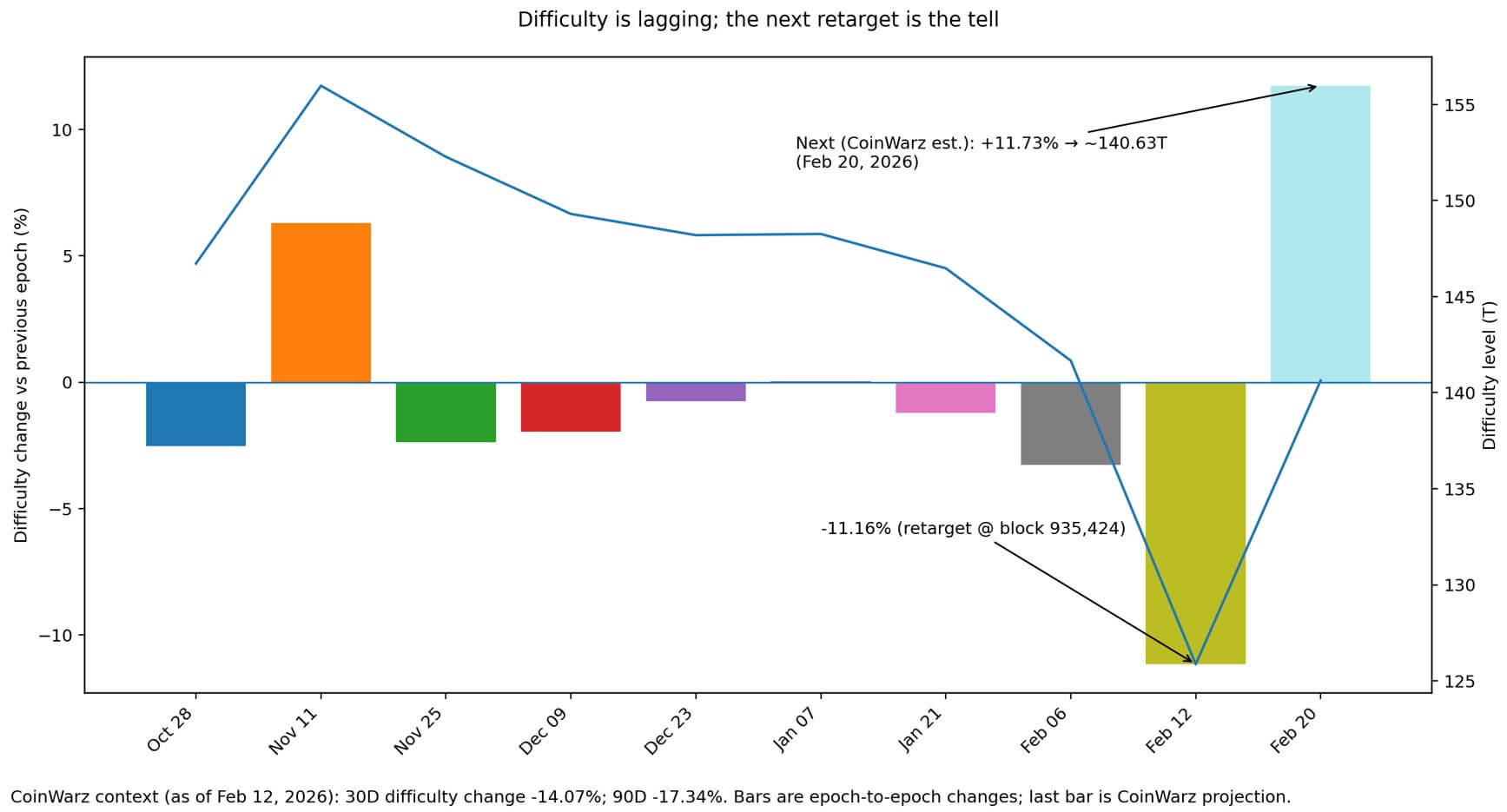

Bitcoin mining issue decreased by 11.16% to roughly 12.586 billion on the newest retargeting boundary round block 935,424.

That is the most important unfavourable correction because the Chinese language mining ban in 2021, the sixth consecutive downward revision goal, and the tenth largest unfavourable correction in Bitcoin historical past.

Nonetheless, the issue adjustment is a lagging indicator, because it displays what has occurred over the previous 2,016 blocks, slightly than what’s at the moment occurring.

The actual query is whether or not the machine that disappeared into the shadows will return, or whether or not this retargeting marks the start of a extra severe shakeout of miners.

Probably the most helpful ahead indicators are the next changes: CoinWarz has already estimated a 12% pullback round February twentieth, suggesting that the hashrate is recovering shortly.

It is a transfer extra according to reductions in manufacturing exercise and short-term economics than with a structural exodus of miners. If that restoration doesn't materialize and the issue continues to say no, “give up” turns into greater than only a headline.

Three drivers, just one surrendered

A lower in issue signifies that block occasions have turn into slower in comparison with the earlier epoch, indicating a lower in on-line hashrate.

However three completely different forces can take a hashrate offline, they usually don't all imply the identical factor.

