The Bitcoin community is increasing on an industrial scale, and power-hungry mining rigs are driving vitality consumption to unprecedented highs, even when transaction flows trickle. Nonetheless, the community seems to be tense because the hashrate rise and infrastructure clashes with weak price income and clearing uncommon memo swimming pools, clashing with miners incomes greater than block subsidies.

abstract

- Bitcoin's mining community has grown into an energy-intensive large, drawing greater than 33 gigawatts and persevering with to circulation new blocks, at the same time as on-chain transactions sluggish to their weakest ranges in almost two years.

- The Gomining Institutional Report depicts an ecosystem the place hashrate and {hardware} deployments proceed to rise, however price income and total exercise stay silenced, creating discrepancies between community scale and minor income.

- Observers say this imbalance might stay for years, with operators counting on a decline in block subsidies, half each 4 years till the ultimate Bitcoin was mined round 2140.

The Bitcoin (BTC) community is in a distinguished stage of distinction. Whereas the urge for food for electrical energy is rising, the financial rewards for miners are beneath stress from low buying and selling actions. A brand new report from Gomining Institutional, seen by Crypto.Information, sketches the panorama of an unusually quiet on-chain surroundings that accelerates vitality use, reduces the issue of mining.e.

The report reveals that networks' estimated vitality consumption is growing, as researchers described as an “unprecedented tempo.” Utilizing knowledge from Coinmetrics Labs, Gomining stated it’s trashing from 15.6 gigawatts (GW) in January 2024 to 24.5 GW in January 2025.

A lot of that surge is concentrated within the early 2025. “The 35% rise in vitality demand, which is only a soar from January to Might — displays each the rise in deployment of energy-dense mining infrastructure after half of April,” the report states.

Business analysts cited within the report recommend that particular person mining rigs are extra environment friendly than ever, however their progress overpowers their income. “The elevated effectivity on the machine stage is more and more offset by the huge quantity of deployed {hardware},” the report states, including that the significance of innovation now extends past ASIC designs to the best way and the place miners can supply their strengths.

The sharp decline since 2021

Accelerated vitality use is because of the comparatively low issue in community mining (an indicator of how troublesome it’s to confirm new blocks). Within the first half of 2025, 13 issue changes have been made, with metrics rising from 109.78 trillion at first of the yr to 116.96 trillion by the tip of June. This represents a rise for the reason that begin of the yr of simply 6.54%, with a mean month-to-month enhance of 1.09%.

The report constitutes this slowdown in opposition to the speedy growth in 2024, which averaged up 4.48% per thirty days. The comparatively calm of 2025 was interrupted by a second of volatility. The 6.81% upward adjustment on April 5 and a 4.38% enhance on Might 30 bringing the file excessive of 126.98 trillion. Nonetheless, the height shortly gave approach to a pointy inversion.

By late June, a warmth wave throughout North America compelled some operators to restrict their exercise, sending hashrates to 147 EH/s. “Bitcoin's difficulties have been adjusted to -7.48% downward, the sharpest decline since July 2021,” the report stated, drawing comparisons with China's interval of banning mining.

You would possibly prefer it too: Cango finalizes Pivot right into a Bitcoin Mining Firm

If a community energy draw is climbing, that transaction layer tells the other story. On-chain exercise within the first half of 2025 plummeted to a stage not seen since October 2023. The seven-day transferring common of day by day buying and selling additionally fell to about 313,510 by June twenty fifth, with 256,000 confirmed circumstances confirmed on June 1st.

Its weak point has been transformed to traditionally low charges. All year long, customers have been capable of broadcast transactions at one Satoshi lowest charge per digital byte, no matter their priorities. “By H1, transactions might be broadcast at a minimal charge of simply 1 SAT/VB, no matter precedence stage, and highlighted the sustained low demand for block house throughout the community,” the report states.

Ghost Mempool

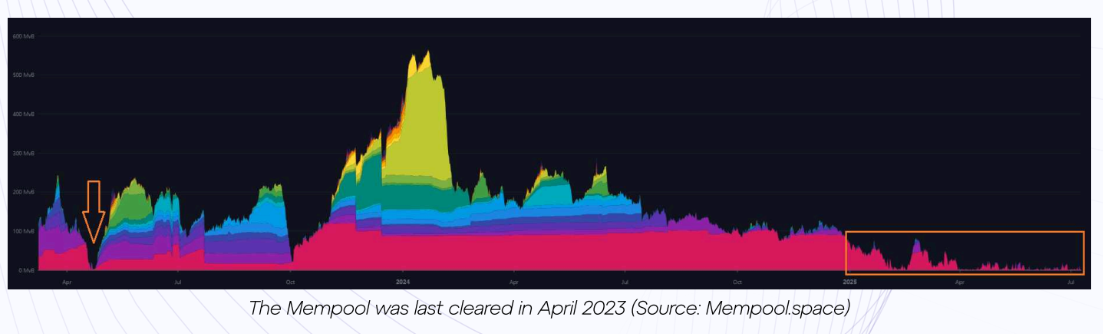

The surroundings produced a uncommon phenomenon: totally cleared reminiscence. Mempool is a ready room for unconfirmed transactions, and was empty for almost two years in 2025. The ultimate comparable occasion happened in April 2023, with ordinances and BRC-20 token exercise not but crowded the present norm block house.

As soon as Mempool is cleared, miners are quickly working with “lol buying and selling price revenues” and are virtually completely depending on block subsidies. That dynamic highlights one among Bitcoin's long-term financial issues. As fastened subsidies get midway virtually each 4 years and ultimately disappear for good, the community depends on transaction charges to maintain miners in place. Low-cost environments are welcome for customers, however can pinch operators who’re already engaged on excessive vitality prices.

Bitcoin Members | Supply: Gomining

For Bitcoin miners, the strain between rising electrical energy demand and skinny revenues is changing into troublesome to disregard. Excessive warmth in main US mining areas has already demonstrated vulnerability in hashrates beneath environmental stress. In the meantime, doubling of community vitality consumption since early 2024 suggests infrastructure scaling quicker than buying and selling exercise and price income.

Business observers recommend that this paradox could final. Mining firms proceed to deploy energy-dense fleets to safe networks and earn block rewards, however long-term economics has led to regulate, community exercise, person demand for block house, and the tempo of programmed harving for Bitcoin.

learn extra: Bitmain: Bloomberg to launch the primary US Bitcoin Mining Chip Manufacturing facility by 2026