Written by Francisco Rodriguez (all occasions Jap Time until in any other case famous)

Bitcoin has struggled to keep up its footing as issues a couple of sturdy yen and monetary instability have created a disconnect between cryptocurrencies and conventional safe-haven belongings.

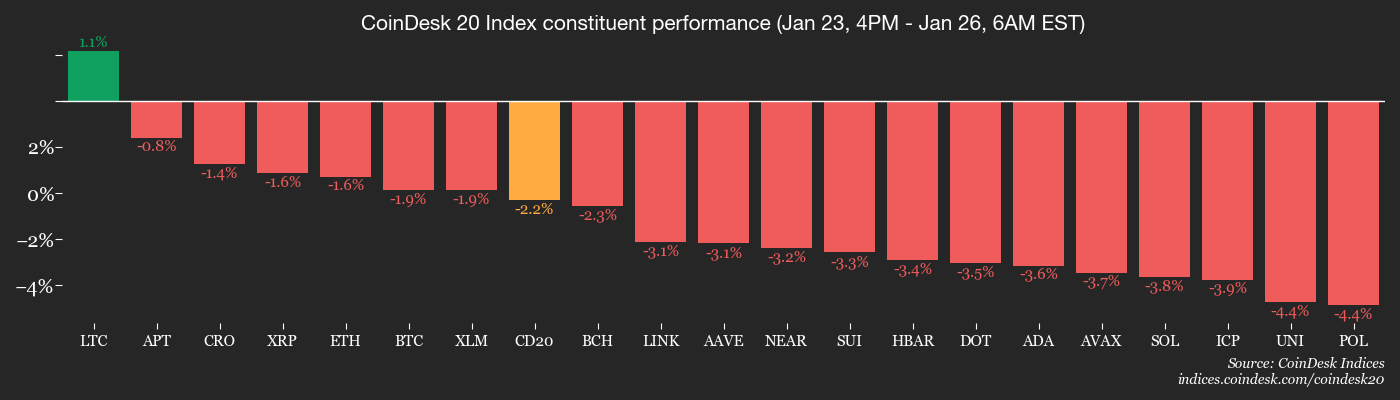

Bitcoin fell 0.8% in 24 hours to beneath $88,000, whereas Ethereum fell greater than 1.6% to simply underneath $2,900. The broader CoinDesk 20 (CD20) index fell 1.54%.

In the meantime, the yen rose greater than 1.4% in opposition to the greenback after Prime Minister Sanae Takaichi mentioned Japan would “take all vital measures to cope with speculative and extremely irregular actions.”

Takaichi didn’t specify any worrying market actions, however the nation's 10-year bond yield has fallen barely after hitting a 27-year excessive this month.

Merchants are additionally deciphering the New York Fed's current “rate of interest test” as an indication of attainable concerted motion with Japan, a situation that sees buyers exit riskier belongings because the yen carry commerce unwinds.

Investor Michael Barry, who profited from shorting the market through the subprime mortgage disaster by betting on a decline, not too long ago identified that the hole between Japanese authorities bond yields and international rates of interest was narrowing, commenting that “repatriation is on maintain.''

The suggestion is that almost $5 trillion of international funding, primarily from america, will likely be pulled out to benefit from these yields. Consequently, capital fled threat belongings in anticipation of such a transfer. The Nikkei 225 index fell 1.8%, and Nasdaq and S&P 500 futures additionally fell.

Nevertheless, that capital didn’t rotate into Bitcoin, however relatively into gold. The valuable metallic breached $5,000 an oz. for the primary time earlier immediately and is already at $5,090. Greg Cipolaro, head of world analysis at NYDIG, mentioned Bitcoin's always-on nature, considerable liquidity, and instantaneous funds could also be hindering its adoption.

“In durations of stress and uncertainty, liquidity preferences prevail, and this dynamic is much extra damaging to Bitcoin than it’s to gold,” he mentioned in a be aware shared with CoinDesk.

Blockchain knowledge additionally suggests inner weaknesses. CryptoQuant mentioned in a report that older Bitcoin holders are beginning to promote at a loss for the primary time since October 2023.

Merchants are maintaining a tally of this week's Federal Reserve assembly, which is predicted to maintain rates of interest on maintain, though Chairman Powell's steerage will likely be key.

Moreover, the chance of a U.S. authorities shutdown is presently pegged at 79% for Polymarket and close to 78% for Calci, including additional uncertainty forward of the week when massive tech corporations report earnings and share steerage. Be alert!

Extra info: For an evaluation of immediately's exercise in altcoins and derivatives, see Crypto Markets At this time.

what to see

For a extra complete record of this week’s occasions, see CoinDesk’s “Crypto Week Forward.”

- cryptography

- macro

- January twenty sixth, 8:30 a.m.: US sturdy items orders for November month-on-month change (-2.2% month-on-month)

- January twenty sixth 10:30 a.m.: Dallas Federal Reserve Manufacturing Business Index for January (beforehand -10.9)

- income (estimated based mostly on FactSet knowledge)

token occasion

For a extra complete record of this week’s occasions, see CoinDesk’s “Crypto Week Forward.”

- Governance votes and calls

- Maple Finance is voting to increase its 25% protocol income allocation to the Syrup Strategic Fund for the primary half of 2026. Voting ends on January twenty sixth.