Obligatory enterprise closures and energy outages are non permanent. Winter Storm Fern hit U.S. miners in early February, forcing grid-connected operations to close down throughout peak demand.

Foundry's pool hash reportedly decreased by roughly 60% on the peak of the disruption. If miners reduce operations throughout an influence grid emergency, hashrate can disappear in a single day, however can shortly come again when the climate improves.

Though a majority of these offline occasions could appear dramatic by way of issue numbers, they aren’t indicative of economic hardship.

An economic-driven shutdown borders on capitulation.

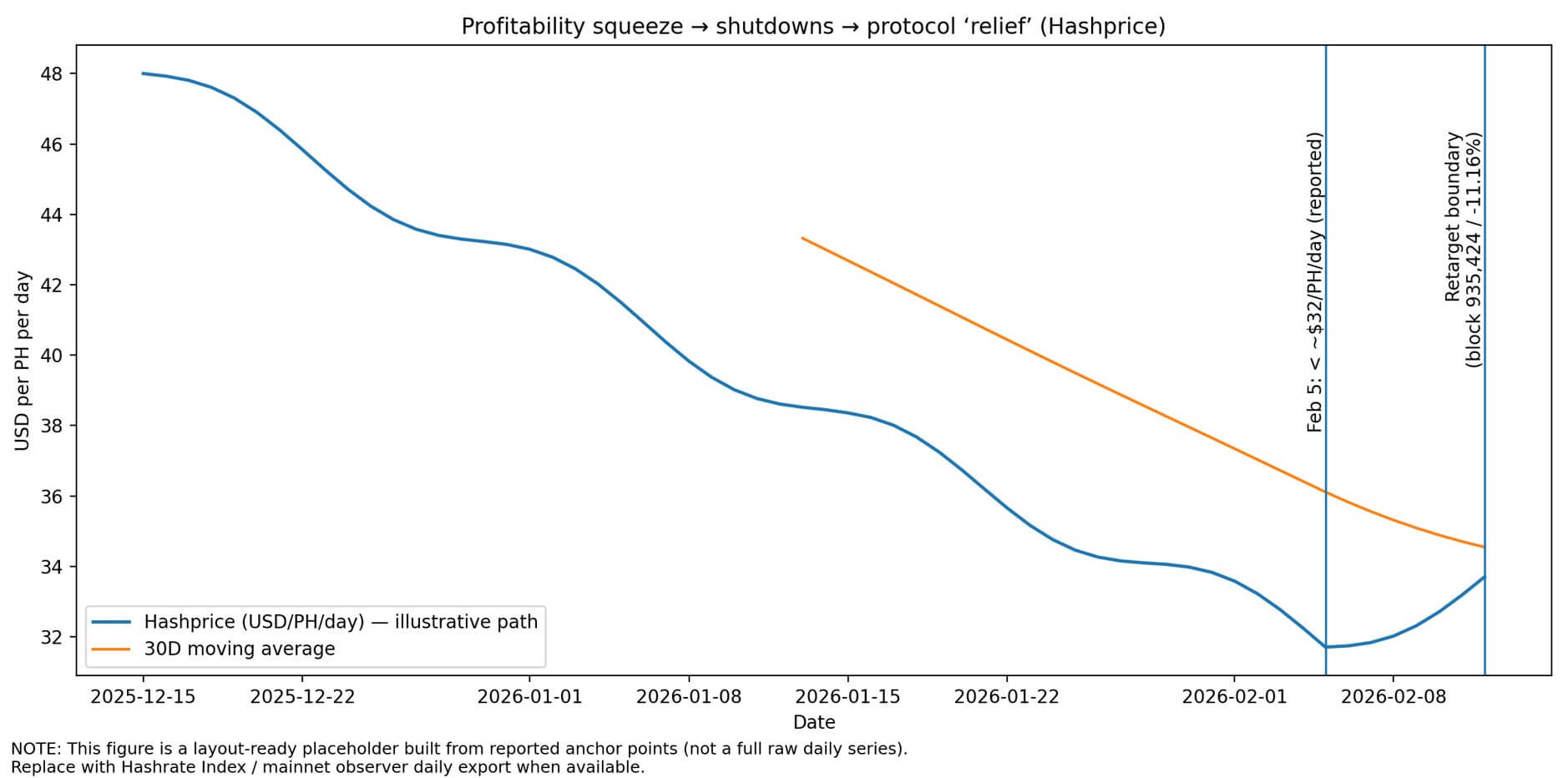

The income per unit of hashrate, generally known as the hash worth, hit a report low in early February. TheEnergyMag reviews that hash costs are beneath $32 per petahash per day, and Hashrate Index knowledge exhibits real-time hash costs hovering within the low $30s.

When hash costs collapse, marginal fleets operating older ASICs or paying increased energy prices shall be shut down. It may very well be give up, but it surely is also affordable idling. Miners are ready for difficulties to reset and profitability to enhance earlier than turning the machine again on.

The protocol rewards that persistence. When the reduce issue reaches 11.16%, the anticipated Bitcoins earned per unit hash will increase by roughly 12.6% till the hashrate returns, creating a short honeymoon of profitability for survivors.

