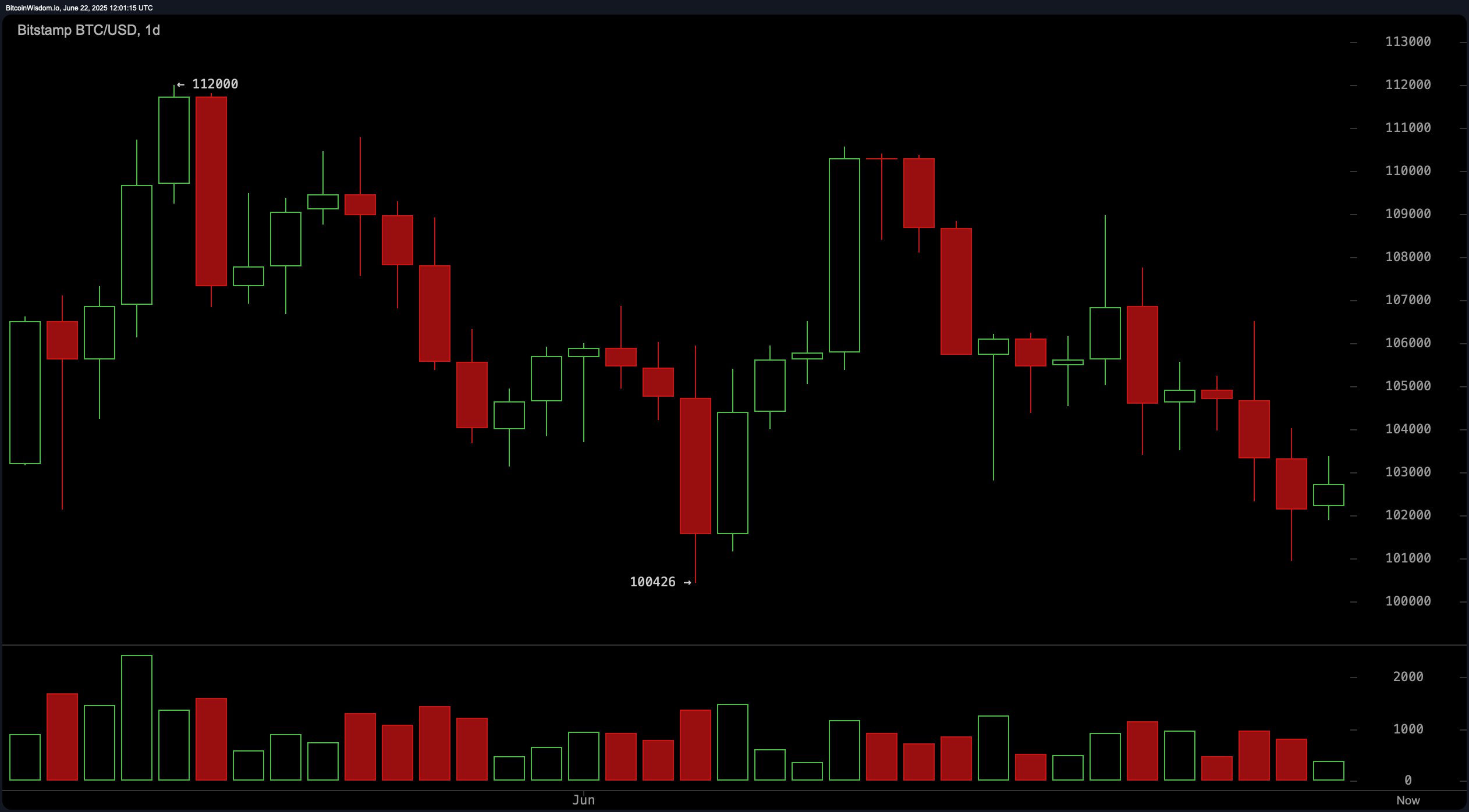

Within the each day time-frame, Bitcoin has a bearish stance with a transparent downward pattern channel and a current crimson candle that prevails after a short-lived rally. Resistance stays about $112,000 aside, however short-term help is simply over $100,400. This construction suggests a decrease top configuration that’s normally related to continuity of the decrease pattern. Bullish reversals between $100,000 and almost $101,000 are efficient when supported by inversion patterns corresponding to hammers and bullish sieges confirmed by elevated quantity. With out such affirmation, a break beneath $100,000 opens the door to a transfer from $96,000 to $98,000.

BTC/USD 1-Day Chart on Sunday, June 22, 2025 through BitStamp.

The oscillator indicator provides to the general uncertainty and presents a blended picture. The relative power index (RSI) is positioned at 43, signaling impartial momentum. The probabilistic index is 14, impartial, and the Commodity Channel Index (CCI) is -125, suggesting potential buying alternatives. Momentum of -2,980 is equally tilted in the direction of buying, however a transferring common convergence divergence (MACD) of -368 signifies a bearish sign. The good oscillator stays adverse at -2,492 with a impartial angle, reflecting indecisiveness amongst market members.

Shifting averages (MAS) are overwhelmingly bearish on the short-to-medium scale. The exponential transferring common (EMA) and easy transferring common (SMA) values for intervals 10, 20, 30, and 50 are all aligned within the gross sales space, suggesting steady underside stress. Nevertheless, long-term averages such because the $99,223 EMA (100) and $95,675 SMA (100) at the moment supply structural help underneath present worth ranges. Equally, EMA (200) and SMA (200) counsel that the broader upward pattern stays unhurt at $93,586 and $95,956, respectively. Till short-term feelings change, merchants want to concentrate and anticipate a clearer sign earlier than they are often positioned for an even bigger transfer.

Bull Verdict:

If help continues to be retained at $100,945, and sustained breakouts of over $103,000 are realized with sturdy volumes, Bitcoin might have a short-term restoration. Affirmation of potential fatigue in gross sales pressures on a number of time frames might catalyze a reduction rally, notably when traders are searching for alternate options amid rising geopolitical tensions.

Bear Verdict:

Regardless of the technical setup for bounce, Bitcoin stays susceptible to additional losses given the final bearish momentum and lack of quantity checks. The dominance of gross sales alerts throughout short- and medium-term transferring averages and oscillators highlights persistent debilitation. The geopolitical shock of US airstrikes on Iran brings about a rise in systemic danger. If this spirals right into a wider battle or market panic, Bitcoin can fall beneath $100,000 and trigger slides to virtually underneath $96,000.