Bitcoin fell under the $70,000 stage, a transfer that mirrored growing promoting strain and growing market jitters. The breach of this psychological threshold intensified volatility, with short-term members reacting shortly to the downward momentum. Analysts be aware that the present atmosphere is outlined by inner market buildings, notably the habits of long-term holders, moderately than macro headlines.

Bitcoin value alone hardly ever defines a market backside, in line with insights shared by On-chain Thoughts. As a substitute, key indicators have a tendency to come back from holder habits, notably whether or not long-term traders are beginning to present indicators of stress. Traditionally, these gamers have been the least responsive cohort, usually absorbing volatility moderately than amplifying it by means of fast promoting.

Nonetheless, when long-term holders endure intensive unrealized losses, the dynamics change. Such conditions usually coincided with the later levels of a bear market, when confidence waned and a broader capitulation turned potential. This step doesn’t assure a direct reversal, however usually indicators that structural exhaustion is underway.

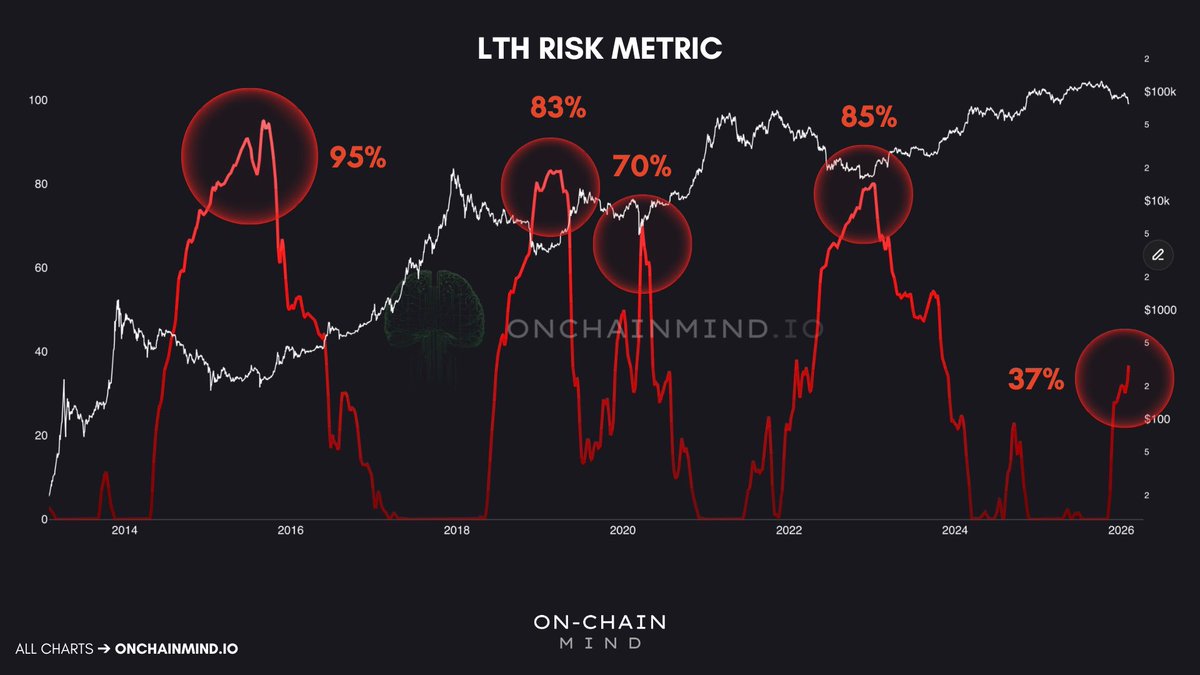

On-chain Thoughts additional emphasizes that long-term holding threat has traditionally performed a vital function in figuring out late-stage bear market conditions. Earlier cycles have seen clear peaks on this indicator. In 2015 it was round 95%, in 2019 it was round 83%, throughout the Corona disaster it was round 70% and throughout the 2022 recession it was round 85%. These surges sometimes mirror widespread unrealized losses amongst long-term traders, indicating extreme structural stress throughout the community.

Traditionally, when this indicator rises above the 55-60% vary, the bottoming course of tends to speed up. At that stage, even probably the most affected person particular person begins to expertise important strain, usually coinciding with the ultimate stage of give up. This doesn’t essentially imply that the precise value is decrease, however it’s usually forward of stabilization and eventual restoration.

Nonetheless, this indicator is now near 37%, properly under the earlier yield threshold. This means that whereas market stress is clear, circumstances could not but mirror the full-blown exhaustion sometimes related to the underside of a sustainable cycle. If the sample of decrease highs continues, a transfer into the 70% space would imply that even robust palms are beneath important strain. That is traditionally a prerequisite for extra structural and sustained market lows.

Bitcoin's weekly construction has seen a definite deterioration in momentum after being rejected within the $120,000-$125,000 space, with the worth presently buying and selling close to the $69,000 space. The latest decline has taken Bitcoin under its 50-week transferring common (blue) and 100-week common (inexperienced), ranges which have served as dynamic assist all through the earlier upward pattern. Losses in each indicators sign a transition from a corrective pullback to a extra structural downtrend part.

The 200-week transferring common (purple) stays properly under present costs, suggesting that the broader macro pattern has not but entered deep bear market territory. Nonetheless, the pace of the decline and the enlargement of the bearish candle point out an aggressive distribution moderately than an orderly sideways motion. The surge in quantity accompanying the latest downward transfer reinforces the interpretation of compelled promoting and liquidation exercise.

From a technical perspective, the $70,000 space has transitioned from assist to resistance following the collapse. Failure to recuperate this stage shortly will increase the probability of additional draw back exploration, doubtlessly in the direction of historic demand areas within the sub-$60,000 area. Conversely, stabilization above this space with declining gross sales might point out depletion amongst sellers.

Featured picture from ChatGPT, chart from TradingView.com

modifying course of for focuses on offering completely researched, correct, and unbiased content material. We adhere to strict sourcing requirements, and every web page is diligently reviewed by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of the content material for readers.