Bitdeer Applied sciences Group will worth the $330 million personal providing in its 2031 Convertible Senior Notes. The Singapore-based Bitcoin mining firm has elevated its providing measurement from the initially introduced $300 million.

BitDeer extends the providing of convertible notes

The 4.875% memo matured on July 1, 2031 was offered to consumers of certified establishments. Preliminary consumers retain a 13-day choice to buy principals as much as $45 million. The sale is scheduled to shut on June 23, 2025. The Bitcoin Mining Firm stated the memo may convert to Class A typical inventory at an preliminary worth of roughly $15.88 per share, representing a 25% premium at its closing worth on June seventeenth.

BitDeer estimates internet income of roughly $319.6 million, or $363.3 million, if the choices are totally exercised. After deducting charges and bills, the corporate plans three primary makes use of. $36.1 million for fee of associated zero strike name choices transactions, money concerns in concurrent observe exchanges, and the rest for knowledge heart enlargement, ASIC-based mining rig improvement, manufacturing, working capital, and common company functions.

Similtaneously the worth, Bitdeer entered the preliminary purchaser affiliate and nil strike name possibility transactions. The corporate paid a premium of $129.6 million for its proper to obtain roughly 10.2 million shares on Expiry. This transaction will encourage hedging actions by sure observe buyers and will have an effect on the market worth of Bitdia shares and memos.

Bitdeer additionally exchanged roughly $75.7 million of personal transactions of the prevailing 8.50% memo to pay in 2029 for $36.1 million in money and eight.1 million Class A typical inventory. The corporate famous that holders of exchanged notes that rewind hedges may have a big influence on the inventory worth.

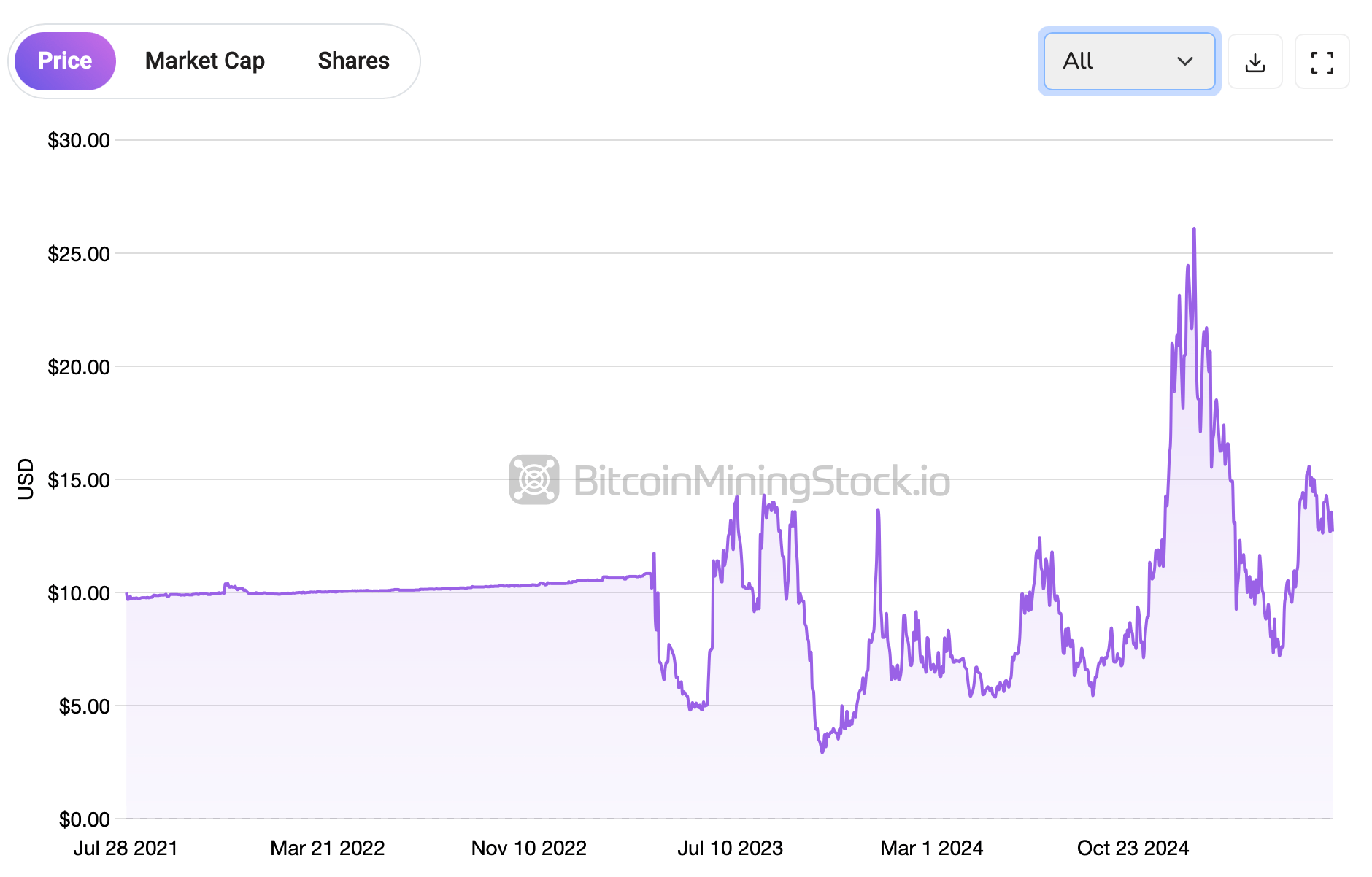

Bitdeer (NASDAQ: BTDR) hit a tough patch this yr. Within the final 5 buying and selling classes, Bitcoin Miner has fallen by greater than 14% in its worth, with greater than 45% hits since January. However right here's a twist. Regardless of the latest recession, BTDR continues to be fairly seated with a revenue of 27% since its market debut.