Bitcoin is approaching a brand new all-time excessive that might doubtlessly be steadily transferring ahead in the direction of the $123,000 mark. Total, each technical indicators and sentiment knowledge level to the potential for a steady rise, suggesting that the rally nonetheless has momentum behind it.

Shayan Market

Every day Charts

Within the day by day timeframe, Bitcoin continues to be a pointy upward channel. The latest bullish crossover between the 100-200-day transferring common additional strengthens the bullish market construction.

With costs approaching a serious resistance degree of $123,000, many merchants are hoping for a robust breakout and the potential of persevering with the rally. For now, the slower channel trendlines are performing as dynamic help, serving to to extend costs.

Nevertheless, if this channel help fails because of a sudden pullback, the close by $110,000 degree, together with the close by 100-day transferring common, can function a key help zone, inflicting rebounds and continuation to recent highs.

4-hour chart

The four-hour chart means that Bitcoin has moved from a clearly bearish or lateral stage to a bullish construction, and has escaped from the descending channel after nearly a month of integration. The property are at the moment following the uptrend line.

The RSI is above 50 ranges, strengthening bullish momentum, growing the possibilities of retesting, and potential breakouts exceeding $123,000. Nonetheless, if a pullback happens, the $116,000 help zone may function a key space for rebound and continuation of uptrends.

On-Chain Evaluation

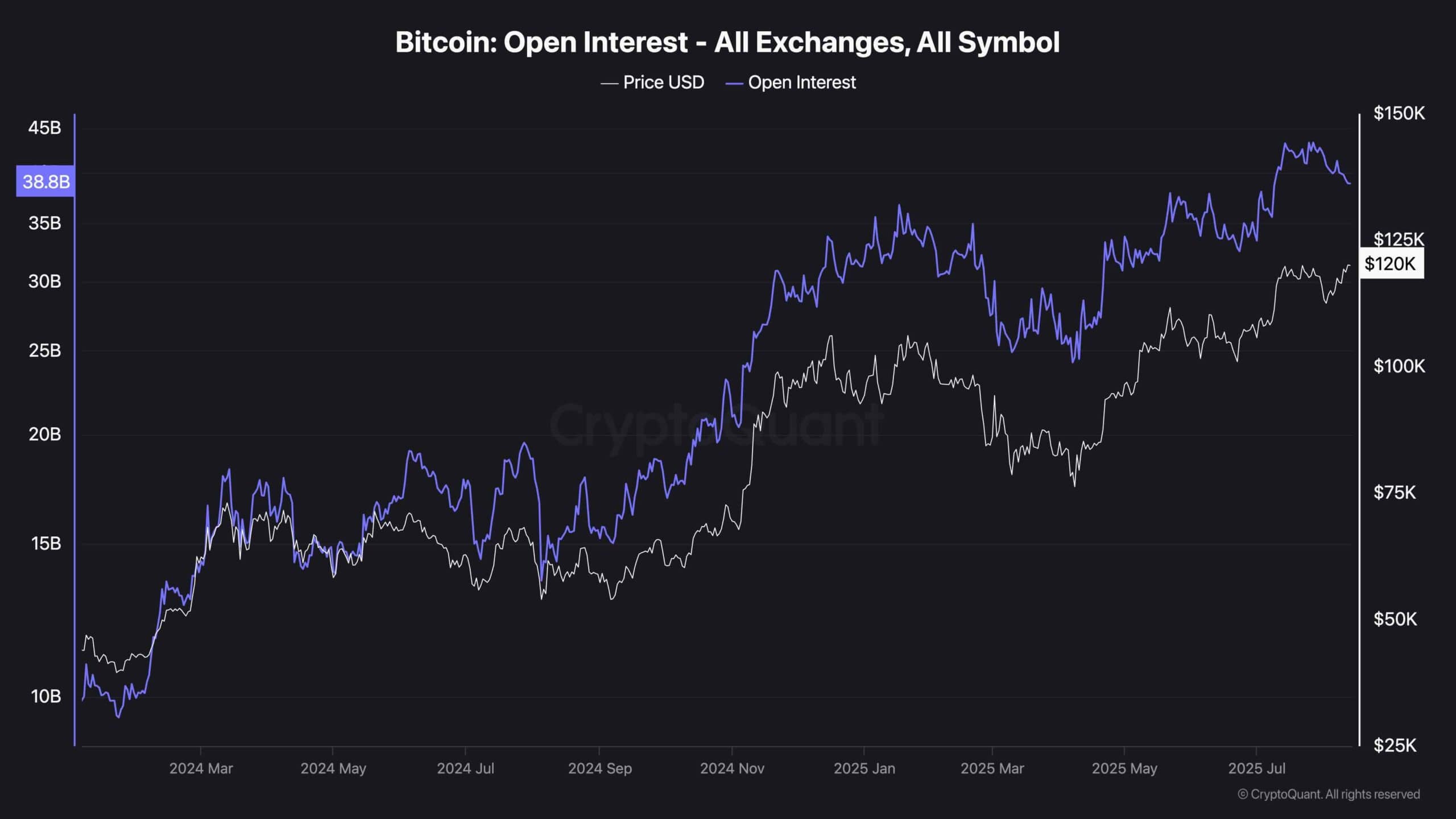

Bitcoin Open Curiosity

Open Curiosity (OI) is a key metric within the derivatives market that displays the whole variety of distinguished futures and possibility contracts. Usually, as Bitcoin costs rise, we count on open curiosity to proceed as extra merchants open up longer positions, and the rally will proceed. This conduct is usually pushed by elevated market participation, elevated leverage, and total bullish sentiment.

Nevertheless, over the previous few weeks, Bitcoin costs have progressively risen, whereas open curiosity has steadily declined. This distinction means that present gatherings could also be pushed not by leveraged positions or constructive inferences, however reasonably by spot demand or brief cowl.

This decline in OI may level to more healthy, much less speculative gatherings regardless of rising costs, however it additionally signifies that fewer contributors may rapidly observe the important thing ranges if momentum slows down.