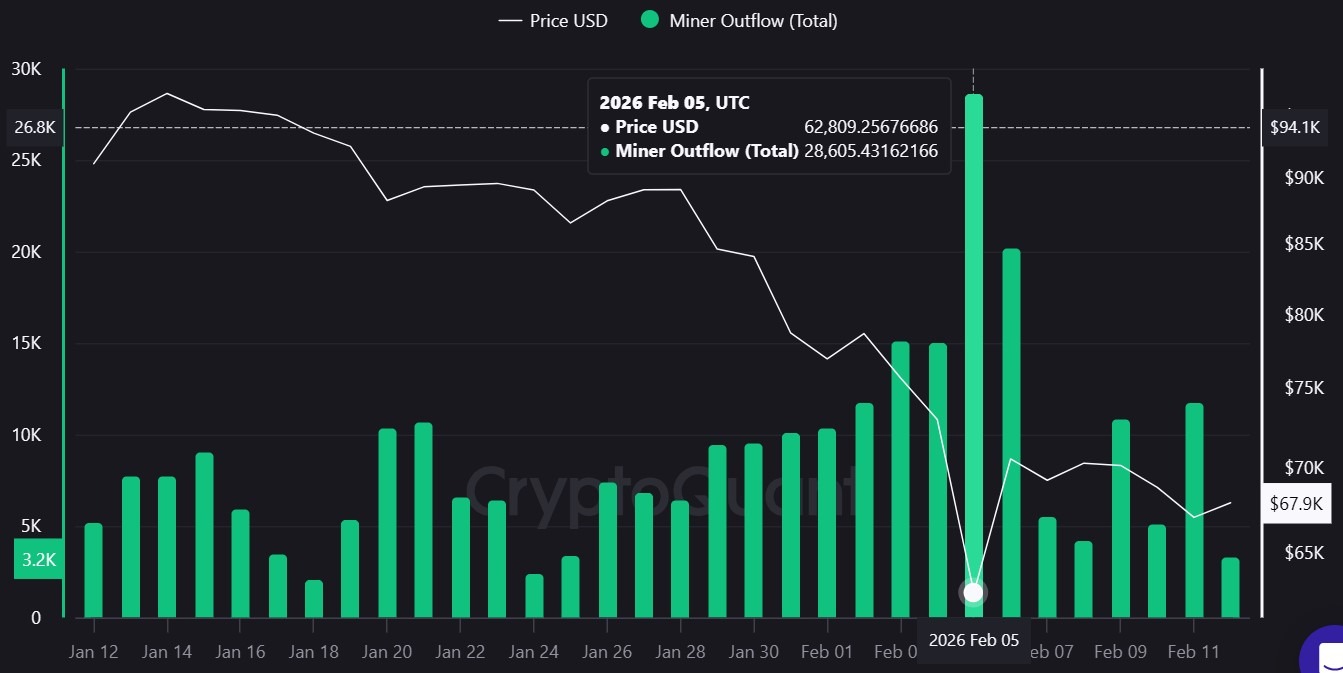

Variety of Bitcoin miners leaked soars to twenty-eight,605 $BTCtransactions price about $1.8 billion passed off on February 5, making it the most important single-day switch since November 2024 as costs soared throughout unstable buying and selling.

A further 20,169 Bitcoins ($BTCRoughly $1.4 billion price of cryptocurrencies have been leaked from wallets linked to miners on February 6, in response to knowledge from CryptoQuant. The final comparable spike occurred on November 12, 2024, when the variety of exodus reached 30,187. $BTC.

This spike coincides with fast worth actions; $BTC It traded at round $62,809 on February 5, however rebounded to $70,544 the subsequent day. Massive scale transfers of miner wallets throughout unstable periods are sometimes topic to scrutiny as they will point out potential promoting strain.

