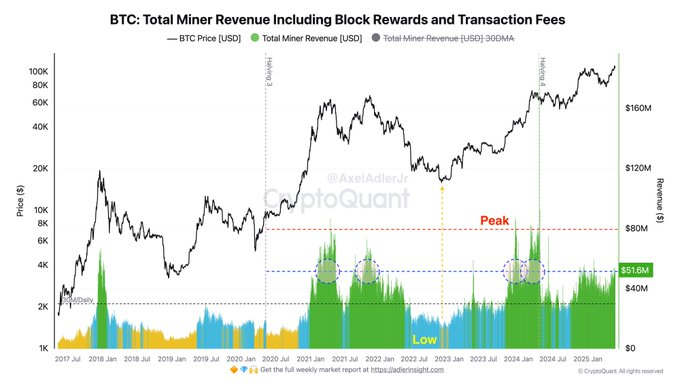

The Bitcoin market continues to stabilize with elevated revenues for miners and exchanges of influx exchanges, which seek advice from progress in community exercise. Nevertheless, these essential metrics haven’t but hit the degrees seen at earlier cycle peaks. In accordance with current information shared by market analysts, Bitcoin miners presently earn round $51.6 million per day.

After the ATH, miners strengthened gross sales in exchanges. The inflow doubled from a median of 25BTC to 50BTC per day, however its historic peak reaches round 100BTC.

This reveals that gross sales are literally accelerating, however we nonetheless have a good distance from peak quantity and…pic.twitter.com/ftsglykovc

– Axel💎🙌Adler Jr (@axeladlerjr) Might 27, 2025

This determine is spectacular, however it’s nonetheless beneath the historic peak income degree, which was final seen on the earlier market prime, exceeding $80 million per day. This implies that whereas the community may be very lively, there may be room for much more mining revenues earlier than reaching historic highs.

Minor exchanges are twice as inflows, however the market absorbs provide. Actions beneath peak degree

One other essential pattern is the rise in miner trade inflows. Miners have stepped up gross sales actions after Bitcoin lately touched on a brand new all-time excessive. The typical each day influx has doubled. That is rising from about 25 btc to 50 btc per day. Traditionally, the height of mine trade influx reached roughly 100 btc per day.

Regardless of this improve in provide, the market has proven robust absorption, and is snug dealing with of extra bitcoins bought by miners. This regular demand means that it has not but dominated the market whereas gross sales pressures are rising.

Rising miners' revenues and growing trade inflows imply a wholesome and lively Bitcoin community. Present numbers nonetheless have house for additional progress. It factors to markets the place there may be room for growth on this cycle so long as income and influx numbers are beneath historic peaks.

Has Bitcoin reached the highest? What's subsequent?

Analysts say Bitcoin's subsequent peak worth forecast is anticipated to be between $200,000 and $250,000. When you attain these ranges, the modifications could proceed. For instance, if Bitcoin fell 50% after reaching $200,000, the value would settle at round $100,000. That is doable primarily based on previous market habits.

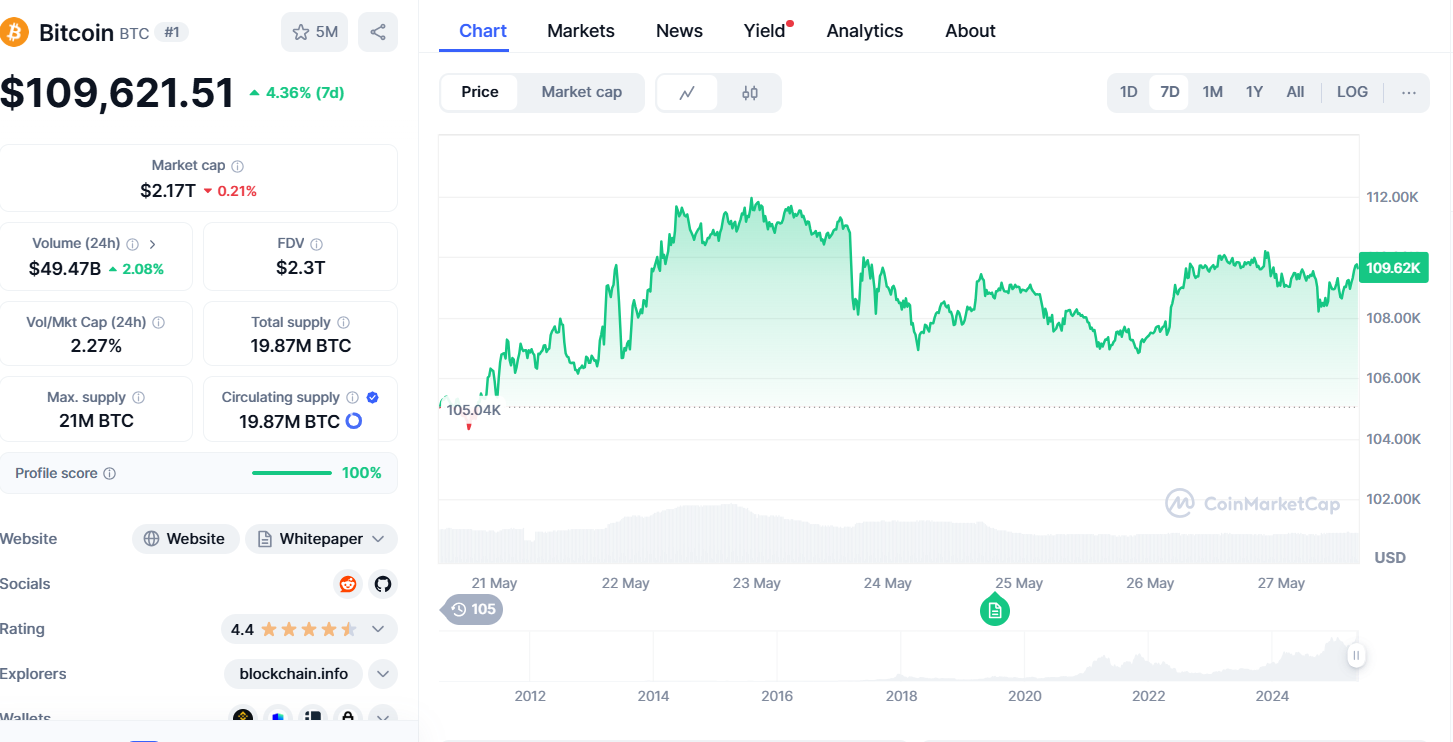

Supply: CoinMarketCap

Demand might improve if main hedge funds and Wall Road buyers started Bitcoin as a secure various to conventional Fiat forex, particularly in periods of financial bother. In that state of affairs, Bitcoin cannot solely attain $200,000 to $250,000, however may even climb larger.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version shouldn’t be responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.