Bitcoin (BTC) mining issue is a metric that tracks the relative problem of including new blocks to the ledger, climbing to a brand new all-time excessive of 142.3 trillion on Friday.

Mining difficulties hit consecutive all-time highs in August and September, pushed by a newly deployed inflow of computing energy over the previous few weeks.

Bitcoin's hash charge, the typical complete computing energy that secures decentralized forex protocols, hit an all-time excessive of over 1.1 trillion per second on Friday, in response to Cryptoquant.

The rising issue of mining and the fixed want for energy-hungry, high-performance computing energy to guard networks make it troublesome for particular person miners and companies to compete, elevating considerations that Bitcoin mining is turning into more and more centralized.

The issue of the Bitcoin Community was a brand new all-time hit in September. sauce: Encryption

Associated: Bitcoin mining shares outperform BTC as traders guess on AI pivots

Publicly accessible companies face warmth from authorities and power infrastructure suppliers

Even small miners and public firms face rising competitors from governments with entry to free power sources, permitting power infrastructure suppliers to vertically combine Bitcoin mining into their enterprise operations.

Some governments are already mining Bitcoin or are exploring mining with extra or runoff power, together with Bhutan, Pakistan and El Salvador.

In Might, the Pakistani authorities introduced plans to allocate 2,000 megawatts (MW) of surplus power to Bitcoin mining as a part of a rustic's regulatory pivot that accepts cryptocurrency and digital property.

The US Texas power supplier has built-in Bitcoin mining into infrastructure to stability {the electrical} masses in collaboration with the Texas Vitality Reliability Council (ERCOT).

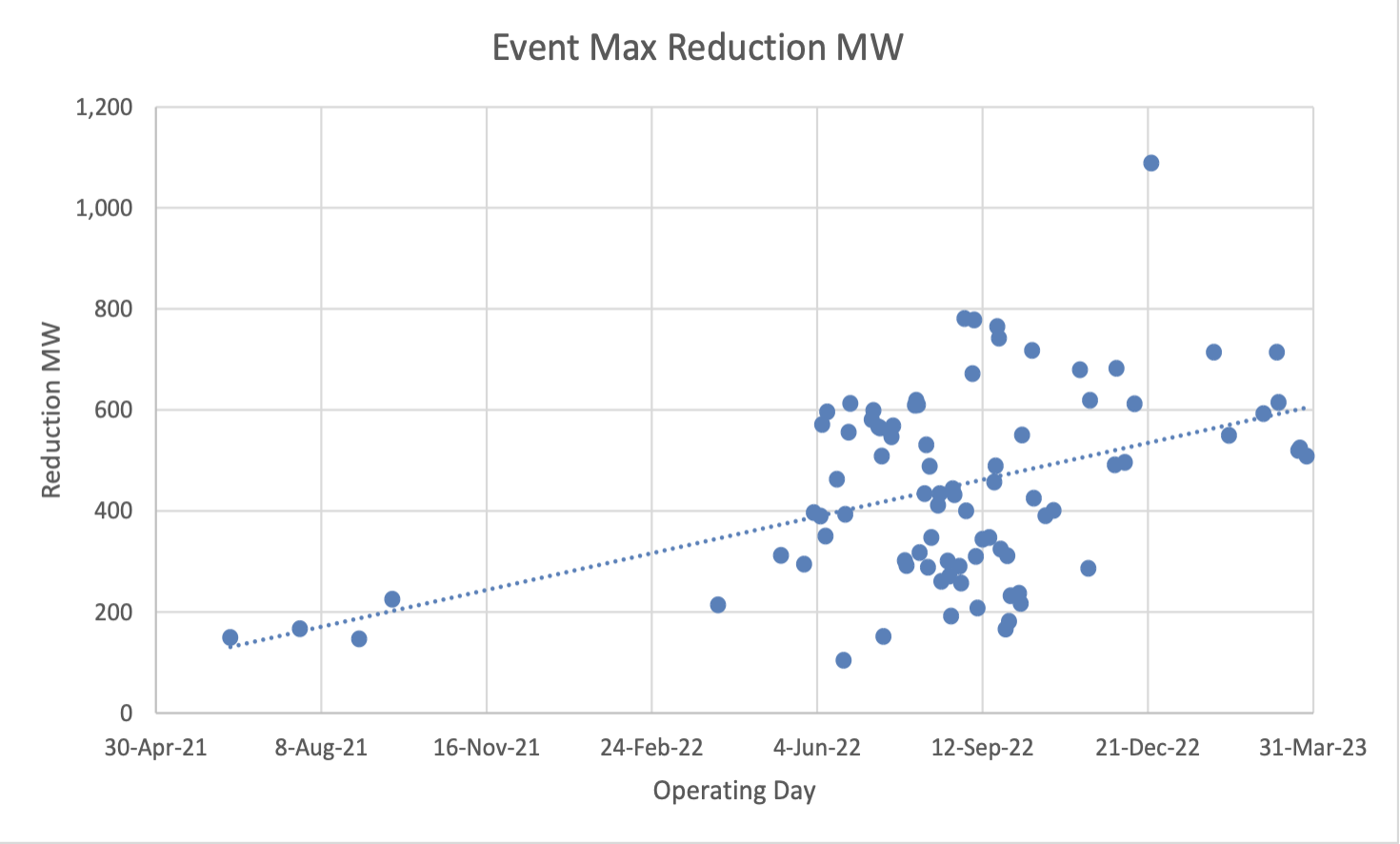

A chart exhibiting a decline in power utilization by Cryptominers in Texas throughout peak demand between 2021 and 2023. Supply: ERCOT

Electrical grids can undergo from power shortages to fulfill shopper wants throughout peak demand, or power shortages to fulfill surplus power during times of low shopper demand.

Texas power firms leverage Bitcoin mining as a controllable load useful resource that balances these electrical mismatches, consuming extra power during times of low demand and turning off mining rigs at peak shopper demand.

This creates a higher aggressive benefit over publicly traded mining firms that need to make income and pay for these energy suppliers with out worrying in regards to the fluctuating prices of power.

journal: 7 Causes Why Bitcoin Mining is a Worst Enterprise Concepts