The eight miners which have disclosed January numbers to date are CleanSpark, Bitdeer, Hive Digital Applied sciences, BitFuFu, Canaan, LM Funding America, Cango, and DMG Blockchain Options. They reported a complete manufacturing of roughly 2,377 models. $BTC Throughout that month. This complete is far decrease than 28,605 circumstances. $BTC It was transferred in someday on February fifth.

Runoffs seemingly replicate broader ecosystem flows

The dimensions of the outflow on February fifth and February sixth exceeded the January output of publicly traded firms surveyed by Cointelegraph.

The mixed January gross sales reported by CleanSpark, Cango, and DMG account for less than a fraction of the 28,605 confirmed gross sales. $BTC Will probably be transferred in 1 day.

Nevertheless, a miner exodus doesn’t robotically result in capitulation or instant spot market gross sales.

Based on CryptoQuant, miner outflows embrace transfers to exchanges in addition to inner pockets actions and transfers to different entities, and this metric by itself doesn’t affirm that the cash have been bought on the open market.

Given the scale of the transfer relative to disclosed public miner gross sales, the transfer might replicate exercise past giant publicly traded firms.

30-day chart of Bitcoin miner outflow. sauce: cryptoquant

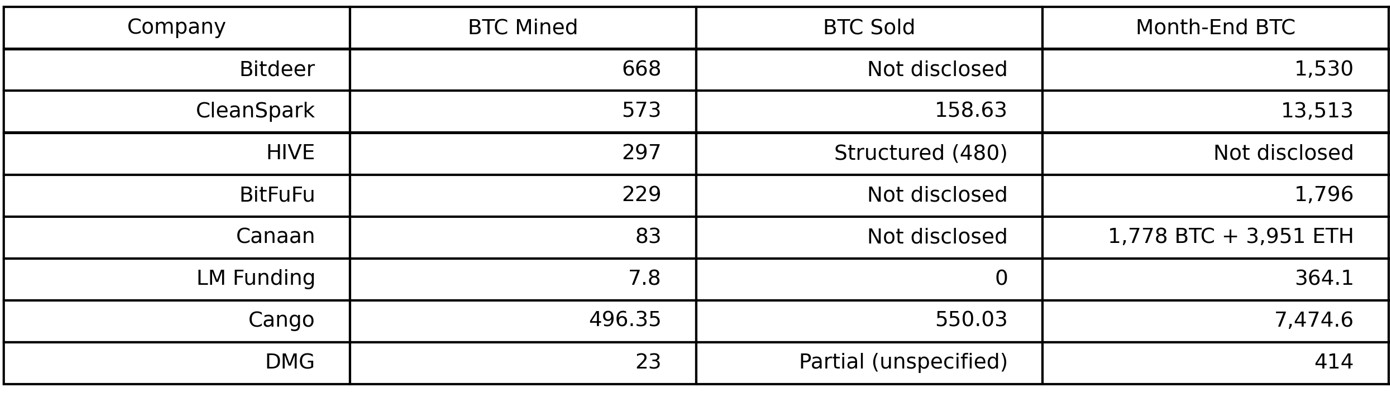

Miners' public disclosures present numerous strikes by the Treasury Division

CleanSpark reported mining 573 $BTC and gross sales 158.63 $BTC January ended at 13,513 $BTC It's on the stability sheet.

Kango mining 496.35 $BTC Disclose sale of 550.03 $BTCstated it’ll proceed promoting newly mined Bitcoin to help the enlargement of its synthetic intelligence and inference platform.

On February 9, the corporate bought an extra 4,451 models. $BTC Roughly $305 million can be paid to partially repay a Bitcoin-backed mortgage and lift funds for AI tasks.

Associated: Bitcoin issue drops greater than 11%, largest drop since China's ban in 2021

Different firms took a distinct method. canaan mining 83 $BTC Reserves elevated to 1,778 $BTC and three,951 ETH. LM Fund Mining 7.8 $BTC No gross sales have been reported and the financials rose to $364.1. $BTC.