- Lido is voting to reform its reward distribution committee to assist Lido V3 options resembling stVault, in addition to implement a dynamic DVT incentive mannequin that adjusts reward splits based mostly on working prices. Voting ends on January twenty sixth.

- unlock

- January twenty sixth: BGB$3.5828 Liberate 10.5% of circulating provide value $508.2 million.

- Activate token

- January 26: Rainbow (RBNW) airdrop snapshot is taken.

convention

For a extra complete record of this week’s occasions, see CoinDesk’s “Crypto Week Forward.”

market actions

- $BTC Shares fell 1.5% from Friday at 4:00 PM ET to $87,928.03 (24 hours: -0.67%).

- $ETH fell 1.5% to $2,897.28 (24 hours: -1.31%)

- CoinDesk 20 fell 2.05% to 2,681.29 (24 hours: -1.34%%)

- Ether CESR complete staking rate of interest decreased by 2bps to three.05%

- $BTC Funding charge on Binance is 0.0051% (5.5856% p.a.)

- DXY fell 0.92% to 97.46.

- Gold futures rose 1.42% to $4,983.10.

- Silver futures rose 7.15% to $103.26.

- The Nikkei 225 closed 1.79% decrease at 52,885.25.

- Hold Seng closed unchanged at 26,765.52.

- FTSE unchanged at 10,143.44

- The Euro Stoxx 50 fell 0.13% to five,948.20.

- The DJIA closed 0.58% decrease at 49,098.71 on Friday.

- The S&P 500 closed unchanged at 6,915.61.

- The Nasdaq Composite Index rose 0.28% to finish at 23,501.24.

- The S&P/TSX Composite rose 0.43% to finish at 33,144.98.

- The S&P 40 Latin America index rose 1.5% to finish at 3,591.57.

- US 10-year authorities bond rate of interest fell 2.8bps to 4.211%

- E-mini S&P 500 futures fell 0.16% to six,933.75.

- E-mini NASDAQ 100 futures have been unchanged at 25,680.50.

- E-mini Dow Jones Industrial Common Index futures fell 0.76% to 49,180.00.

bitcoin statistics

- $BTC Dominance: 59.79% (-0.13%)

- Ether to Bitcoin ratio: 0.03294 (1.31%)

- Hashrate (7-day shifting common): 951 EH/s

- Hash Value (Spot): $39.17

- Whole charge: 1.93 $BTC / $169,938

- CME futures open curiosity: 124,740 $BTC

- $BTC Gold worth: 17.2 oz.

- $BTC Market capitalization in opposition to gold: 5.87%

technical evaluation

- $BTC Going through stiff resistance after weekly shut beneath $88,000, rejecting 50-week exponential shifting common of $96,700

- Except $88,000 is regained, the market will seemingly transfer right into a consolidation vary between $80,000 and $88,000 for short-term volatility costs earlier than trying a broader breakout amid this localized uncertainty.

crypto belongings

- Coinbase International (COIN): Friday closed at $216.95 (-2.77%), pre-market ended at $212.06, -2.25%

- Circle Web (CRCL): $71.33 (-0.03%), -2.29% to shut at $69.70.

- Galaxy Digital (GLXY): $31.90 (+3.17%), -2.51% to finish at $31.10

- Bullish (BLSH): $35.75 (-2.00%), -0.73% to shut at $35.49

- MARA Holdings (MARA): $10.50 (+2.04%), -2.10% to shut at $10.28.

- Riot Platform (RIOT): Ended at $17.28 (+1.17%), -1.79% at $16.97

- Core Scientific (CORZ): $18.79 (+3.93%), -1.33% to finish at $18.54

- CleanSpark (CLSK): Closed at $13.71 (+3.94%), -2.26% at $13.40

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): $49.14 (+4.71%), -1.59% to finish at $48.36

- Exodus Motion (EXOD): Closed at $14.99 (-4.83%)

crypto asset firm

- Technique (MSTR): Ended at $163.11 (+1.32%), -2.33% at $159.31

- Attempt (ASST): $0.87 (+0.06%), -1.78% to shut at $0.85

- SharpLink Gaming (SBET): Closed at $9.75 (-0.31%), -2.56% at $9.50

- Upexi (UPXI): $2.00 (+1.01%), -4.50% to shut at $1.91

- Mild Technique (LITS): Closed at $1.27 (-3.79%)

ETF stream

spot $BTC ETF

- Every day internet stream: -$103.5 million

- Cumulative internet stream: $56.48 billion

- complete $BTC Holding quantity ~1.29 million objects

spot $ETH ETF

- Every day internet stream: -$41.7 million

- Cumulative internet stream: $12.33 billion

- complete $ETH Holding quantity ~6.02 million

Supply: Farside Traders

whilst you have been sleeping

As Europe's dependence on U.S. pure fuel grows, so does Trump's affect (New York Instances): Tensions over Greenland have raised issues that the Trump administration will flip the U.S. oil and fuel business right into a instrument to stress Europe.

Gold soars above $5,000, greenback hits four-month low (Bloomberg): The greenback widened its decline on Monday as hypothesis swirled that the U.S. may coordinate intervention with Japanese authorities to assist the yen. Shares fell, however gold topped $5,000 an oz..

India plans to chop tariffs on vehicles to 40% in commerce cope with EU, sources say (Reuters): India plans to chop tariffs on vehicles imported from the EU from as much as 110% to 40% within the nation's greatest market opening but as the 2 international locations transfer nearer to signing a free commerce deal that might be signed as early as Tuesday.