The builders of Singapore-based Bitcoin Mining ASIC Chips and Rig Canan (CAN) have a tricky run, however may very well be a five-bager, suggesting benchmark analyst Mark Palmer.

Palmer on Tuesday started protecting ADRs with a purchase order ranking and a $3 value goal. The shares closed at $0.62 yesterday, reducing 72% per 12 months.

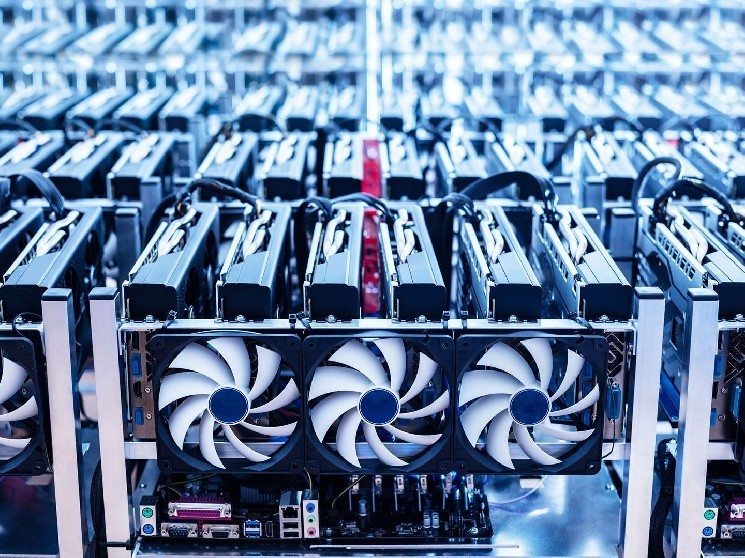

Canaan's twin technique focuses on the event of ASIC Bitcoin chips and rigs, significantly on increasing self-recruitment work within the US, Palmer mentioned.

“Can's vertically built-in strategy will distinguish it throughout the Bitcoin mining area and place it to benefit from each chip/rig gross sales and distinctive mining income,” he writes.

He famous that the push to Canaan's dwelling mining rig diversified the corporate's revenues.

Tools producers are additionally increasing their skill to self-recruit themselves within the US and worldwide.

“The corporate has derived 16.3% of its revenues in 2024 from its self-recruitment enterprise, nevertheless it intends to extend the overall pc energy and drive self-recruitment work to 10 EH/s in North America and 15 EH/s globally by mid-2025,” Palmer added.

Canaan has a stack of 1,408 Bitcoins, with present worth of round $133 million or practically 70% of its present market capitalization, Palmer says. That ought to assist the corporate's ranking.

learn extra: Bitcoin miners with HPC publicity didn’t carry out BTC for 3 months: jpmorgan