Hive, then again, used the structured pledge mechanism related to 480. $BTC To take care of liquidity whereas sustaining operations.

Some miners persistently report month-to-month manufacturing efficiency, whereas others solely report intermittently or have moved to quarterly disclosure.

January miner knowledge compiled by Cointelegraph. Supply: Cointelegraph

Associated: Inventory costs of Bitcoin mining firms IREN and CleanSpark plummet resulting from lack of income

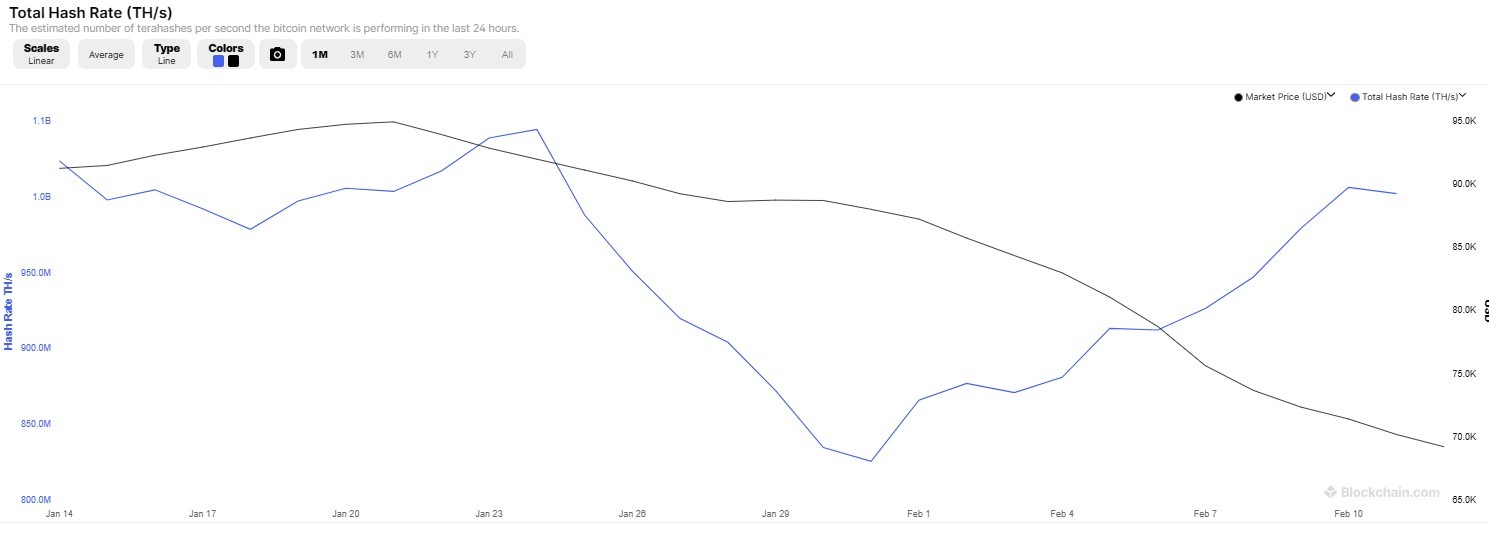

Winter storm impacts US miner hashrate

In late January, the community's hashrate additionally fluctuated quickly as extreme winter storms hit components of the US. On January twenty seventh, Bitcoin's hashrate dropped to 663 exahashes per second in two days, a drop of greater than 40%.

Whole mining hashrate. sauce: Blockchain.com

The non permanent decline got here as miners scaled again operations to stabilize the area's energy grid amid frigid temperatures and hovering vitality demand. U.S.-based firms equivalent to Marathon Digital Holdings and Airen have reported decreased working hours, leading to a big short-term drop in day by day manufacturing.

Based on knowledge from Blockchain.com, the hashrate dropped within the final week of January earlier than recovering in early February.

journal: The 6 strangest units individuals used to mine Bitcoin and cryptocurrencies