Bitcoin (BTC) mining is the following sector that feels the influence of the US-China tariff struggle. Miners are looking for workarounds as ASIC and mining rig standing stays unknown.

Bitcoin mining has responded to the US-China tariff struggle because the scenario of the machine and its parts stays unknown. The aggressive mining of the SHA-256 nonetheless depends on Bitmain machines, that are shipped to areas or use rental mining amenities abroad.

The tariff struggle has flapped up simply as Bitmain introduced new shipments of among the strongest ASIC rigs. The S21, essentially the most highly effective Bitcoin mining machine in the intervening time, is now delivery this month.

Antminer S21E HYD spot sale.

#BTC #Mining Value-Efficient Choices✅288t

✅4896W

✅17j/t

💲12/t solelyGross sales will start on April fifteenth at 9am EST

ship Obtainable from April to Might it.twitter.com/jmgq0uaekw– Bitmain (@bitmaintech) April 15, 2025

A 90-day tariff bounty interval may result in elevated delivery demand for ASICs. Miners also can double their US amenities and will buy as many hashrates as potential earlier than a delivery failure happens.

Customs duties could also be in a rush to ship ASICs to the US

The most important query is whether or not the promised electronics and mining gear can be shipped. US tariffs have an effect on not solely China, however Malaysia, Thailand and Vietnam.

A number of the mining startups utilizing parts of those nations scrambled to ship as a lot as potential earlier than customs duties are enforced.

“We’ve began chartering freight planes from Malaysia and Thailand to ship to the US earlier than the unique deadline. ” stated Vishnmackenchery, director of world logistics and providers for compass mining.

Primarily based on the most recent classification, ASIC miners don’t fall below exempt electronics. Moreover, if the commerce struggle just isn’t resolved by the tip of the commerce struggle, it could be shipped with exorbitant tariffs. Compass Mining is likely one of the firms supporting influence attributable to restricted replies for exemptions primarily based on the present US tariff system and classification.

🚨Buyer Duties & Bitcoin Mining {Hardware} 🚨

Following the White Home's April 11, 2025 replace on tariff exceptions below EO 14257, let's dive into the influence of imported ASIC miners into the US

In 2018, US Customs and Border Safety (CBP) was labeled…

– Compass Mining🧭 (@compass_mining) April 15, 2025

One other mining gear distributor, Luxor Know-how, plans to proceed offering info to its customers, however hints at it Customs It could be that you simply're coming to a brand new system. Like different electronics, not all provide chains cross by way of China, with fewer tariffs on some machines and parts.

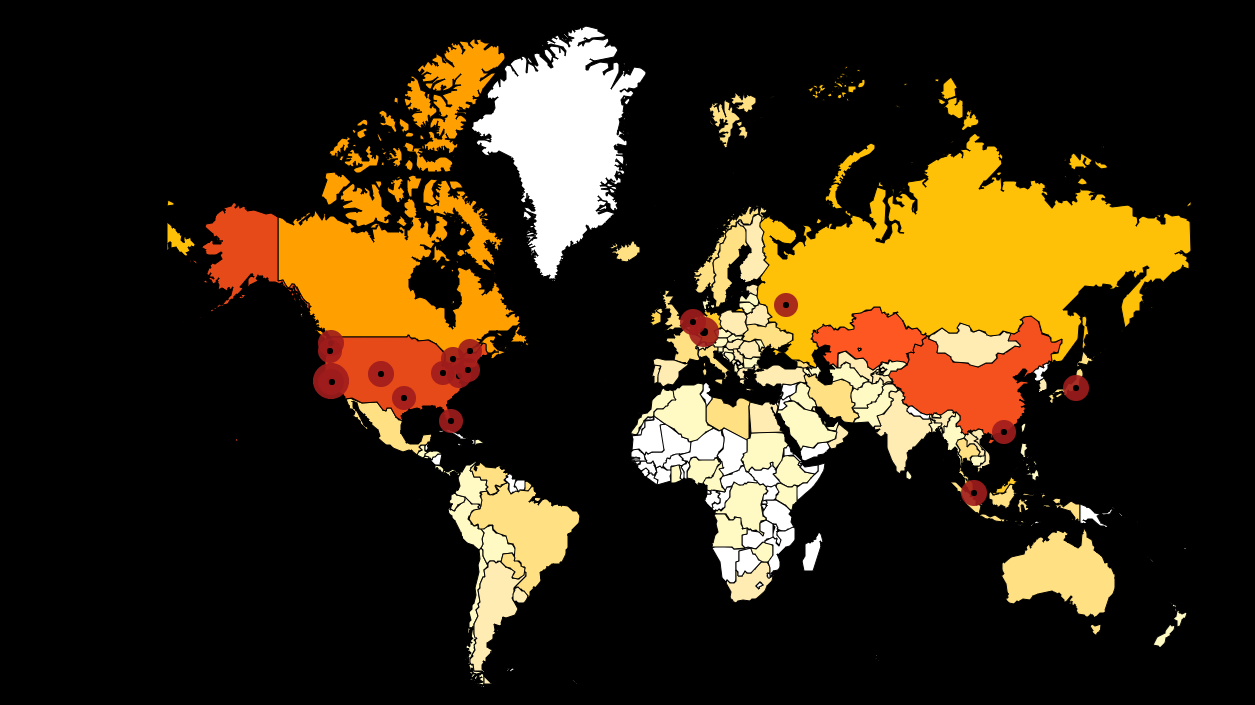

The US continues to manage hashrates

Till just lately, all mining ASICs from China have been nonetheless taxed at 25% on their entry into the US. Merchants have circumvented this requirement by delivery from different nations. Now, these areas additionally collide with mutual tariffs, making certain miners discover new potential routes for rigs and provides. Indonesia, Malaysia and Thailand could also be a very powerful markets affected.

At present, the US continues to be one of many main nations with uncooked hashrates. High mining firms like Mara Holdings are increasing hashrates and constructing new amenities.

The US continues to be each leaders, each internet hosting native mining information facilities, in addition to pool aggregators. |Supply: Chain Breaking Information

The specter of tariffs may gain advantage current mining firms, significantly those who change gear and are trapped at greater hashrates. US-based shares Mining What occurred up to now day, China-based Canaan Mining (CAN) decreased its value by 7.2% to $0.26.

Feindryusa, the most important mining pool in the US, presently produces greater than 31% of blocks attributable to an inflow of abroad miners, but in addition provides native hashrates. Bitcoin Community continues to be experiencing peak hashrates 890 EH/s.