Cryptocurrency recovered considerably after a fierce weekend of as little as $112,000 on Saturday.

BTC survives the storm and holds almost $115,000

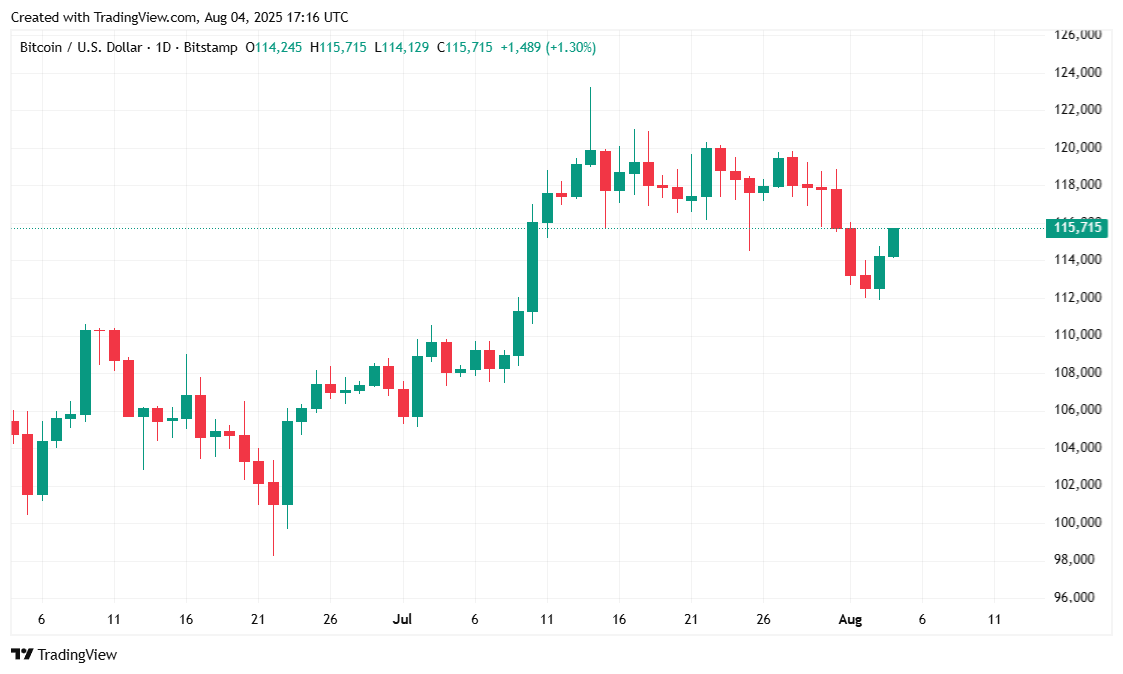

After using final week's curler coaster, Bitcoin costs fell off the cliff and fell to $112,000 on Saturday earlier than returning to $115,000 in pre-trade time on Monday. Final week's macro atmosphere was a combination of excellent and unhealthy information, neutralizing robust GDP numbers with weaker job studies. The Federal Reserve maintained its federal funding charge within the 4.25-4.50% vary, which was anticipated, however the BTC fell sharply shortly after Chairman Jerome Powell's announcement on Wednesday.

The US financial outlook doesn’t have an effect on the crypto market. There have been comparable blood bass in inventory, however in addition they recovered. The S&P 500, Nasdaq, and Dow elevated by 1.30%, 1.75%, and 1.12% on the time of reporting, respectively. CoinMarketCap knowledge reveals Crypto Markets up 1.88%.

Some consultants, together with Bloomberg analyst Eric Baltunas, have praised institutional capital for decrease BTC volatility. With the approval and launch of the primary Spot Bitcoin Trade Fund (ETF) in January 2024, billions have been injected into the cryptocurrency ecosystem. This was adopted by the emergence of Bitcoin finance corporations. An organization that owns a considerable amount of BTC on its steadiness sheet. If Balchunas is correct, it might imply that the times of disgusting shaking in Bitcoin costs are getting longer.

“Since ETFS' launch, Bitcoin volatility has plummeted,” Balchunas wrote in an X submit.

Market Metric Overview

In accordance with Coinmarketcap, Bitcoin was buying and selling at $115,491.54 on the time of writing. Nevertheless, digital belongings have fallen 2.05% in per week, hovering between $113,966.97 and $115,561.82 over the previous 24 hours.

(BTC Value/Commerce View)

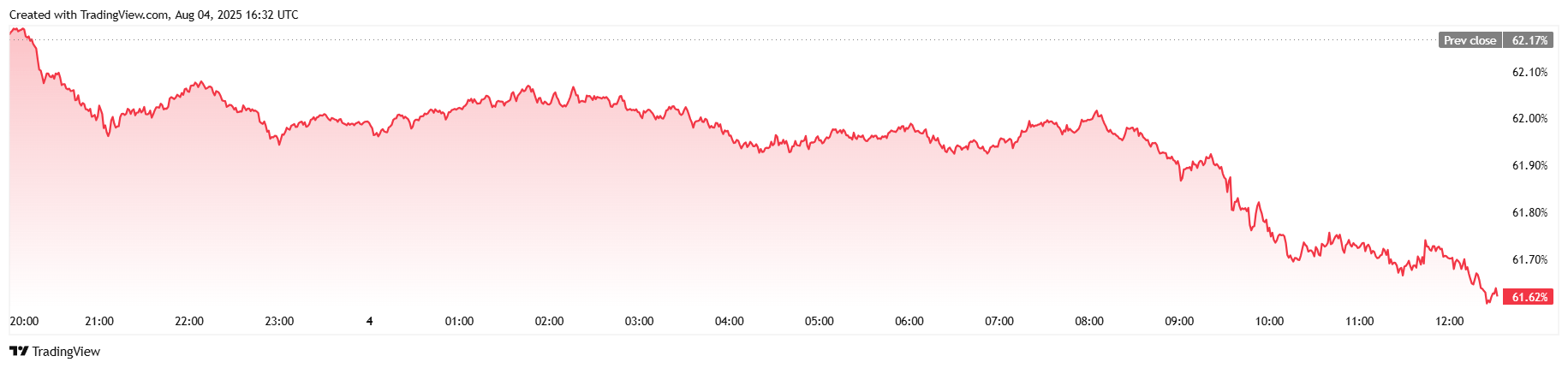

The buying and selling quantity that day was a stunning $53.43 billion, down 2.21% from yesterday. Market capitalization rose simply 0.89%, at $2.28 trillion when reported. Bitcoin's benefit fell by 61.56% over 24 hours, down 0.91%.

(BTC dominance/commerce view)

Open curiosity on complete BTC futures was $79.89 million that day, a 0.47% drop. Bitcoin liquidation total has been $39.25 million since Sunday, of which $34.4 million got here from brief positions, totaling $4.85 million.