High digital property rose above $90K on Tuesday morning, as each conventional and crypto markets noticed constructive momentum regardless of Trump groping for a commerce cope with Japan.

BTC Rally hits a $90,000 milestone regardless of the fears of the commerce struggle

Regardless of the market being adopted lately because of unresolved tariff considerations, inventory indexes, crypto markets and Bitcoin all earned constructive returns on Tuesday morning, with the dominant cryptocurrency hovering past the $90,000 vary.

Market Metric Overview

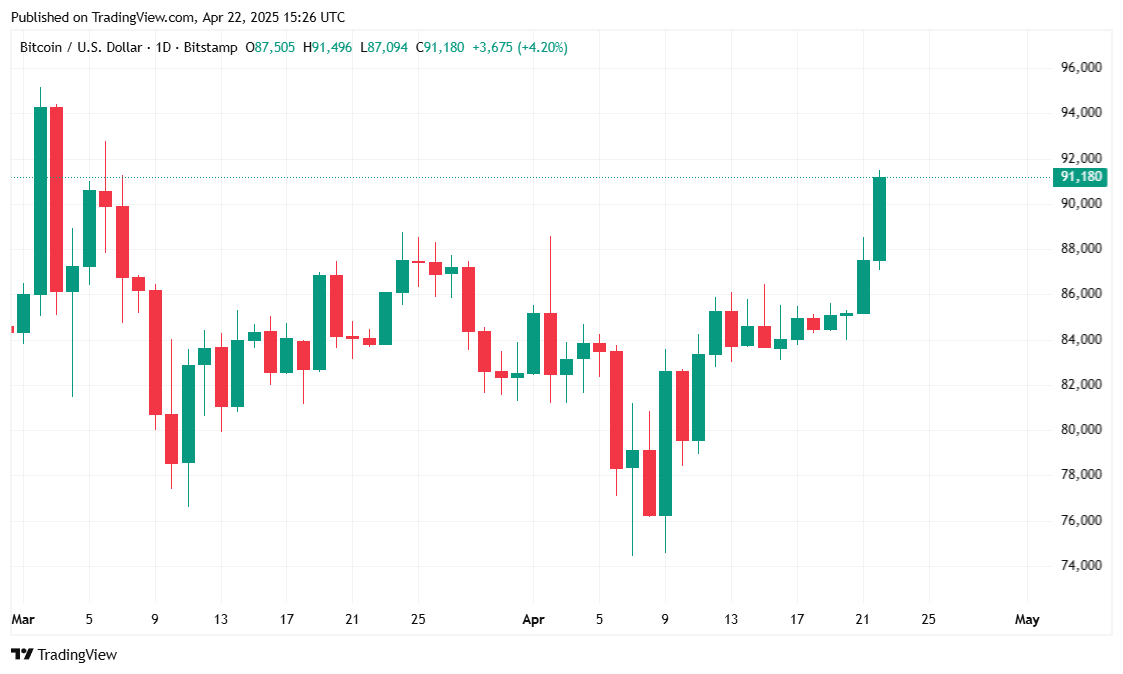

Bitcoin surged to recent native highs on Tuesday, touching $91,463.81 in the course of the 24-hour window and settling at $91,245.60 when reported. That is an upward trajectory from final week's low of round $83,000, up 3.47% over the previous day and 6.86% over the week.

(BTC Worth/Commerce View)