The structural adjustments characterize a slow-burning give up. Some miners are more and more treating Bitcoin mining as an non-obligatory workload, with AI and high-performance computing datacenter axes rising alongside miner stress protection.

If firms are reallocating capital from ASICs to knowledge facilities, hashrate that goes offline might not come again, no less than not instantly. It's a special type of capitulation, a strategic retreat.

Give up Guidelines: What to Search for

Two-digit unfavourable retargeting can have fully completely different meanings relying on subsequent occasions. Deal with it like a diagnostic take a look at, not a verdict.

The conduct of the protocol and hashrate signifies whether or not the machine is coming again or not. The hashrate rebound velocity is the clearest sign. A fast snapback inside hours or days signifies suppression, whereas a gradual grind signifies deeper stress.

The following retargeting projection is a proxy. CoinWarz’s 12% rebound prediction means the hash is already coming again. If this prediction holds true, then the lower in issue is because of a short lived delay in offline capability.

Problem paths throughout a number of epochs are additionally essential. One large worth drop adopted by a rebound is just not capitulation. A number of consecutive cuts outline a stress regime.

Cumulative issue has already dropped by two orders of magnitude over the previous 30-90 days. Which means this retargeting was not the primary signal of hassle, simply the loudest one.

Adjustments in pool focus can reveal real-world capability reallocation. If a big pool loses market share structurally slightly than quickly, it is a sign that the mining infrastructure will change arms or be taken offline completely.

In that context, the Foundry's disruption throughout the storm is noteworthy.

Minor economics explains why machines cease within the first place. Hash worth and “ache threshold” are the central metrics.

Document or near-record lows are when marginal rigs go darkish. The drawdown in Bitcoin worth relative to issue creates a squeeze. If the value drops quicker than the issue resets, the stress will spike.

That is the macro relationship of why that is occurring now. Charge help, which is the share of block rewards derived from transaction charges slightly than subsidies, can also be essential.

If charges don’t cut back subsidies, miners will dwell or die on worth and effectivity. Hash worth stress is amplified in a low worth setting.

It’s often steadiness sheet stress that exhibits true capitulation.

Miner promoting strain, similar to a spike in flows from miners to exchanges or a drawdown of reserves, is an indication of pressured liquidation.

Financing actions for public miners, together with emergency debt and fairness capital will increase, asset gross sales and restructuring language, additionally warn of misery.

Pricing within the ASIC secondary market can also be completely different, with steep declines in used ASIC costs suggesting pressured liquidation, whereas steady pricing suggests non permanent offline functionality slightly than chapter.

climate, financial system, construction

Climate whiplash is a short lived case. Purposeful restrictions and outages will take Hashrate offline and cut back issue, however Hashrate will shortly return as soon as circumstances normalize.

On this situation, the following retarget will flip constructive, precisely as CoinWarz predicts. This situation implies that the issue discount was largely working.

The community adjusts, growing profitability for customers who remained on-line and returning offline capability.

Financial reconstruction is a traditional give up. Hashprice stays depressed, Bitcoin costs stay depressed, and the previous fleet stays offline as a result of it is senseless to function at a loss.

We see repeated unfavourable corrections over a number of epochs, growing miner gross sales and reducing ASIC resale costs.

This creates short-term promoting strain danger and long-term trade consolidation as weaker gamers exit and stronger gamers purchase distressed property.

Structural reset is the trail to knowledge heart reallocation. Some firms deal with mining as interruptible and reallocate capital to AI and high-performance computing. Hashrate turns into seasonally and worth dependent, issue changes turn into extra erratic and extra risky.

Bitcoin's safety funds is more and more tied to broader computing and power markets. This isn’t a disaster, but it surely does change the dynamics of how hashrate reacts to cost.

What the rebound says

The next retargeting will most clearly take a look at which situation is enjoying out. As predicted by CoinWarz, if the hashrate recovers shortly and the issue stage recovers, the “give up” narrative will disappear.

Whereas this decline was actual, it mirrored non permanent disruptions similar to climate, short-term financial circumstances, and affordable idling.

Miners who stayed on-line captured a honeymoon of profitability, issue reset to match the returned hashrate, and the community moved ahead.

The stress will solely deepen additional if the rebound doesn’t materialize, however that’s unlikely. But when the issue drops in a number of extra epochs, it means the offline hash charge received't come again anytime quickly, both as a result of the economics don't help it or as a result of capital has moved elsewhere.

If that occurs, we will count on steadiness sheet stress indicators to start out flashing, similar to increased promoting costs, funding scrambles, and ASIC liquidations.

The discount in issue itself is backwards.

Over the previous two weeks, now we have seen a good portion of our hashing energy taken offline for monetary and operational causes.

What issues now’s whether or not these machines come again, and the reply will seem in subsequent week's knowledge.

The protocol doesn't care concerning the narrative, it simply adjusts to the hashrate it sees.

Whether or not this retargeting was non permanent or the start of an exodus of miners relies on what occurs subsequent, not what has already occurred.