Bitcoin Mining Even though BTC is comfy sitting at over $100,000, it's not straightforward.

Knowledge from Luxor's hashrate index exhibits that earlier June buying and selling charges have fallen beneath 1% of miners' complete block rewards. That is the bottom since 2022. The dip was first reported Theminermag.

The month will not be but full, however the downward development means that the state of affairs will not be getting higher for miners.

Bitcoin miners are rewarded by processing blocks containing transactional knowledge and including them to the blockchain. For every block processing, miners obtain 3.125 BTC (over $327,000 at present costs) together with transaction charges.

Nonetheless, fewer individuals use the Bitcoin community, so buying and selling charges stay low. In different phrases, miners will scale back their revenue with every profitable block win.

In accordance with BitinFocharts, the common value of buying and selling Bitcoin is presently $1.45. Transaction prices often remained low at $1.50 this yr and the top, however spikes have elevated every so often due to the surge in exercise in Craze, a blockchain response to NFTs, just like the Bitcoin ordinance.

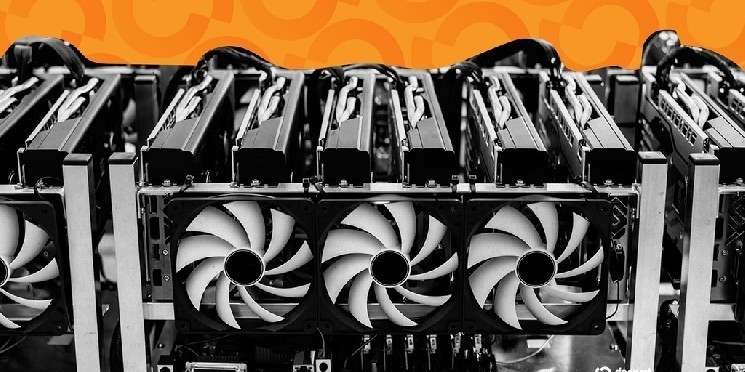

Miners are often warehouse industrial companies full of specialised computer systems, which had been hit arduous earlier this yr by the decline in Bitcoin costs, and in some circumstances had been pressured to promote extra cash to maintain their enterprise up.

Issues gave the impression to be getting higher as Bitcoin costs have risen once more in current months, however blockchain knowledge exhibits that lately processed blocks comprise small quantities of transactions. it's been Flag included Sq. CEO and Funds entrepreneur Jack Dorsey believes BTC needs to be used extra extensively for on a regular basis funds, not as a precious retailer.

100%

– Jack (@jack) March 31, 2025

Bitcoin was lately buying and selling at $104,648 at Crypto knowledge supplier Coingecko presentafter a drop of almost 4% in 24 hours. The coin has recovered considerably since falling beneath $75,000 in April. This can be a dip that seems to have been brought on by President Trump's tariff announcement.

Nonetheless, in accordance with CJ Burnett, the chief revenue officer of Compass Mining, the rise within the worth of belongings stays inadequate to alleviate considerations amongst miners. “Regardless of the rising costs of Bitcoin, mining revenues remained at an all-time low since half of 2024,” he stated. Decryption.

Half of it’s a sq. occasion burned right into a Bitcoin code. Each 4 years, mining compensation is decreased by half. The final half passed off in April 2024, slicing the rewards from 6.25 BTC.

Usually, Bitcoin costs are likely to skyrocket after half a yr to 18 months, Decryption Beforehand It has been reported The coin is behind in comparison with earlier cycles.

Nonetheless, the miner stated Decryption The value of BTC shouldn’t be a difficulty if you’re performing lean and environment friendly operations. Barnett added that miners can survive tough instances with “probably the most environment friendly mining {hardware} and aggressive electrical energy prices.”

Mihir Bhangley, co-founder and accomplice of Sangha Renewables, an organization that turns renewables into bitcoin mining operations, added that the motion of risky BTC costs is all a part of the sport.

“The profitability of Bitcoin mining at all times is dependent upon the fee construction reasonably than the value of Bitcoin,” he stated, including that funding in the perfect {hardware} “will guarantee long-term, resilient returns whatever the market cycle.”

edit Andrew Hayward