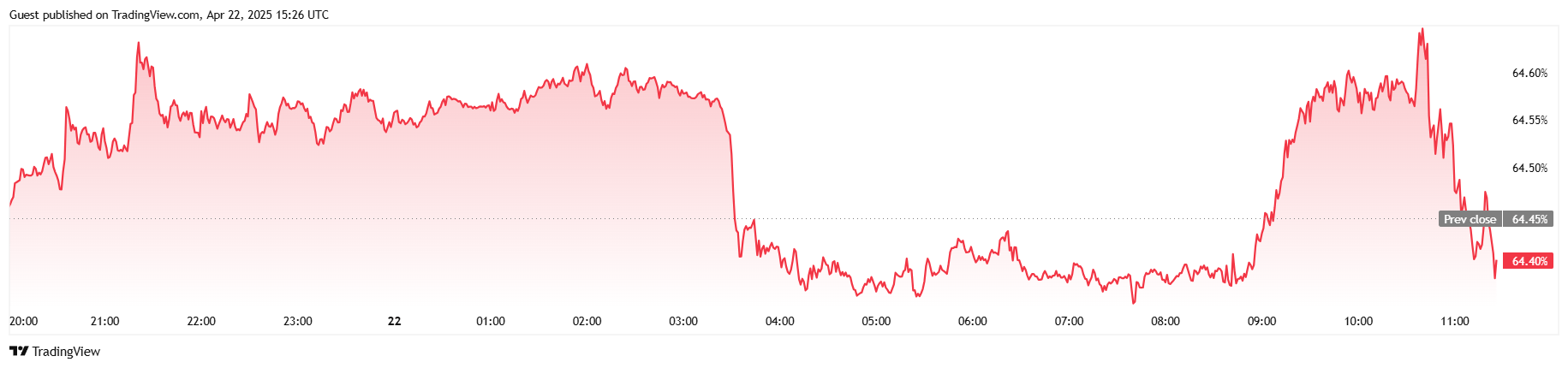

Buying and selling volumes rose 25.20% over the previous 24 hours to $43.27 billion, with Bitcoin's market capitalization reaching $1.8 trillion, a rise of three.18% from the day prior to this. Curiously, BTC's benefit is just immersed by 0.12% to 64.40%, suggesting a small revenue for the Altcoin area, regardless of Bitcoin persevering with to steer the invoice.

(BTC dominance/commerce view)

Within the derivatives market, open curiosity on complete BTC futures rose 10.82% to $685.9 billion, reflecting rising speculative curiosity. In response to Coinglas, liquidation has reached $38 million within the final 24 hours, with the quick vendor absorbing many of the $37.19 million. The lengthy liquidation is minimal, indicating that the bear is as soon as once more on the flawed aspect of the commerce.

“90 transactions in 90 days” guarantees shall be flat

The Trump administration as soon as promised to shut 90 commerce offers 90 days after launching a three-month suspension on aggressive world tariffs. Japan was one of many first nations to return to the desk, and the president bragged about how the consultations are shifting ahead.

Nonetheless, discussions are actually cut up from Japan, and the nation's Financial Revitalization Minister has revealed to native media that he “reveals the tariff measures are extraordinarily unlucky and urged the US to rethink these insurance policies.”

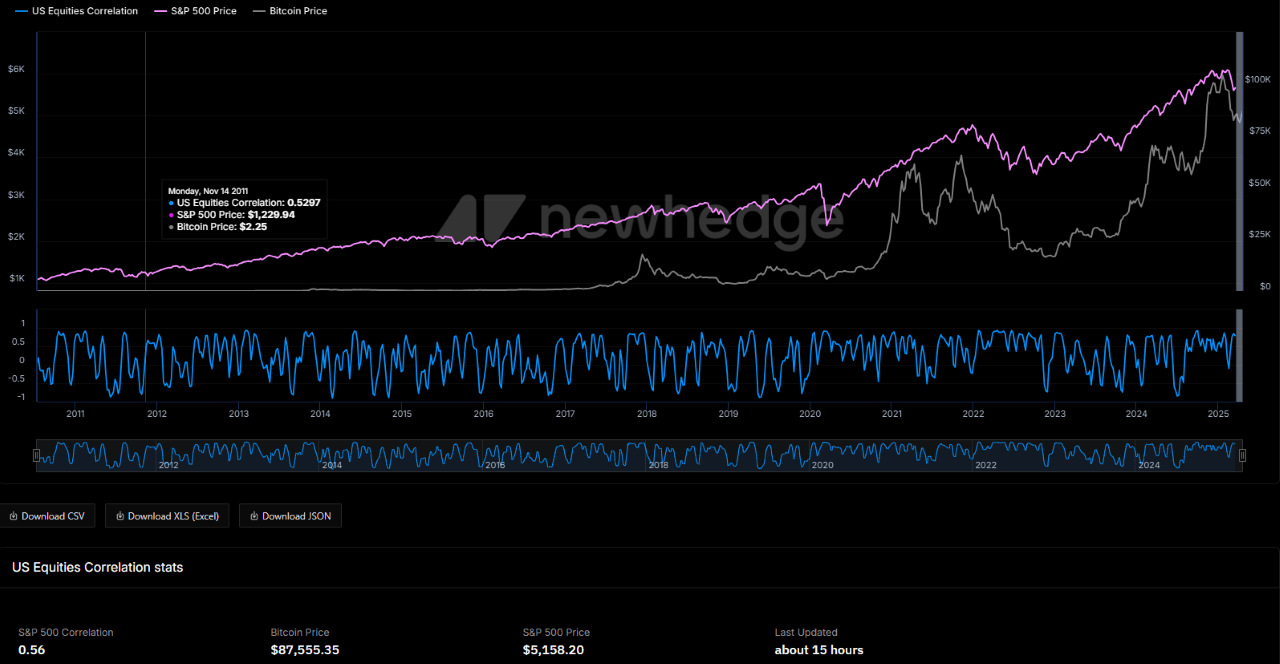

(BTC/S&P 500 correlation drops to 0.56/NewHedge)

Regardless of the fallout, the S&P 500, Dow, and Nasdaq all have grown by greater than 2% on the time of writing, with Bitcoin surgening past $91,000. Cryptocurrency correlates with stock and about 56% of clips, based on information from NewHedge, however that correlation will drop considerably, with full decoupling attainable by the top of the yr.